Research and Development (R&D) Tax Credit

Course Description:

This webinar will cover the fundamentals of the Research and Development (R&D) Tax Credit. Topics include history and recent developments, project qualifications, calculating the benefits, the chronology of a typical project, and joint issues. Hundreds of companies take advantage of the credit each year to increase their bottom line. It’s time to learn how you can benefit!

Objectives:

- Provide a general overview of the R&D Tax Credit

- Learn how to identify qualifying projects

- Understand the various calculation methods and a sample calculation

- Discuss the project implementation and issues to consider

Upcoming Webinars:

To receive CPE credit, you must answer 75% of the polling questions throughout the presentation and participate (logged in) for a minimum of 50 min for each hour. CPE certificates will be emailed to eligible attendees and may take up to two weeks to be issued after the webinar: They can also be retrieved from your KBKG Solutions account dashboard once issued.

Webinars are hosted by CPA Academy.

Our courses are not approved for Enrolled Agent (EA) Continuing Education (CE)

If you are having technical difficulties during the webinar, you can send an inquiry to the Q&A chat or please send an email to [email protected] or [email protected]. If you have any questions or issues with your CPE certificate please send an email to [email protected].

Webinars are conducted by CPA Academy. For Zoom or in-person CPE courses click here.

National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. National Registry of CPE Sponsors ID Number: 108505. State boards of accountancy have final authority on accepting individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org

KBKG is registered with The American Institute of Architects (AIA) as part of its Continuing Education Services program to provide continuing education learning units on specific courses. Provider Number: 10009587

WHAT ATTENDEES ARE SAYING ABOUT US

"Outstanding webinar on the basics of the R&D credit. The information they provided was easy to understand, relevant to multiple industries and focused less on a product they are trying to sell and more on teaching the topic at hand. One of my favorite webinars I've participated in!"

Alecia B, Tulsa, OK

"The presenters were knowledgeable in the R&D Credit and were able to present in such a manner that made the calculations easy to grasp and the components that comprise the credit easy to understand. Thank you!"

Marta H, Tampa, FL

"Accumulating necessary information in order to obtain the R&D credit can be a daunting task for an organization and this seminar provided some big picture items to consider when considering whether it is beneficial and worthwhile to obtain the R&D credit for the organization."

Jason M, Omaha, NE

R&D Tax Insights

Why R&D Credit Claims Fail Without Documentation

08/08/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Many businesses invest heavily in innovation, developing new technologies, improving systems, and solving technical problems. However, when it comes time to claim the Research and Development (R&D) Tax Credit, they often come up short because they fail to demonstrate a proper process of experimentation, which is … Read More

R&D Deductions for 2024? AICPA Pushes IRS for Urgent Guidance with Recommendations

08/07/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker and Paul McVoy | Principals – Research & Development Tax Credits The One Big Beautiful Bill Act (OBBBA) established that eligible small businesses may fully deduct domestic research costs capitalized in 2022-2024 via amended return. The problem is there’s currently no clear guidance … Read More

Choosing Between ASC and Regular R&D Credit Methods

08/01/2025This update was originally published on June 2, 2014. Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Kevin Zolriasatain | Principal, Research & Development Tax Credits In a surprising, and long overdue modification to the Section 41 Research & Development tax credit, Treasury announced TD 9666 allowing taxpayer’s the opportunity to use the Alternative … Read More

Mastering the Business Component Test for R&D Tax Credit Success

07/28/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube When it comes to claiming the Research and Development (R&D) Tax Credit, understanding the Business Component Test is essential. This test serves as a cornerstone of eligibility, requiring that all qualified research activities be directly tied to a specific business component. Without this alignment, your R&D … Read More

New Refund Option for Minnesota R&D Credit Could Boost Cash Flow

07/25/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Paul McVoy and Michael Maroney | Research & Development Tax Credits On June 14, 2025, Minnesota Governor Tim Walz signed H.F. 9 into law, enacting a major update to the state’s R&D tax credit. Beginning in tax year 2025, businesses may elect to receive a … Read More

Manufacturing: Claiming R&D Credits for Improving Processes

07/24/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube When most people hear “Research and Development,” they imagine high-tech labs, futuristic prototypes, or scientists in white coats. In reality though, Research & Development (R&D) Tax Credits are just as available to the manufacturing floor as they are to the science lab. Many companies in manufacturing, … Read More

Section 174A and the 2024 Filing Dilemma for Eligible Small Businesses: Do You File or Amend?

07/21/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits As the dust settles following the passage of the One Big Beautiful Bill Act (OBBBA), many small businesses and their CPAs are navigating the mechanics of Section 174A, the newly enacted provision that restores the ability to … Read More

How to Claim R&D Credits After an Acquisition

07/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Acquiring another company isn’t just a strategic move that grows market share or expands a portfolio of products. Acquisitions can also unlock significant tax advantages. One area that companies often overlook is the Research and Development (R&D) Tax Credit, which can help them gain significant value … Read More

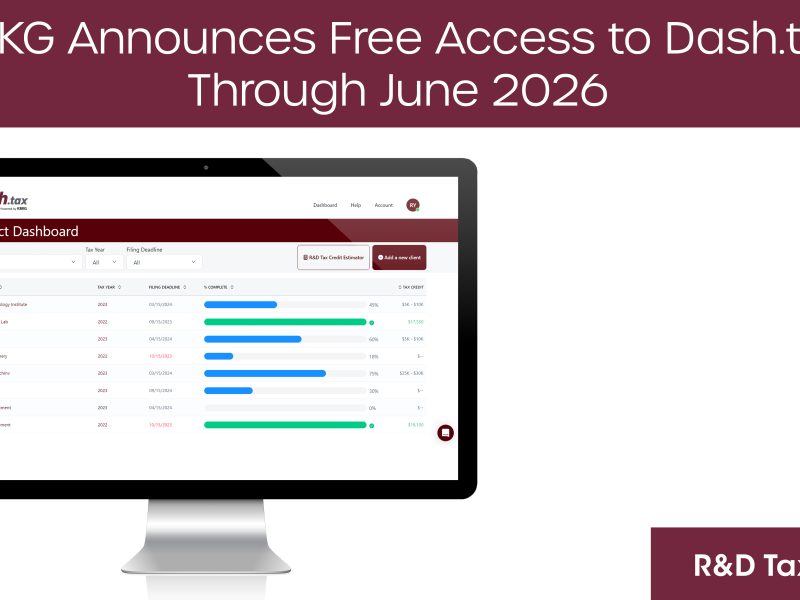

KBKG Announces Free Access to Dash.tax Through June 2026, Empowering Tax Advisors to Claim R&D Tax Credits for Clients

07/14/2025PASADENA, Calif. – July 14, 2025– KBKG, a recognized leader in specialty tax solutions, announced its flagship Research & Development (R&D) tax credit software, Dash.tax, is now available at no cost to approved tax preparers through June 30, 2026. The limited-time initiative enables Certified Public Accountants (CPAs) and other tax professionals to access the full power of Dash.tax-an … Read More

Claiming the R&D Tax Credit for Failed Projects

07/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Most businesses associate the Research and Development (R&D) Tax Credit with breakthrough innovations and completed projects. If a product launches successfully or a process gets optimized, it seems obvious to include those efforts in an R&D claim, but what happens when your project fails? Surprisingly, failure … Read More