insights

industry-specific tax credits & incentives

and relevant events

informed about recent news,

industry-specific

tax credits & incentives

and relevant events

Featured Article

A&E Firm Leaders: Why You Need to Act Now to Claim 179D Before It’s GoneFollow KBKG on Social Media Linkedin Facebook X-twitter Youtube The One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, included a major shift in tax law, and it’s hitting architects and engineers (A&E) harder than most. Section 179D, a powerful incentive that rewards firms for designing energy-efficient buildings for government and nonprofit clients, is now set to sunset. However, the good news is that there is still a sizable window to capture this benefit — both retroactively and on active projects — before it’s gone. If A&E firms have designed schools, universities, … Read More

A&E Firm Leaders: Why You Need to Act Now to Claim 179D Before It’s GoneFollow KBKG on Social Media Linkedin Facebook X-twitter Youtube The One Big Beautiful Bill (OBBB), signed into law on July 4, 2025, included a major shift in tax law, and it’s hitting architects and engineers (A&E) harder than most. Section 179D, a powerful incentive that rewards firms for designing energy-efficient buildings for government and nonprofit clients, is now set to sunset. However, the good news is that there is still a sizable window to capture this benefit — both retroactively and on active projects — before it’s gone. If A&E firms have designed schools, universities, … Read More

KBKG Tax Insights

- New Refund Option for Minnesota R&D Credit Could Boost Cash FlowFollow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Paul McVoy and Michael Maroney | Research & Development Tax Credits On June 14, 2025, Minnesota Governor Tim Walz signed H.F. 9 … Read More

- How Manufacturers Can Now Fully Expense Their Facilities and Real PropertyFollow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Lester Cook | Principal, Cost Segregation The 2025 One Big Beautiful Bill Act (OBBBA) introduced a significant opportunity for … Read More

- Section 174A and the 2024 Filing Dilemma for Eligible Small Businesses: Do You File or Amend?Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits As the dust settles following the passage of the One Big … Read More

- KBKG Tax Insight: 179D is Sunsetting – What to Do Before it’s Too LateFollow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jesse Stanley, P.E. | Principal, Green Building Tax Incentives The One Big Beautiful Bill (H.R. 1) modified the previously permanent … Read More

Regional News & Events

- KBKG to Attend and Exhibit at the New England Practice Management ConferenceOur Principal, Alex Martin, and Regional Director, Alexis McClellan will be exhibiting at the New England Practice Management Conference. This conference takes place from November 16th to 18th at the Foxwoods Resort Casino in Mashantucket, CT. About the New England Practice Management Conference … Read More

- This Month’s WebinarsLooking for CPE credit? We have several sessions available this month. Click the links below to register. If you have questions or need help registering, please email [email protected]. Research & Development Tax Credits 11/1/2022 | 12:00 PM PT | 1 hour | 1 CPE credit This webinar will cover the … Read More

- KBKG to Exhibit at the GSCPA Southeastern Accounting ShowOur Regional Directors Chad Niehaus and Matt Kemp are exhibiting at the GSCPA Southeastern Accounting Show. The conference is taking place from Wednesday, August 24, 2022, to Thursday, August 25, 2022, at the Cobb Galleria Centre in Atlanta, Georgia. About the GSCPA Southeastern Accounting Show The … Read More

- KBKG to Exhibit and Sponsor at the ICPA Summit ’22Our Director, Robert VanDeVeire and Regional Director, Todd French are exhibiting at the (Illinois) ICPA Summit ’22. The conference is taking place from August 23rd to August 24th at the Donald E. Stephens Convention Center, in Rosemont, Illinois. About the ICPA Summit ‘22 The ICPAS SUMMIT22 is one … Read More

Timely Tips & Reminders

Firm Updates

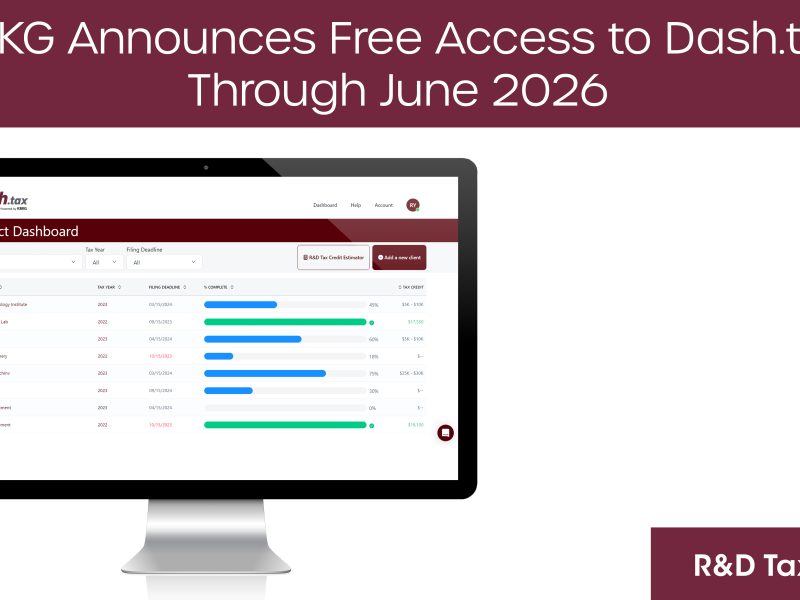

KBKG Announces Free Access to Dash.tax Through June 2026, Empowering Tax Advisors to Claim R&D Tax Credits for Clients

07/14/2025PASADENA, Calif. – July 14, 2025– KBKG, a recognized leader in specialty tax solutions, announced its flagship Research & Development (R&D) tax credit software, Dash.tax, is now available at no cost to approved tax preparers through June 30, 2026. The limited-time initiative enables Certified Public Accountants (CPAs) and other tax professionals to access the full power of Dash.tax-an … Read More

BREAKING NEWS: Trump Announces Sweeping “Reciprocal Tariffs”

04/02/2025By Alex Martin | Principal, Transfer Pricing President Trump signed an executive order on April 2, 2025, implementing a new “Reciprocal Tariffs” policy, aimed at what the administration describes as unfair trade practices. See tariff rates for select trading partners below. Tariff Rates for Selected Trading Partners China: 54% (20% current tariff rate + 34% … Read More

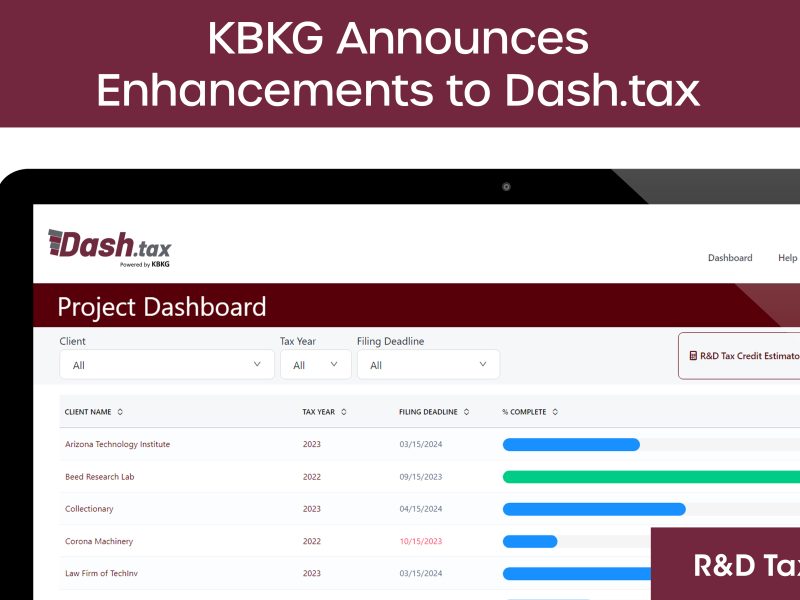

KBKG Announces Enhancements to Dash.tax, Streamlining R&D Tax Credit Claims for CPAs, Startups, and Small Businesses

03/04/2025PASADENA, Calif. – March 4, 2025– KBKG, a leader in tax credits and incentives solutions, has introduced significant enhancements to Dash.tax, its innovative tax automation platform designed for CPAs, startups, and small businesses. The latest updates further streamline the process of claiming R&D tax credits, ensuring businesses can efficiently apply credits to payroll taxes, maximize … Read More

Higher Tariffs Are on the Way – Can Your Company Manage the Damage?

01/30/2025By Alex Martin | Principal, Transfer Pricing By Andrew Astor | President, Focus Solutions Business taxes are regularly a hot topic of speculation with every new US presidential administration. This time, customs duty rates may actually be the more painful issue for importers. Higher tariff duties are designed to encourage domestic production, but many companies … Read More

KBKG Announces Leadership Changes

11/01/2024PASADENA, Calif. – November 1, 2024 – KBKG, a nationwide leader in specialized tax services and solutions, proudly announces the appointment of Jason Melillo as Chief Executive Officer and Gian Pazzia as Chairman & Chief Strategy Officer. Melillo and Pazzia begin their positions November 1, 2024. Melillo recently served as a Principal for KBKG, overseeing … Read More

KBKG Announces New DFW Office Location to Support Growing Client Base

10/18/2024Irving, Texas – October 18, 2024 – KBKG, a leading provider of tax services and solutions, is excited to announce the relocation of its DFW office to a new, expanded location at 1400 Corporate Drive, Suite #225, Irving, TX 75038. This move reflects KBKG’s continued growth and commitment to serving clients across Texas and the … Read More

KBKG Named a World’s Leading Transfer Pricing Practice for the Fourth Consecutive Year

10/17/2024PASADENA, Calif. – October 15, 2024 – KBKG, a leading provider of specialty tax services, is proud to announce that its Transfer Pricing practice has been named one of the world’s leading consultancies by International Tax Review (ITR) for the fourth consecutive year. Both clients and professional service firm partners rely on KBKG to deliver … Read More

KBKG Tax Insight – Does Coke Owe the IRS $10+ Billion for Transfer Pricing?

12/09/2023What Happens if Coke Continues to Lose in Tax Court? Coca-cola recently lost an appeal of a transfer pricing court case, which concluded that Coke owes an additional $3.1 billion in tax for 2007 through 2009.¹ In addition to denying the Motion for Reconsideration on procedural grounds, Tax Court Judge Albert Lauber decided to elaborate … Read More

![There’s Still Time to Claim the R&D Tax Credit on Extension [Infographic] There’s Still Time to Claim the R&D Tax Credit on Extension [Infographic]](https://www.kbkg.com/wp-content/uploads/Theres-Still-Time-to-Claim-the-RD-Tax-Credit-on-Extension.jpg)