Residential Cost Segregator®

Now available for properties up to $1.2M in depreciable basis (not including land)!

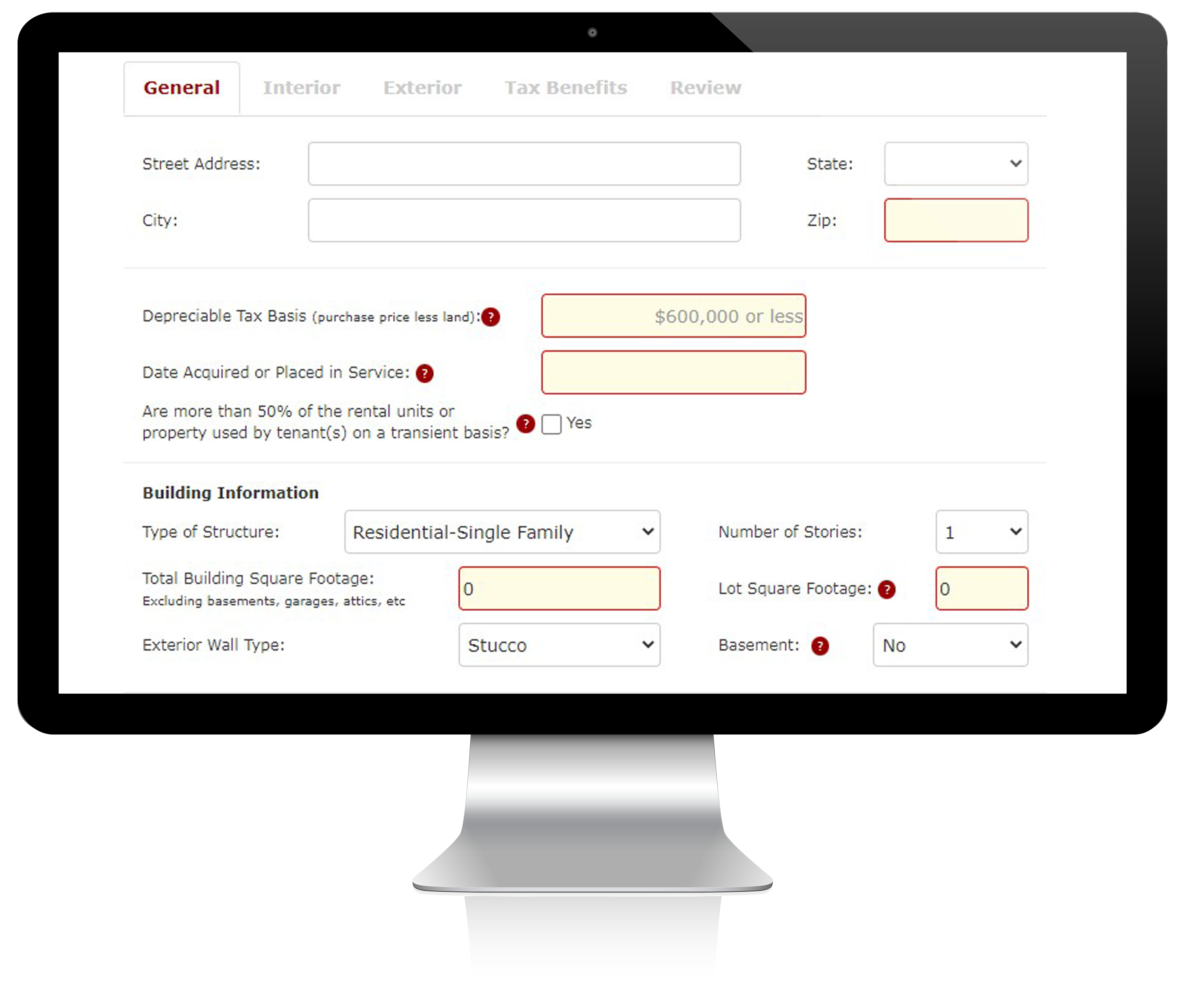

DIY Cost Segregation Software

The Residential Cost Segregator® is software that allows CPAs and property owners to generate custom reports in just minutes which can be submitted to claim the tax benefit without having to hire a specialist.

The software is available for residential rental properties up to 6 units with a depreciable tax basis of $1,200,000 or less (purchase price less land).

Quick and Easy Cost Segregation Results

Residential Properties

Available for residential rental homes, condos, apartments and short-term vacation rentals up to 6-units with depreciable tax basis of $1,200,000 or less (excluding land)

Easy to Use

Results in less than 15 minutes!

Designed for CPAs & Owners

KBKG Audit Guarantee

Free audit support

Backed by KBKG

Designed by Certified engineers with decades of experience

481(a) Adjustment

Convenient access to depreciation adjustment calculator

$450 per Credit

Discount available for multiple credits

*The cost of a report does not include your tax preparer’s fees to assist with information gathering, reviewing data, and implementation on your tax return. Please consult your tax advisor regarding additional fees.

Case Studies

-

Short-Term Vacation Rental

$234k Additional Deductions -

6-Unit Apartment Bldg

$215k Additional Deductions -

Duplex Condo

$87k Additional Deductions

Single Family Short-Term Vacation Rental

Property Details:

Additional Deductions of $234K in the first year

Deductions offset taxable income and reduce tax liability

- Depreciable basis = $750,000

- Placed in Service: June 2023

- Building Area: 2,500 SF

- Lot Size: 7,100 SF

- Assumes general depreciation and applicable bonus rates apply

6-Unit Apartment Building

Property Details:

Additional Deductions of $215K in the first year

Deductions offset taxable income and reduce tax liability

- Depreciable basis = $1,000,000

- Placed in Service: July 2021

- Building Area: 4,500 SF

- Lot Size: 3,050 SF

- Assumes general depreciation and applicable bonus rates apply

This video will demonstrate the Residential Cost Segregator® designed to address residential rental property with a maximum of $1,200,000 in depreciable tax basis.

Preview Your Tax Savings with KBKG's Residential Cost Segregator® Calculator

Maximize Value, Minimize Cost!

Scale Up, Save Big: Unlock Discounts with Bulk Credits for Multiple Properties!

Frequently Asked Questions

For most buildings, a Cost Segregation study requires the knowledge of a Certified Cost Segregation Professional (CCSP) with an engineering background. This is because of variations in construction from one building to another as well as varied tax law depending on building types. The engineer physically inspects the property and performs construction quantity takeoffs to account for each building component. Empirical cost data is then used to reconstruct the cost of the entire property. The result is a report with schedules showing values that can be substantiated by the data collected by the engineer.

The Residential Cost Segregator® utilizes many of the same concepts, calculations, and data. Instead of an engineer, the Residential Cost Segregator® relies on data provided by the building owner. So if the building owner indicates the property has carpet in the bedrooms and was acquired with certain appliances, the software accounts for these items. The information provided is processed using KBKG’s proprietary algorithms and empirical data to generate a logical breakdown of costs for each major property component.

The Residential Cost Segregator® is designed specifically for properties too small to hire an experienced CCSP to analyze. Because every property is unique, it may not account for unusual items that exist and generally provides a more conservative allocation than may be available to the taxpayer. The Residential Cost Segregator® is not adequate for use to conduct a Cost Segregation study on larger, more complex properties.

Cost Segregation is a commonly used strategic tax planning tool that allows building owners who have constructed, purchased, expanded or remodeled real estate to increase cash flow by accelerating depreciation deductions and deferring federal and state income taxes.

A Cost Segregation report for residential investment property dissects the purchase price of the property that would otherwise be depreciated over 27.5 years for income tax purposes.

- Accelerate Depreciation Deductions: The primary goal of Cost Segregation is to identify all property-related costs that can be depreciated faster (typically over 5, 7 and 15 years).

- Retirement and Partial Disposition Deductions: The secondary goal of Cost Segregation is to establish the depreciable tax value for each major building component that is likely to be replaced in the future. Examples include roof, windows, doors, bathroom fixtures, HVAC, etc. When a component is replaced, taxpayers need this information to claim a “retirement loss” or “partial disposition” deduction for its remaining depreciation.