SOFTWARE SOLUTIONS HUB

KBKG’s suite of software offers a range of tools built to maximize tax savings, create efficiencies, and scale your business. Login to our Solutions portal for access to our flagship products: Dash.tax R&D Tax Credit Software & the Residential Cost Segregator, our DYI software that transformed cost segregation for smaller residential properties. You can also try out our 481(a) Adjustment Calculator, Partial Disposition Calculator, and more!

Our goal? To make your life easier.

Premium Software

Discover KBKG's most innovative, time and tax-saving software products.

R&D Tax Credits up to $50,000!

R&D Tax Credit Software

Designed for CPAs, Small Businesses & Startups- White-label dashboard, syncs with 200+ payroll systems, instant deliverables - flat fee!

LEARN MORE

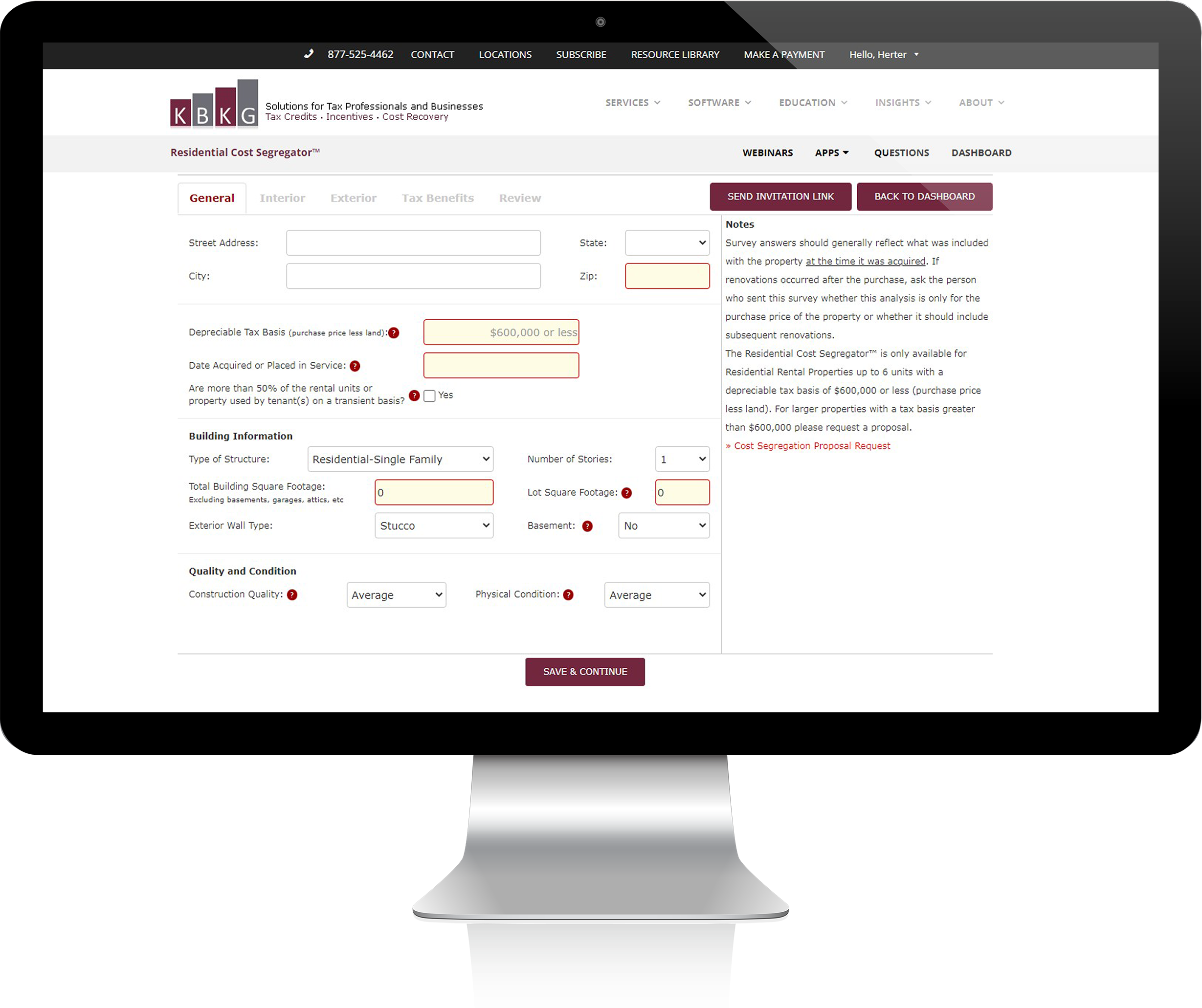

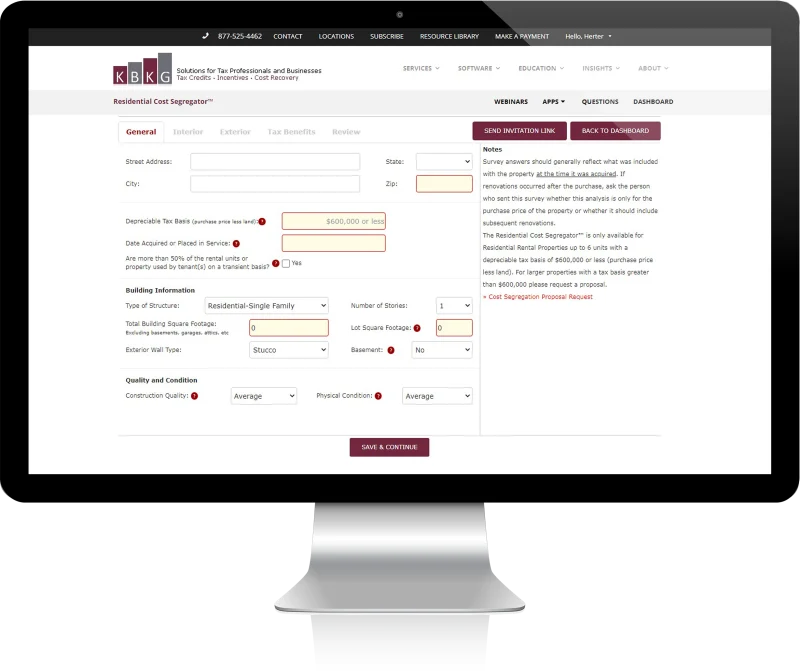

Residential Cost Segregator®

Properties up to $1.2M in depreciable basis

DIY Cost Segregation Software

Available for residential rental homes, condos, apartments and short-term vacation rentals up to 6-units with depreciable tax basis of $1,200,000 or less (excluding land)

LEARN MORE481(a) Adjustment Calculator

Calculate IRC §481(a) adjustments required for IRS Form 3115, Change in Accounting Method

481(a) Adjustment

Adjustment Software for Cost Segregation, depreciation & repair deduction

LEARN MOREPartial Disposition Calculator

Easy to use PPI adjusted value calculation using the discounting approach

Partial Disposition Calculator

By entering basic data, the calculator provides a PPI adjusted value while considering the condition of the respective component at the time it was acquired.

LEARN MOREKBKG Solutions offers powerful tools that empower businesses of all sizes to easily navigate the intricacies of various tax incentives, including Dash.tax R&D Tax Credit Software, Payroll Tax Credit, Residential Cost Segregator® DYI Software, 481(a) Adjustment, Partial Disposition, Employee Retention Tax Credit, and IC-DISC Federal Export Tax Incentive. With our user-friendly and accurate calculators, you can now harness the full potential of these incentives to boost the bottom line.

Testimonials

I had an excellent experience working with KBKG as the controller and tax manager for my employer. I had worked with other credit providers in the past. They felt very organized and were courteous and easy to work with. They exceeded expectations in their work product and the amount of credits we received. Very happy experience all the way around. Thanks KBKG.

KBKG is truly a great firm!!! I contacted them for a cost segregation study on a short term vacation rental property I own. From the initial engagement, they were very professional and down to earth. I do my own taxes and just completed a 1031 exchange as well. They took me through the entire process and explained it in a manner that I could understand. I ended up dealing with multiple people and was amazed at how experienced and knowledgeable the whole team was. Great experience and would highly recommend.