FEATURES

We are proud to have our thought leadership published by distinguished journalists, publications, agencies, and organizations across the nation. As nationally-recognized authors and public speakers, our team of technical experts, provide a depth of knowledge to the business industry with a focus on tax credits, incentives and cost recovery. Please see below for a listing of our latest features. For media inquiries, contact Ryan Levine at [email protected]. To learn about speaking engagements, please view our topics and speaker bios in our Speaker Media Kit.

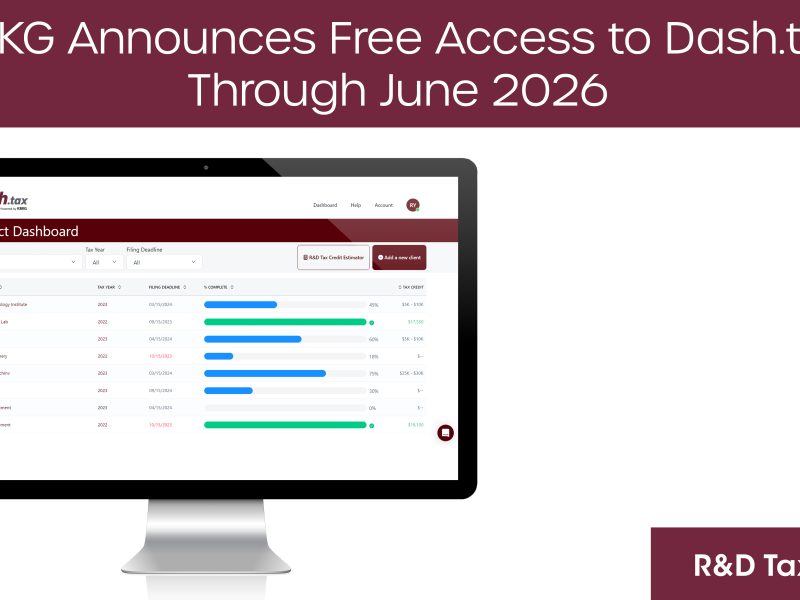

KBKG Announces Free Access to Dash.tax Through June 2026, Empowering Tax Advisors to Claim R&D Tax Credits for Clients

07/14/2025PASADENA, Calif. – July 14, 2025– KBKG, a recognized leader in specialty tax solutions, announced its flagship Research & Development (R&D) tax credit software, Dash.tax, is now available at no cost to approved tax preparers through June 30, 2026. The limited-time initiative enables Certified Public Accountants (CPAs) and other tax professionals to access the full power of Dash.tax-an … Read More

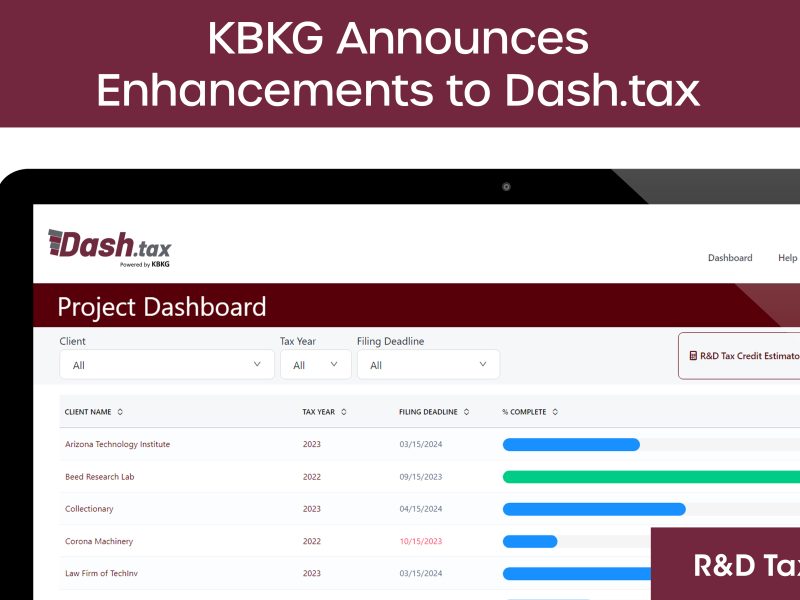

KBKG Announces Enhancements to Dash.tax, Streamlining R&D Tax Credit Claims for CPAs, Startups, and Small Businesses

03/04/2025PASADENA, Calif. – March 4, 2025– KBKG, a leader in tax credits and incentives solutions, has introduced significant enhancements to Dash.tax, its innovative tax automation platform designed for CPAs, startups, and small businesses. The latest updates further streamline the process of claiming R&D tax credits, ensuring businesses can efficiently apply credits to payroll taxes, maximize … Read More

KBKG Announces Leadership Changes

11/01/2024PASADENA, Calif. – November 1, 2024 – KBKG, a nationwide leader in specialized tax services and solutions, proudly announces the appointment of Jason Melillo as Chief Executive Officer and Gian Pazzia as Chairman & Chief Strategy Officer. Melillo and Pazzia begin their positions November 1, 2024. Melillo recently served as a Principal for KBKG, overseeing … Read More

KBKG Announces New DFW Office Location to Support Growing Client Base

10/18/2024Irving, Texas – October 18, 2024 – KBKG, a leading provider of tax services and solutions, is excited to announce the relocation of its DFW office to a new, expanded location at 1400 Corporate Drive, Suite #225, Irving, TX 75038. This move reflects KBKG’s continued growth and commitment to serving clients across Texas and the … Read More

KBKG Named a World’s Leading Transfer Pricing Practice for the Fourth Consecutive Year

10/17/2024PASADENA, Calif. – October 15, 2024 – KBKG, a leading provider of specialty tax services, is proud to announce that its Transfer Pricing practice has been named one of the world’s leading consultancies by International Tax Review (ITR) for the fourth consecutive year. Both clients and professional service firm partners rely on KBKG to deliver … Read More

KBKG Proudly Promotes Jesse Stanley to Principal of Green Building Tax Incentives

09/25/2024PASADENA, Calif. – September 25, 2024 – KBKG, a nationwide leader in specialized tax services and solutions, proudly announces the promotion of Jesse Stanley to Principal, joining its executive team. In his elevated role, Stanley will oversee and lead all of KBKG’s Green Building Tax Incentives (GBTI) services, including the 179D Tax Deduction and the … Read More

KBKG Expert, Alex Martin, Featured in Financial Times on Coca-Cola’s $6 Billion Tax Court Defeat

08/19/2024PASADENA, Calif. – August 19, 2024 – KBKG, a nationwide leading provider of specialized tax services and solutions, recently presented its expert analysis surrounding a $6 billion Coca-Cola tax court case. As one of the nation’s few Transfer Pricing experts, KBKG Principal Alex Martin was featured in the Financial Times and Bloomberg Law for his … Read More

Simple, Swift, Secure: KBKG’s Dash.tax Transforms R&D Credits Up to $50k

04/29/2024PASADENA, Calif. – April 29, 2024 – KBKG, a premier provider of comprehensive specialty tax services and solutions, proudly announces the debut of Dash.tax, its latest R&D tax credit software solution tailored for CPAs and businesses. Designed for swift and precise outcomes, Dash empowers users to effortlessly generate customized Research & Development (R&D) tax credit … Read More