Research and Development Tax Insights

Choosing Between ASC and Regular R&D Credit Methods

08/01/2025This update was originally published on June 2, 2014. Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Kevin Zolriasatain | Principal, Research & Development Tax Credits In a surprising, and long overdue modification to the Section 41 Research & Development tax credit, Treasury announced TD 9666 allowing taxpayer’s the opportunity to use the Alternative … Read More

Mastering the Business Component Test for R&D Tax Credit Success

07/28/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube When it comes to claiming the Research and Development (R&D) Tax Credit, understanding the Business Component Test is essential. This test serves as a cornerstone of eligibility, requiring that all qualified research activities be directly tied to a specific business component. Without this alignment, your R&D … Read More

New Refund Option for Minnesota R&D Credit Could Boost Cash Flow

07/25/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Paul McVoy and Michael Maroney | Research & Development Tax Credits On June 14, 2025, Minnesota Governor Tim Walz signed H.F. 9 into law, enacting a major update to the state’s R&D tax credit. Beginning in tax year 2025, businesses may elect to receive a … Read More

Manufacturing: Claiming R&D Credits for Improving Processes

07/24/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube When most people hear “Research and Development,” they imagine high-tech labs, futuristic prototypes, or scientists in white coats. In reality though, Research & Development (R&D) Tax Credits are just as available to the manufacturing floor as they are to the science lab. Many companies in manufacturing, … Read More

Section 174A and the 2024 Filing Dilemma for Eligible Small Businesses: Do You File or Amend?

07/21/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits As the dust settles following the passage of the One Big Beautiful Bill Act (OBBBA), many small businesses and their CPAs are navigating the mechanics of Section 174A, the newly enacted provision that restores the ability to … Read More

How to Claim R&D Credits After an Acquisition

07/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Acquiring another company isn’t just a strategic move that grows market share or expands a portfolio of products. Acquisitions can also unlock significant tax advantages. One area that companies often overlook is the Research and Development (R&D) Tax Credit, which can help them gain significant value … Read More

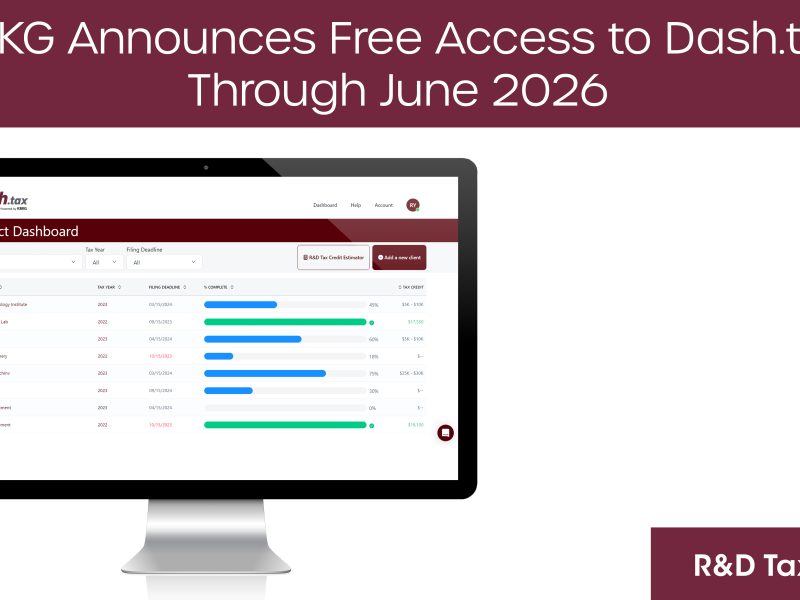

KBKG Announces Free Access to Dash.tax Through June 2026, Empowering Tax Advisors to Claim R&D Tax Credits for Clients

07/14/2025PASADENA, Calif. – July 14, 2025– KBKG, a recognized leader in specialty tax solutions, announced its flagship Research & Development (R&D) tax credit software, Dash.tax, is now available at no cost to approved tax preparers through June 30, 2026. The limited-time initiative enables Certified Public Accountants (CPAs) and other tax professionals to access the full power of Dash.tax-an … Read More

Claiming the R&D Tax Credit for Failed Projects

07/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Most businesses associate the Research and Development (R&D) Tax Credit with breakthrough innovations and completed projects. If a product launches successfully or a process gets optimized, it seems obvious to include those efforts in an R&D claim, but what happens when your project fails? Surprisingly, failure … Read More

R&D Expensing is Back: What the Section 174 Fix Means for Your 2024 Tax Strategy

07/08/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Kevin Zolriasatain and Paul McVoy | Principals, Research & Development Tax Credits For the last two years, companies conducting qualified research have been burdened with an unfavorable tax provision that has made Research and Development (R&D) investments more expensive, at precisely the wrong time. That’s … Read More

KBKG Tax Insight: One Big Beautiful Bill – 2025 Tax Changes and Summary Chart

07/03/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Gian Pazzia and Paul McVoy | Research & Development Tax Credits Breaking News – July 4, 2025 On July 4th, President Trump signed the “One Big Beautiful Bill Act” (OBBBA), marking a significant overhaul to federal tax policy. The signing reflects a major pivot in legislative … Read More

SALT Workaround Preserved, Real Estate & R&D Expensing Win Big. What Businesses Need to Know

06/30/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Paul McVoy | Principal, Research & Development Tax Credits The reconciliation process for the “One Big Beautiful Bill” (OBBB) has entered its final phase, and in the past three days, Senate Republicans cleared a key procedural hurdle and released updated text that could reach the Senate … Read More

Texas Enhances R&D Credit, Allowing Companies to Claim More

06/27/2025By Bill Taylor and Giovanni Ortiz | Research & Development Tax Credits On June 1, 2025, Texas lawmakers passed Senate Bill 2206 legislation that significantly enhances the state’s R&D Tax Credit structure. The Governor signed this bill into law on June 17, 2025. Effective for franchise tax reports due on or after January 1, 2026, … Read More

Retroactive and Permanent R&D Expensing Restored Under Proposed Senate Legislation

06/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits The Senate Finance Committee has proposed a significant change to the way U.S. businesses deduct their research and development (R&D) expenses. If passed, the bill would reverse a major change that took effect in 2022 based on … Read More

California Senate Bill 711 Proposes Simplified R&D Credit Method

06/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Tetyana Guguchkina, Elise Rhee, & Michael Maroney | Research & Development Tax Credits California is poised to overhaul its R&D Tax Credit with Senate Bill 711 (SB 711), which proposes replacing the state’s Alternative Incremental Research Credit (AIRC) with a new Alternative Simplified Credit (ASC) … Read More

House Narrowly Passes Major GOP Tax Bill 215–214, Senate Signals Revisions Ahead

05/22/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits Just after midnight on Thursday, May 22, 2025, a full House debate on the multi-trillion-dollar tax bill began, and the House narrowly passed this sweeping tax and spending package dubbed the “One Big Beautiful Bill Act” with … Read More

House Committee Advances Major GOP Tax Bill Amid Internal GOP Divisions

05/19/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits On May 18, 2025, the House Budget Committee narrowly approved a major tax and spending package dubbed the “One Big Beautiful Bill Act” with a 17-16 vote. Four Republicans voted “present,” highlighting growing tension within the party … Read More

Senate Reacts to Key Provisions from House Tax Bill, Eyeing Permanent R&D Expensing

05/16/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits Important developments recently came out of Congress related to the House’s ongoing reconciliation efforts, specifically around tax provisions that impact businesses directly, most notably, research and development (R&D) expensing. At a recent Tax Council Policy Institute conference, … Read More

House Tax Bill Prioritizes 174 R&D Amortization Fix, Bonus Depreciation, SALT Cap, and more

05/13/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits On May 12, 2025, the House Ways and Means Committee released a larger text than what Chairman Jason Smith (R-MO) released on May 9 for proposed tax legislation as part of the FY 2025 budget reconciliation process. … Read More

The Case for Human Expertise in your R&D Tax Credits

04/29/2025In a world increasingly driven by automation, it’s tempting to turn to Artificial Intelligence (AI) powered solutions for complex tasks, even something as nuanced as claiming R&D tax credits. While AI can be a powerful tool, when it comes to maximizing your R&D tax credit claim, human expertise of a trusted advisor is not just … Read More

House Passes 2025 Budget Resolution, Paving Way for Tax and Spending Reform

04/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits On April 10, 2025, the U.S. House of Representatives approved the final version of the Fiscal Year (FY) 2025 budget resolution (H. Con. Res. 14) by a razor-thin margin of 216 to 214, which will incorporate amendments … Read More

Lawmakers Introduce Bill to Retroactively Fix R&D 174 Expensing

03/14/2025By Kevin Zolriasatain and Paul McVoy | Principals, Research & Development Tax Credits On March 10, 2025, a bipartisan group of lawmakers introduced the American Innovation and R&D Competitiveness Act of 2025 in the U.S. House of Representatives. The legislation aims to restore the immediate deductibility of research and experimental (R&E) expenditures and reverse the amortization requirement imposed … Read More

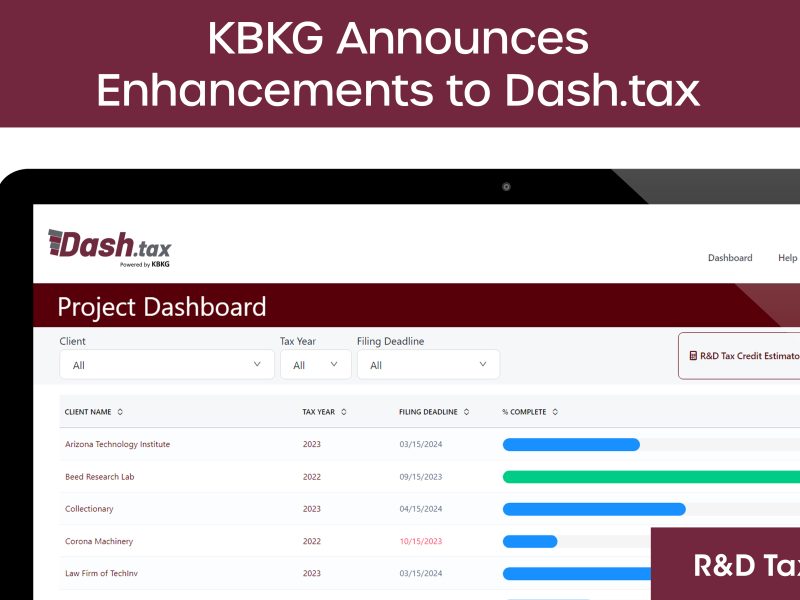

KBKG Announces Enhancements to Dash.tax, Streamlining R&D Tax Credit Claims for CPAs, Startups, and Small Businesses

03/04/2025PASADENA, Calif. – March 4, 2025– KBKG, a leader in tax credits and incentives solutions, has introduced significant enhancements to Dash.tax, its innovative tax automation platform designed for CPAs, startups, and small businesses. The latest updates further streamline the process of claiming R&D tax credits, ensuring businesses can efficiently apply credits to payroll taxes, maximize … Read More

Engineering Firms Loses R&D Credits in Court Ruling

02/12/2025By Michael Maroney | Director, Research & Development Tax Credits The Phoenix Design Group, Inc. v. Commissioner decision issued on December 23, 2024, is an important reminder of the hurdles faced when substantiating research activities for the R&D tax credit. The court denied all research credits claimed by Phoenix Design Group (PDG), a multidisciplinary engineering … Read More

KBKG Tax Insight: Michigan R&D Tax Credit Now Available

02/07/2025By Michael Maroney | Director, Research & Development Tax Credits On January 13, 2025, Michigan Governor Gretchen Whitmer signed HBs 5099-5102 and 4368 to establish the Innovation Fund and the R&D tax credit. With the passage of HBs 5100 and 5101, Michigan will again offer a state-level R&D tax credit. The Michigan research credit offers … Read More

Texas Issues Guidance on Franchise Tax Credits and Carryforward

01/23/2025By Bill Taylor | Principal, Research & Development Tax Credits Recently, the Texas Comptroller’s Tax Policy Division issued guidance on how to apply multiple franchise tax credits and credit carryforwards when more than one is available. The updated guidance clarifies the order in which credits should be applied to maximize tax benefits for taxable entities. … Read More

45X Advanced Manufacturing Production Credit Regulations Update

12/19/2024By Jonathan Tucker | Principal – R&D Tax Credits Republican Senators Tom Cotton (R-AR) and Rick Scott (R-FL) have introduced a resolution (S.J.Res. 119) to overturn final regulations (TD 10010) implementing the Section 45X Advanced Manufacturing Production Credit, a green energy tax incentive created by the Inflation Reduction Act. This mirrors a bipartisan House resolution … Read More

KBKG Tax Insight: Potential Tax Changes Under a Republican Trifecta – Key Issues to Watch

12/03/2024By Jonathan Tucker | Principal, Research & Development Tax Credits Republicans are slated to take control of the legislative and executive branches this coming year, and shifts in fiscal policy will affect taxes, tariffs, and broader economic strategies. KBKG Insight: While there is excitement and talk around “tax cuts,” taxpayers should monitor this changing landscape, … Read More

Key Changes in Accounting Method Procedures for Section 174 Research Expenditures

10/02/2024The IRS has recently issued Rev. Proc. 2024-34, which modifies the method change procedures for specified research or experimental (SRE) expenditures under Section 174. This updated guidance provides important changes for taxpayers seeking to comply with the amended rules following the 2017 Tax Cuts and Jobs Act (TCJA). Here’s a breakdown of the key provisions … Read More

Senate Votes on Tax Relief Bill for IRC 174 R&E Expenditures, Bonus Depreciation and Section 163(j)

08/01/2024By Jonathan Tucker | Principal, Research & Development Tax Credits In a significant move after months of waiting, the Senate voted on the highly anticipated tax relief for American Families and Workers Act, aimed at easing the financial burden on millions of Americans. Championed by Senate Majority Leader Chuck Schumer to bring a vote in … Read More

KBKG Tax Insight: Identifying Expenditures for the New IRC 174 Capitalization Requirements

07/24/2024By Jonathan Tucker | Principal, Research & Development Tax Credits With the enactment of the Tax Cuts and Jobs Act (TCJA) of 2017, significant changes were made to the Internal Revenue Code (IRC), notably to IRC 174. Starting in the tax year 2022, businesses can no longer fully expense their research and experimental (R&E) costs … Read More

KBKG Tax Insight: IRS Finalizes Form 6765 to Claim R&D Credit for the 2024 Filing Season

06/25/2024By Jonathan Tucker | Principal, Research & Development Tax Credits This post was most recently updated on 2/18/2025 to reflect official changes from the IRS. The IRS has officially released the new Form 6765 and its accompanying instructions. These forms are no longer in DRAFT status and should be filed with the 2024 Federal tax … Read More

KBKG Tax Insight: IRS Eases Requirements for R&D Credit Refunds

06/20/2024By Jonathan Tucker | Principal, Research & Development Tax Credits The IRS issued new guidance around amending for R&D tax credit refunds postmarked as of June 18, 2024. This guidance reduces the documentation requirement to be submitted for amending by removing two previously required items. KBKG Insight: With just three documents needed to submit the … Read More

KBKG Tax Insight: Tax Court Denies R&D Credits for Engineering Firm

05/13/2024By Emily Flemmer | Manager, Research & Development Tax Credits In the case of Meyer, Borgman & Johnson, Inc. v. Commissioner No. 23-1523 (8th Cir. May 6, 2024), the U.S. Court of Appeals for the Eighth Circuit upheld the Tax Court’s decision denying research tax credits to a structural engineering firm because the taxpayer’s research … Read More

Tax Alert: DEA Proposal to Ease Restrictions on Marijuana

05/10/2024By Paul McVoy and Bill Taylor | Principals, Research & Development Tax Credits A recent proposal by the Drug Enforcement Agency (DEA) to reclassify marijuana from a Schedule I to a Schedule III drug represents a significant shift in the regulatory framework surrounding cannabis. This change could have profound effects on companies operating within the marijuana … Read More

Simple, Swift, Secure: KBKG’s Dash.tax Transforms R&D Credits Up to $50k

04/29/2024PASADENA, Calif. – April 29, 2024 – KBKG, a premier provider of comprehensive specialty tax services and solutions, proudly announces the debut of Dash.tax, its latest R&D tax credit software solution tailored for CPAs and businesses. Designed for swift and precise outcomes, Dash empowers users to effortlessly generate customized Research & Development (R&D) tax credit … Read More

KBKG Tax Insight: April Update, 174 Capitalization Fix & Bonus Depreciation, 2024 Tax Relief Act

04/24/2024KBKG Tax Insight: April Update, 174 Capitalization Fix & Bonus Depreciation, 2024 Tax Relief Act By Emily Flemmer | Manager, Research & Development Tax Credits Frustration mounts among advocates of a bipartisan tax agreement initially approved by the House in January but has since hit a roadblock in the Senate due to Republican resistance. This … Read More

Arizona Introduces New Research & Development Calculation Method for Tax Year 2023

04/22/2024KBKG Tax Alert: Arizona Introduces New Research & Development Calculation Method for Tax Year 2023 By Elise Rhee| Director, Research & Development Tax Credits Effective for the tax year ended 2023, Arizona has implemented a new calculation method, mirroring the federal Alternative Simplified Calculation (ASC) approach. Notably, if a taxpayer hasn’t incurred qualified research expenses … Read More

Virginia Research and Development Expenses Tax Credits Amended

04/15/2024KBKG Tax Alert: Virginia Research and Development Expenses Tax Credits Amended By Ian Williams| Principal, R&D Tax Credits Effective July 2024, Virginia’s Governor Youngkin signed legislation that impacts Virginia’s major research and development expenses tax credit. The changes include a decreased major R&D expenses cap, a new credit calculation method, and an increased R&D expenses … Read More

Michigan’s Senate Enacts R&D Tax Credit

03/25/2024KBKG Tax Insight: Michigan’s Senate Enacts R&D Tax Credit By Michael Maroney | Director, Research & Development Tax Credits On March 19, 2024, Michigan’s Senate passed legislation enacting an R&D credit, the first of its kind since the R&D credit expired over a decade ago. The Senate passed HB 5100, which the Democrat-led Michigan House … Read More

Research and Development Expensing (IRC Section 174) Still has Bipartisan Support

03/22/2024KBKG Tax Alert: Research and Development Expensing (IRC Section 174) Still has Bipartisan Support During a March 21 hearing on President Biden’s Fiscal 2025 budget, members of the Senate Finance Committee urged Treasury Secretary Janet Yellen to remember federal research and development (R&D) tax incentives to improve the United States’ economic competitiveness. The R&D tax … Read More

KBKG Tax Alert: Update on the 174 Capitalization Fix, 2024 Tax Relief Act

03/11/2024KBKG Tax Alert: Update on the 174 Capitalization Fix, 2024 Tax Relief Act The American Families and Workers Act of 2024 (“the Act”), aimed at reinstating the ability to deduct R&D expenditures, extending bonus depreciation, and expanding the Child Tax Credit has hit a significant roadblock in the Senate. Despite its bipartisan passage in the … Read More

Biotech R&D Tax Benefits

03/01/2024Understanding R&D Tax Credits for Biotech, Bioscience, and Pharma Research and development (R&D) is a huge part of the biotech, bioscience and pharmaceutical industries. Biotech, bioscience, and pharmaceutical companies operate on the forefront of innovation, constantly seeking new solutions to complex problems through cutting-edge technology and scientific research. R&D is the lifeblood of these industries, … Read More

R&D Tax Credit for Robotics Industry

02/26/2024R&D Tax Credits for Robotics Industry If you run a small business, large corporation, or a startup, business payroll taxes could take a big bite out of your profitability. Companies in the robotics industry can lower their tax burden with the research and development (R&D) tax credit. This tax credit can help businesses developing exciting innovations … Read More

Common Misconceptions About R&D Tax Credits: Debunking Myths and Clearing Up Confusion

02/26/2024Common Misconceptions About R&D Tax Credits: Debunking Myths and Clearing Up Confusion The R&D credit refers to tax-saving opportunities for companies that invest in research and development. The R&D tax credit incentivizes businesses of all sizes to develop or improve products and processes within their industry. Unfortunately, many misconceptions may unnecessarily stop a company from claiming the … Read More

Tax Credits for Developing Battery Tech and Chemicals for Electric Vehicles

01/31/2024Using the R&D Tax Credit to Join the EV Market The production and sale of electric vehicles (EVs) are on the rise, with more consumers switching to this eco-friendly option each year. The EV market has witnessed substantial growth, driven by factors such as increasing environmental awareness, government incentives, advancements in battery technology, and improvements … Read More

How the PATH Act Helps Small Businesses

01/31/2024Understanding R&D Tax Credits for Forest Products | KBKG Companies in the forest products industry increasingly rely on research and development initiatives to optimize manufacturing, increase revenue, and create a competitive edge. Even small and medium-sized forestry businesses may qualify for valuable tax incentives related to R&D. Unfortunately, the U.S. Chamber of Commerce estimates that … Read More

Understanding R&D Tax Credits for Forest Products

01/31/2024Understanding R&D Tax Credits for Forest Products | KBKG Companies in the forest products industry increasingly rely on research and development initiatives to optimize manufacturing, increase revenue, and create a competitive edge. Even small and medium-sized forestry businesses may qualify for valuable tax incentives related to R&D. Unfortunately, the U.S. Chamber of Commerce estimates that … Read More

KBKG Tax Alert: Proposed Bill Fixes 174 Capitalization and Cuts Off New ERC Claims

01/16/2024KBKG Tax Alert: House passes proposed bill to Fix 174 Capitalization, Extend 100% bonus depreciation, and Cut Off New ERC Claims, now in Senate consideration. Proposal Aims to Boost Businesses with Immediate Deductions for Domestic Research and Experimental (R&E) Expenditures and Capital Investments on qualified property while reining in the Employee Retention Credit (ERC). The … Read More

New IRS Amendments to the Amortization of Specified Research or Experimental Expenditures

01/03/2024New IRS Amendments to the Amortization of Specified Research or Experimental Expenditures Thought Leadership by KBKG The Internal Revenue Service (IRS) issued updates regarding the amortization of specified research or experimental (SRE) expenditures under Section 174. These modifications, outlined in Notice 2024-12 and complemented by Rev. Proc. 2024-9, introduce crucial changes that tax professionals should … Read More

Year-End Legislation Aimed at Changing the TCJA

12/20/2023Year-End Legislation Aimed at Changing the TCJA Kevin Zolriasatain, Principal • Research & Development Tax Credit Services A sizable coalition of House Republicans has advocated for end-of-year legislation addressing three key business tax provisions altered by the 2017 tax reform bill. They characterize this proposal as a pro-growth economic package. In a letter dated November … Read More

Qualifying AI for the R&D Tax Credit | KBKG

11/21/2023Qualifying AI for the R&D Tax Credit | KBKG Artificial intelligence (AI) has recently been a mainstay of news headlines worldwide, and for good reason. Publicly released AI tools now allow individuals and companies to generate images and text nearly indistinguishable from those created by humans. If you are a company or have a department … Read More

IRS Extends Transition Period for Perfecting R&D Tax Credit Claims

11/16/2023IRS Extends Transition Period for Perfecting R&D Tax Credit Claims Jonathan Tucker, Principal • Research & Development Tax Credit Services In this post, we discuss the recent IRS update as of October 30, 2023. The IRS has extended through January 10, 2025, the transition period for perfecting research credit refund claims prior to IRS’ final … Read More

The RD Tax Credit

11/14/2023The R&D Tax Credit – The Basics Nurturing and expanding a business in many industries often requires you to develop new technologies, systems, and products. This type of expansion and growth is not only vital to your business but the economy as a whole, which requires a significant degree of innovation to thrive. Innovation, however, … Read More

Reviving Michigan’s R&D Tax Credit

11/08/2023Reviving Michigan’s R&D Tax Credit Michigan businesses are one step closer to large tax benefit. On February 7, Michigan’s governor, Gretchen Whitmer, presented her FY2025 Executive Budget Recommendation. Included in the budget is a proposal for a $100 million research and development (R&D) credit, the state’s first R&D credit since the corporate income tax (CIT) … Read More

What Is the Difference Between Refundable and Non-Refundable Tax Credits?

10/31/2023What Is the Difference Between Refundable and Non-Refundable Tax Credits? CPAs are well aware of the intricate tax landscape clients face. Tax credits are essential in reducing their tax liability and maximizing their financial well-being. Among the various credits available, it’s important to understand refundable and non-refundable tax credits. Examine the difference between a refundable … Read More

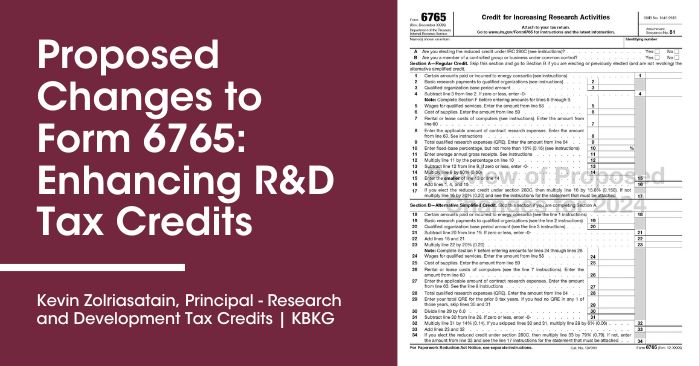

Proposed Changes to Form 6765: Enhancing R&D Tax Credits

10/26/2023Proposed Changes to Form 6765: Enhancing R&D Tax Credits Thought Leadership by Kevin Zolriasatain | Principal, Research & Development Tax Credits Staying informed about regulatory updates is vital for tax professionals, especially when it comes to Research and Development (R&D) tax credits. The Internal Revenue Service (IRS) made a significant announcement on Friday, September 15th, unveiling … Read More

Kansas Issues New Notice to the Research and Development Tax Credits

09/26/2023Kansas Issues New Notice to the Research and Development Tax Credits Thought Leadership by Jonathan Tucker, Principal – Research and Development Tax Credit Services As certified public accountants, staying abreast of changes in tax laws and regulations is crucial to best serve your clients. In this blog, we’ll dive into the recent amendments by House Bill … Read More

KBKG Tax Insight: IRS Releases Guidance on Section 174 R&E Expenses

09/11/2023KBKG Tax Insight: IRS Releases Guidance on Section 174 R&E Expenses Monday, September 11, 2023 By Kevin Zolriasatain | Principal, Research & Development Tax Credits On Sept. 8, 2023, the Internal Revenue Service (IRS) unveiled Notice 2023-63. This significant and eagerly awaited update to tax regulations under Section 174 marks a pivotal moment in the realm … Read More

Wisconsin Department Revenue Updates Publication 131 – R&D Tax Credits

08/30/2023Wisconsin Department Revenue Updates Publication 131 – R&D Tax Credits Thought Leadership by Michael Maroney, Director – Research and Development Tax Credit Services | KBKG Understanding tax incentives and research credits can often be as intricate as deciphering a complex puzzle. Fortunately, the Wisconsin Department of Revenue has developed the newly updated Publication 131, a … Read More

How Form 6765 Can Benefit Your Business

08/07/2023How Form 6765 Can Benefit Your Business Form 6765 is a document the Internal Revenue Service published as part of the tax code. The official name of the document is Credit for Increasing Research Activities. However, it is more informally called the R&D Tax Credit Form. It can be a valuable source of savings for your … Read More

KBKG to Host Webinar Series with AIA Los Angeles

07/26/2023KBKG to Host Webinar Series with AIA Los Angeles PASADENA, Calif. – 7/26/2023 – KBKG, a leading provider of turnkey tax services and solutions, is set to host a series of webinars alongside AIA Los Angeles on August 1 and August 8. The two-part series is to educate architects on effective cost-saving strategies through various … Read More

Everything You Need to Know About R&D Tax Credits

07/25/2023Everything You Need To Know About R&D Tax Credits Business owners often consider taxes an inconvenient but necessary part of everyday operations. However, a better understanding of taxes can save you money by taking advantage of various credits, such as the R&D tax credit. How does the R&D tax credit work? Get an in-depth look into everything … Read More

R&D Tax Credit for Software Development

07/25/2023R&D Tax Credit for Software Development Has your company paid to create or improve software? You may be eligible for the research and development tax credit for software companies. The government offers incentives for R&D software development, both domestically and internationally. What Is R&D Software Development? Companies do R&D projects to acquire knowledge as a long-term … Read More

Understanding the R&D Tax Credit for Manufacturing

07/20/2023Understanding the R&D Tax Credit for Manufacturing Innovation is at the heart of every successful manufacturing company. Businesses must find ways to improve, create more efficient processes, and develop new and valuable products. That innovation can be expensive. R&D tax credits for manufacturing can be helpful. Still, too many companies don’t know how to take advantage … Read More

R&D Tax Credits for Small Businesses

07/05/2023R&D Tax Credits for Small Businesses Did you know that businesses that engage in research and certain manufacturing processes may be eligible for a tax credit? The Research and Development tax credit, or R&D credit, may be able to reduce your small business’s tax burden and allow you to obtain funding for further research. To … Read More

Boost to Businesses – Build It In America Act

06/15/2023Boost to Businesses – Build It In America Act by Kevin Zolriasatain | Principal, KBKG, 6/15/2023 Tax Insight: Research and Development (R&D) Tax Credit / Research and Expenditures On Tuesday, June 13, the House Ways and Means Committee approved three bills: the Small Business Jobs Act, or H.R. 3937, and the Build It in America Act, or … Read More

Section 174 and R&E – Uncertainty and Questions

05/23/2023Section 174 and R&E – Uncertainty and Questions by Kevin Zolriasatain | Principal, KBKG, 3/23/2023 Many businesses, small and large, rely on research and development to improve their offerings, compete with international markets, and increase profits. The implications of recent changes to section 174 and no movement from Congress have left many business owners unsure … Read More

IRC/Multistate Corporate Income Tax Comparison Guide

05/05/2023IRC/Multistate Corporate Income Tax Comparison Guide Friday, May 5, 2023 – Thought Leadership by R&D | KBKG Note: The data in the chart is only current as of the publish date of this blog. We expect this data to change. Research and experimental expenditures are essential to many businesses, especially in technology, manufacturing, and healthcare. … Read More

IRS Issues Revenue Ruling on the Deductibility of R&E Expenditures

04/18/2023IRS issues Revenue Ruling on the Deductibility of Research and Experimental Expenditures by Jonathan Tucker, Principal | KBKG, 4/18/2023 Revenue Ruling 58-74 No Longer Applicable – The IRS issued Revenue Ruling 2023-8, making obsolete Revenue Ruling 58-74 on a prospective basis as of July 31, 2023. This means that taxpayers can no longer file an amended … Read More

Mississippi Allows Businesses to Deduct Research or Experimental Expenditures

04/04/2023Mississippi Allows Businesses to Deduct Research or Experimental Expenditures By Jonathan Tucker, Principal | Published Monday, April 3rd, 2023 On Monday, April 3, 2023, Mississippi passed H.B. 1733, a change in the Mississippi State Income Tax Law. The law allows businesses to elect to fully deduct research or experimental expenditures in the year they are … Read More

American Innovation and Jobs Act Aims to Expand R&D Tax Credits and Address Confusion Over Section 174 Rules

03/23/2023American Innovation and Jobs Act Aims to Expand R&D Tax Credits and Address Confusion Over Section 174 Rules by Kevin Zolriasatain | Principal, KBKG, 3/23/2023 On March 17, 2023, Senators Maggie Hassan (D-NH) and Todd Young (R-IN) reintroduced the American Innovation and Jobs Act (“The Act”). This act aims to expand the refundable R&D Credit and … Read More

AICPA Pens Letter Urging Congress to Defer R&D Expense Capitalization (Sec 174) Provision Until 2026

02/22/2023On February 14, 2023, the American Institute of Certified Public Accountants (AICPA) sent a letter urging Congress to address expired and expiring tax provisions to avoid needless complexity and ambiguity. More specifically, the AICPA called on Congress to defer the Internal Revenue Code Section 174 amortization requirement for research and experimental expenditures until 2026. The … Read More

IRS Issued Additional Guidance on Section 174, Specified Research or Experimental Expenditures

12/15/2022This article has been updated from its original posting on Dec. 15, 2022. The Treasury Department and Internal Revenue Service (IRS) issued Revenue Procedure 2023-11 providing updated guidelines for accounting method changes for the treatment of specified research or experimental expenditures under Section 174 that changed with the Tax Cuts and Jobs Act of 2017 … Read More

KBKG Tax Insight: Tax Court Denies Construction Company R&D Credits

12/13/2022A summary judgment was recently granted when the government successfully argued that a construction company did not conduct qualified research activities during the tax year in question and was therefore not entitled to the $576,756 refund they were paid. In this case, the defendant was a shareholder of a civil construction company and the contested … Read More

An Introduction to the Reverse Plea to the U.S. Senate and House of Representatives to Extend Section 174

11/02/2022Over 150 U.S.-based businesses and trade associations recently issued a plea to the U.S. Senate and U.S. House of Representatives leadership urging Congress to extend Section 174 provisions allowing taxpayers to deduct 100% of Section 174 R&E expenditure in the year they were incurred. Historically, 100% of Section 174 R&E expenditures could be 1) deducted … Read More

This Month’s Webinars

11/01/2022Looking for CPE credit? We have several sessions available this month. Click the links below to register. If you have questions or need help registering, please email [email protected]. Research & Development Tax Credits 11/1/2022 | 12:00 PM PT | 1 hour | 1 CPE credit This webinar will cover the fundamentals of the Research and … Read More

Inflation Reduction Act Expands Payroll Tax Credit Benefits for Small Businesses

08/12/2022The Inflation Reduction Act provides huge opportunities for the real estate industry as well as for architects and engineers. However, the expansion of “green” tax incentives 45L and 179D is not the only tax benefits getting a boost. The newly formed law will also improve upon the R&D Tax Credit. This change will have a … Read More

KBKG Tax Insight: Changes to Recently Amended Texas Franchise Tax Regulations

06/27/2022Published on June 10, 2022, Texas Register, the Texas Comptroller proposed revisions to the recently amended Texas franchise tax regulations surrounding the Texas sales and use tax exemption and the Texas franchise R&D tax credit. These revisions soften the Internal Use Software (IUS) and Combined Group definitions after receiving overwhelming feedback surrounding the Texas franchise … Read More

KBKG Tax Insight: Reviving Missouri’s R&D Tax Credit 2023

06/20/2022Beginning with the 2023 tax year, Missouri taxpayers can claim a research and development (R&D) tax credit on its state tax returns for R&D activities performed within the state. Not since 2005 have Missourians had the ability to reduce its state tax bill with this credit. If you are a taxpayer or have taxpayer clients … Read More

KBKG, R&D Tax Credits & 179D Incentives Firm, to Exhibit at the American Institute of Architects A’22 National Conference This Week

06/20/2022KBKG plans an educational and interactive booth experience for architect attendees at AIA’s largest annual event. CHICAGO, June 20, 2022 (Newswire.com) – Nationwide tax specialty firm KBKG is set to exhibit at the American Institute of Architect’s (AIA) A’22 Conference on Architecture in Chicago from June 22-25. At the exhibit, KBKG will showcase their architect … Read More

Are You Looking To Upgrade Your R&D Credit or 179D Provider?

06/14/2022Are you looking to upgrade your R&D credit or 179D provider? As you begin to evaluate potential service providers, it’s important to remember that there are significant differences between R&D credit and 179D advisors in the marketplace. Sometimes taxpayers are not immediately aware of how those differences may impact their experience from start to finish. … Read More

KBKG to Exhibit, Sponsor, and Speak at the TXCPA Free CPE Expo

06/14/2022Our Director of R&D Tax Credits and ERTC, Bill Taylor is speaking at the TXCPA Free Expo on June 23rd. Along with him, our Regional Director, Matthew Geltz, is representing KBKG at the exhibit hall. The TXCPA Free CPE Expo is taking place on June 23rd at the UT Commons Conference Center in Texas. About … Read More

R&D Tax Credit Insights from Former IRS Executives

06/14/2022R&D Tax Credit Insights from Former IRS Executives – Videos by Jack Jolly, Director and Mark Bodenstab, Director | KBKG, 6/14/2022 Jack Jolly is a Director of R&D Credit at KBKG. He worked 20 years for the IRS managing a team of IRS engineers who spent most of their time auditing R&D tax credit claims. … Read More

KBKG to Exhibit and Sponsor at PrimeGlobal Partner Leadership Summit

06/14/2022Our CEO, Gian Pazzia is attending the PrimeGlobal Partner Leadership Summit as a delegate. Along with him, our National Director of Business Development, Gina Lim, is sponsoring the event on behalf of KBKG. The conference is taking place from June 20th to June 22nd at the Fairmont Royal York in Toronto, Canada. About PrimeGlobal Partner … Read More

KBKG to Exhibit and Sponsor at AIA Architecture Conference

06/14/2022This year Todd French, Lon O’Connor, Robert VanDeVeire, Brandon Val Verde, and Kyle Ernsberger will be representing KBKG at the AIA Architecture Conference. The conference takes place from June 22nd to June 25th in Chicago, Illinois. About the AIA Architecture Conference The AIA Architecture Conference is the architecture and design event of the year. With … Read More

KBKG to Speak and Exhibit at Tax Alliance Conference

06/03/2022Our Regional Director, Bill Taylor is speaking about Employee Retention Tax Credits & Impact on Research and Development Tax Credits, CCM, and TX Law Changes at the Tax Alliance Conference on June 7th. Joining him is our Regional Director, Matthew Geltz, and he is representing KBKG at the exhibition hall. The Tax Alliance Conference is … Read More

KBKG to Exhibit at AICPA Engage 2022 Conference

06/03/2022We are exhibiting at this year’s AICPA Engage Conference that is taking place at the ARIA Resort & Casino in Las Vegas from Monday, June 6th to Thursday, June 9th. Representing KBKG are Greg Kniss, Jason Melillo, Lester Cook, Lon O’Connor, Robert VanDeVeire, and Will Long. We will be located at booth #307, please feel … Read More

KBKG to Speak and Exhibit at FICPA MEGA CPE Conference

06/03/2022Research & Development Tax Credit Principal, Jonathan Tucker and Director, Ian Williams will be speaking on Research and Development Tax Credits Overview and Recent Updates. Their presentation is taking place on Thursday, June 9th from 10:30 AM – 11:20 AM. Regional Director, Chad Niehaus is speaking in a 25-minute Ted-Talk, a new way of presenting … Read More

KBKG to Speak at NECANN Illinois Conference

06/03/2022On Friday, June 10th from 1-1:50 PM, our Senior Manager, Tetyana Guguchkina, is speaking about R&D Tax Credit for the Cannabis industry at this year’s NECANN Illinois. Joining her are Robert VanDeVeire and Kyle Ernsberger from our Midwest office. NECANN Illinois is taking place from June 10th to June 11th at the McCormick Place Lakeside … Read More

KBKG to Exhibit and Sponsor the NJCPA Convention & Expo

06/03/2022This year, Sumit Sharma, Paul McVoy, Alexis McClellan, and Justin Brumfield will be representing KBKG at the NJCPA Convention & Expo. This conference takes place from June 14th to June 17th at NJCPA Convention & Expo in Atlantic City. About the NJCPA Convention & Expo The NJCPA Convention & Expo knows that there are mega-changes … Read More

KBKG Tax Insight: Wisconsin’s Refundable R&D Tax Credit Gets a Boost

05/27/2022Wisconsin’s Department of Revenue recently updated its Publication 131, entitled Tax Incentives for Conducting Qualified Research in Wisconsin for Taxable Years Beginning on or After January 1, 2021. It explains qualified research, eligibility and the mechanics for calculating and substantiating the credit. The most notable change to the Wisconsin credit is increasing the percentage of … Read More

Breaking News: Senate Moves to Preserve R&D Expensing & Expand Research Credit

05/09/2022A motion to instruct conferees of the America COMPETES/USICA competitiveness bills by Senator Maggie Hassan (D-NH) was agreed to 90-5 on Wednesday, May 4, 2022. The bill called for preserving R&D expensing, rather than the IRC Section 174 five-year amortization that took effect this year, and an expansion of the R&D tax credit for small … Read More

KBKG to Speak at SCACPA Spring Splash Conference 2022

05/02/2022Our Research and Development Tax Credit Director, Ian Williams, is speaking while Principal, Jonathan Tucker, and Regional Director Chad Niehaus are representing KBKG at the SCACPA Spring Splash Conference 2022. This event takes place from May 12th and May 13th in Spartanburg, SC. Our Southeast team specializes in Cost Segregation, Green Building Tax Incentives (45L … Read More

KBKG Speaking at New York Multifamily Summit 2022

05/02/2022>Our Cost Segregation & Fixed Assets Principal, Sumit Sharma, will be speaking at NYMS this year during the Value Add panel discussion. Along with him, Alexis McClellan and Justin Brumfield will represent KBKG. The New York Multifamily Summit will take place on Thursday, May 12th in New York, New York. This event is New York’s … Read More

![[PRESS RELEASE] KBKG Expands Atlanta Footprint with Office in Buckhead [PRESS RELEASE] KBKG Expands Atlanta Footprint with Office in Buckhead](https://www.kbkg.com/wp-content/uploads/KBKG-Tax-Insight-Nebraska-Legislators-Consider-Research-or-Experimental-Expenditures-Fully-Deductible-3-2.jpg)

[PRESS RELEASE] KBKG Expands Atlanta Footprint with Office in Buckhead

04/22/2022After five years in the north Atlanta metro region, the firm has moved operations inside the city’s perimeter to better serve surrounding businesses. Nationwide tax specialty firm KBKG has recently moved its existing Atlanta metro operations from the original Alpharetta location to the heart of Atlanta’s Buckhead business district. The firm’s southeast team has upgraded … Read More

KBKG Tax Insight: Changes in Kansas Research and Development Tax Credit Incentive

04/22/2022Earlier this month, the Kansas University Jayhawks men’s basketball team captured the school’s 6th National NCAA Championship with a 72-69 victory over the North Carolina Tarheels. In one of the most competitive college basketball years to date, Kansas was crowned number 1. Much like college basketball, states compete to attract businesses and innovation to spur … Read More

KBKG Representing at TXCPA Austin Accounting & Finance Leaders Conference 2022

04/07/2022Eddie Price, Matthew Geltz, and Bill Taylor will be representing KBKG at the TXCPA Austin Accounting & Finance Leaders Conference on Thursday, April 21st in Austin, Texas. Our Texas team specializes in Cost Segregation, Green Building Tax Incentives (45L and 179D), Transfer Pricing, and more.. About the TXCPA Austin Accounting & Finance Leaders Conference The … Read More

KBKG Tax Insight: Minnesota Introduces an Alternative Simplified R&D Tax Credit

02/22/2022In an effort to further stimulate the Minnesota economy, state Senator Julia Coleman and House Representative Kristin Robbins introduced S.F. 2970 and H.F. 3316, respectively. Both bills would add a new methodology for taxpayers to utilize in calculating its Minnesota R&D Tax Credit. It is modeled after the federal Alternative Simplified R&D Credit (ASC) methodology. … Read More

Hawaii Senator Jarrett Keohokalole Seeks to Increase Annual Cap for State’s Research Credit

02/08/2022On January 21, 2022, Hawaii State Senator Jarrett Keohokalole introduced Senate Bill (SB) 2599, revising the certification requirements and increasing the annual aggregate cap for the State of Hawaii’s tax credit for research activities (“Hawaii R&D tax credit”). The proposed Section 235-110.91 revisions would first and foremost triple the aggregate cap of research credits available … Read More

KBKG Tax Insight Nebraska Legislators Consider Research or Experimental Expenditures Fully Deductible

01/29/2022Earlier this month, Nebraska State Senator Brett Lindstrom introduced Legislative Bill 827 allowing taxpayers to fully deduct research or experimental (R&E) expenditures in the year in which they were paid or incurred. Beginning January 1, 2022, federal law under IRC Section 174 requires federal taxpayers to charge these expenses to a capital account and amortize … Read More