internationally?

Contact us today for more information.

business operate

internationally?

Why Choose KBKG for Transfer Pricing?

Personalized service and practical solutions for our clients and service provider partners. KBKG’s transfer pricing team is led by Alex Martin, an economist with 25 years of experience in the transfer pricing field. We understand how US and international tax authorities enforce transfer pricing regulations, and we design strategies with our clients accordingly. Just as important, we prioritize tax and cash savings when designing strategies for clients.

What is Transfer Pricing?

The transfer pricing of goods, royalties, services, and loans drives the amount of tax a multinational pays by country. We assist US and international companies in establishing, documenting, and defending transfer pricing practices for the IRS and international tax authorities. Our services include IRS and OECD transfer pricing documentation, economic benchmarking, BEPS services, and advance pricing agreement. We assist companies in optimizing cash flow and global effective tax rates.

From a government perspective, transfer pricing audits are a high return on investment making sure companies pay their ‘fair share’ of income tax. Transfer pricing audits can result in significant additional tax, interest, and penalties along with double taxation.

We provide full transfer pricing services to US and international multinationals.

Transfer Pricing Services

- Documentation - US, OECD, and International

- Documentation Report Updates

- Comparable Benchmarking Studies

- Audit Defense

- OECD Base Erosion and Profit Shifting (BEPS) Services

- Consulting

- Tax Reform Transfer Pricing Strategies

- Supply Chain Restructuring

- Mergers & Acquisitions/Due Diligence

- Advance Pricing Agreements

While transfer pricing is a significant tax issue, many US and foreign clients are unaware of the tax and cash flow benefits of proactive planning. For example, US tax reform creates some new incentives for multinationals to increase US taxable income to reduce taxes payable. Strategic intercompany pricing strategies can lead to substantial savings on a global basis.

Transfer Pricing Success Stories

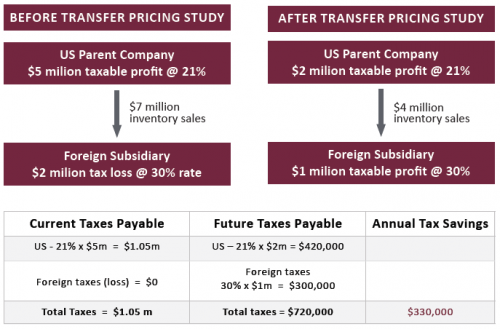

Success Story #1 – Multinational Company Utilizing Tax Net Operating Losses

A profitable US parent company sells $7 million in products to its foreign subsidiary that is incurring losses. The company relies upon a “Cost-Plus” policy.

Strategy

After preparing a transfer pricing analysis, KBKG recommends reducing transfer pricing on cross- border inventory sales by $3M.

Results

Reducing inventory transfer prices by $3 million leads to $330,000 of annual tax savings!

- This strategy is also applicable to foreign-owned companies with US subsidiaries.

- This strategy is also applicable for royalties and service charges.

- Reduces transfer pricing audit risk in foreign country. Tax authorities regularly challenge lossmaking subsidiaries.

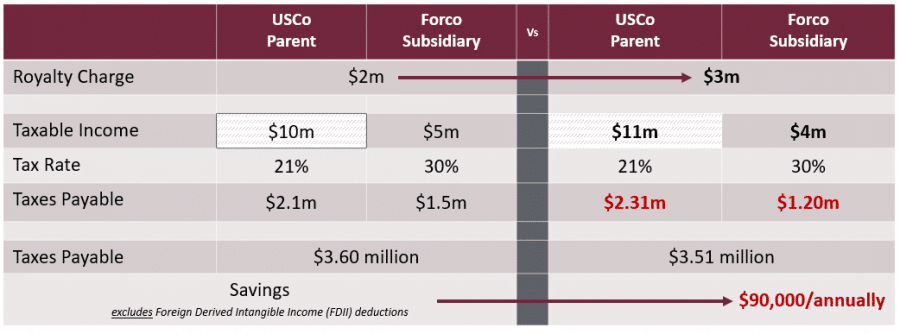

Success Story #2 – Tax Reform Transfer Pricing Strategy

US based C-Corp with global revenue of $50M. Historically minimized their tax footprint in the US (due to old 35% tax rate). New investments in R&D and manufacturing have justified increasing transfer prices for goods, royalties and services to subsidiaries.

Strategy

Increase transfer prices to capitalize on lower US tax rates (21%) through tax reform. Higher transfer prices generate more deductions overseas at higher rates.

Results

A $1 million increase in goods, royalties and/or service charges to subsidiary in a 30% tax jurisdiction yields income tax savings of $90,000 annually ((30%-21%) x $1m)

- This strategy also applies to foreign-owned companies with US subsidiaries

- Higher income in low-tax jurisdictions increases deductions in high-tax subsidiaries

- Every $1m increase in royalty generates $90,000 in tax savings

Additional Benefit

New incentive for C-Corp exporters, Foreign Derived Intangible Income (“FDII”), allows some export income, including goods, royalties and services, to be taxed at a rate of 13.125%.

- Increases to transfer prices could lead to even higher tax savings, e.g. (30% - 13.125%) = $168,750 annual savings

Get a Free Download of this Transfer Pricing One Pager

How Much is it Worth?

US tax reform has created opportunities to improve global effective tax rates through changes to transfer prices. Below is a list of three of the most prominent benefits.

Export Income

Foreign Derived Intangible Income (“FDII”) allows C-Corporations to pay a 13.125% rate on some export income

Tax Savings

Changes to transfer prices of imported goods may also lead to tax savings at the 21% rate

Benefits

Substantial benefits when correcting transfer pricing to utilize tax net operating losses

Transfer Pricing Tax Insights

BREAKING NEWS: Trump Announces Sweeping “Reciprocal Tariffs”

04/02/2025By Alex Martin | Principal, Transfer Pricing President Trump signed an executive order on April 2, 2025, implementing a new “Reciprocal Tariffs” policy, aimed at what the administration describes as unfair trade practices. See tariff rates for select trading partners below. Tariff Rates for Selected Trading Partners China: 54% (20% current tariff rate + 34% … Read More

Higher Tariffs Are on the Way – Can Your Company Manage the Damage?

01/30/2025By Alex Martin | Principal, Transfer Pricing By Andrew Astor | President, Focus Solutions Business taxes are regularly a hot topic of speculation with every new US presidential administration. This time, customs duty rates may actually be the more painful issue for importers. Higher tariff duties are designed to encourage domestic production, but many companies … Read More

KBKG Named a World’s Leading Transfer Pricing Practice for the Fourth Consecutive Year

10/17/2024PASADENA, Calif. – October 15, 2024 – KBKG, a leading provider of specialty tax services, is proud to announce that its Transfer Pricing practice has been named one of the world’s leading consultancies by International Tax Review (ITR) for the fourth consecutive year. Both clients and professional service firm partners rely on KBKG to deliver … Read More

KBKG Expert, Alex Martin, Featured in Financial Times on Coca-Cola’s $6 Billion Tax Court Defeat

08/19/2024PASADENA, Calif. – August 19, 2024 – KBKG, a nationwide leading provider of specialized tax services and solutions, recently presented its expert analysis surrounding a $6 billion Coca-Cola tax court case. As one of the nation’s few Transfer Pricing experts, KBKG Principal Alex Martin was featured in the Financial Times and Bloomberg Law for his … Read More

Is Your Company Overpaying Taxes While Operating Internationally?

02/05/2024by Alex Martin | Principal, KBKG Transfer pricing (TP) regulations govern the prices for goods, services, royalties, loans, and other transactions between related companies operating in different tax jurisdictions. The prices charged in cross-border transactions drive how much tax a multinational company pays by country. Transfer pricing regulations are designed to ensure intercompany transactions are … Read More

KBKG Tax Insight – Does Coke Owe the IRS $10+ Billion for Transfer Pricing?

12/09/2023What Happens if Coke Continues to Lose in Tax Court? Coca-cola recently lost an appeal of a transfer pricing court case, which concluded that Coke owes an additional $3.1 billion in tax for 2007 through 2009.¹ In addition to denying the Motion for Reconsideration on procedural grounds, Tax Court Judge Albert Lauber decided to elaborate … Read More

IRS Puts 150 Companies on Notice: Your Transfer Pricing is a Problem

10/26/2023IRS Puts 150 Companies on Notice: Your Transfer Pricing is a Problem The IRS recently announced several new initiatives as a result of funding from the Inflation Reduction Act, with a special emphasis on making sure multinationals and high-wealth individuals pay their ‘fair share’ of taxes. First item on the press release – the IRS … Read More

KBKG Named One of the World’s Leading Transfer Pricing Practices for Third Consecutive Year

08/30/2023KBKG Named One of the World’s Leading Transfer Pricing Practices for Third Consecutive Year PASADENA, Calif. – 08/30/2023 – KBKG, a leading provider of turnkey tax services and solutions, has been named one of the world’s top transfer pricing firms for 2023-24 by the International Tax Review. This honor marks the third year in a … Read More

South Carolina Court Cancels Tractor Supply Co.’s Transfer Pricing Strategy

08/25/2023South Carolina Court Cancels Tractor Supply Co.’s Transfer Pricing Strategy A recent ruling from a South Carolina judge in the Tractor Supply Co. v. S.C. Dep’t of Revenue case highlights the need for substance when implementing state tax savings strategies. The Court’s rejection of Tractor Supply Company’s (TSC) transfer pricing approach resulted in an additional … Read More

Why Choose KBKG as Your Transfer Pricing Partner

07/11/2023Why Choose KBKG as Your Transfer Pricing Partner Transfer pricing (TP) is widely considered the most contentious tax issue for multinational companies. KBKG is positioned to deliver practical transfer pricing insights with personalized service. Our relationships with multinationals, CPAs, and other professional service providers enable our clients to optimize cash flow, reduce global effective tax … Read More