by Alex Martin | Principal, KBKG

Transfer pricing (TP) regulations govern the prices for goods, services, royalties, loans, and other transactions between related companies operating in different tax jurisdictions.

The prices charged in cross-border transactions drive how much tax a multinational company pays by country. Transfer pricing regulations are designed to ensure intercompany transactions are priced fairly – or “arm’s-length” – among related companies.

Many companies are streamlining their supply chains in response to economic, legal, and geopolitical factors. However, management may be unaware of how transfer pricing can improve cash flow by optimizing intercompany pricing.

Don’t Overpay Tax When Restructuring Supply Chains

Transfer pricing is regularly overlooked when a multinational reorganizes its organizational footprint. Why? Management involved in operational changes may not be aware of the tax and cash flow impact of intercompany prices.

The default option is often a reliance on longstanding policies, but sometimes this approach leads to some companies overpaying tax, while others not paying their ‘fair share of tax.’ A numerical example helps illustrate this dilemma and solution.

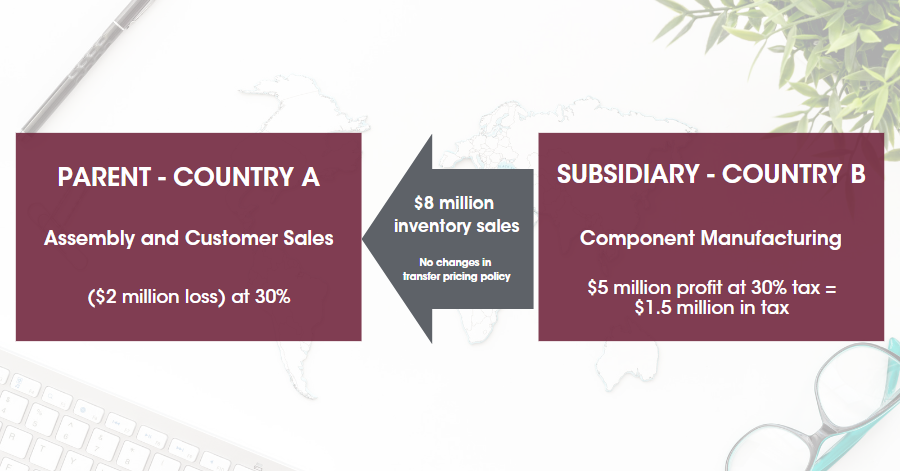

The multinational company in Example 1a has onshored significant parts of its supply chain to mitigate the risk of inventory shortages from Country B. However, the company maintains a longstanding transfer pricing policy leading to the potential for excessive subsidiary profits in Country B. Meanwhile, the centralized assembly and sales operation is incurring losses. In practice, the company may be overpaying tax in Country B while incurring losses in Country A.

Example 1: Is This Company Now Overpaying Tax?

In Example 1a

- The subsidiary in Country B may be overpaying tax;

- The parent company may face a tax audit risk in Country A when losing money, resulting in a tax assessment, potential penalties, and double tax;

- The Company may require additional capital injections from shareholders; and

- The company may need to borrow more from lenders.

In our experience, multinational companies incurring losses in one country and significant profits elsewhere are often well placed to improve their global effective rate. However, an assessment of tax audit risks and ‘excessive’ profits will depend on company-specific facts and circumstances.

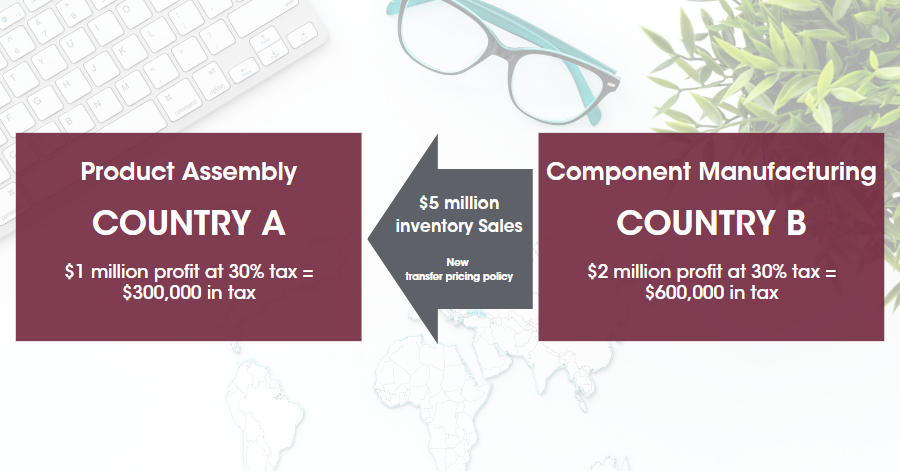

Example 1b: Optimized Transfer Pricing Policies = Lower Taxes and Improved Cashflow

[1] We use manufactured goods in this example, but royalties and service charges operate in a similar manner.

After revisiting the company’s transfer pricing policy, reducing transfer prices by three million dollars leads to lower taxes payable in Country B, while utilizing the losses in Country A. The company should also explain the reasoning behind the changes in transfer prices.

The end result is $600,000 less tax payable on a global basis. Furthermore, the company faces lower tax audit risks in Country A along with less of a need for additional cash investments.

Other Complications and Opportunities

Changing transfer prices does carry some risks. Tax authorities may question why transfer prices have been adjusted. In our experience, explaining how the company is actively complying with transfer pricing rules is a far easier tax audit discussion than justifying misaligned prior-year results. Practically speaking, auditors in Country A would likely expect some taxes would be payable, especially after a supply chain restructuring.

Consequently, a clear explanation of how and why the supply chain has been restructured is helpful evidence to satisfy an auditor’s questions.

Companies should also consider customs duty considerations when changing prices.

Is Transfer Pricing more than a tax savings benefit?

Assessing taxes payable may be the most straightforward savings to calculate when revisiting cross-border pricing. However, the additional borrowing costs and other cashflow complications can be just as crucial when managing day-to-day operations. Reasons to review transfer prices include:

- Subsidiaries incurring losses may need capital injections from the parent company to fund operations;.

- Alternatively, the company may need to borrow more from banks when interest rates are rising; and

- Companies with limited cash on hand may lose out on important investment opportunities such as investing in facilities, hiring employees, and expanding sales and marketing activities. The additional time required to arrange financing can prevent a company from realizing all of the benefits of a local country presence.

Here, an optimized transfer pricing strategy saves on working capital costs and can improve flexibility when making investment decisions.

The Takeaway

In summary, a strategic approach to transfer pricing benefits multinationals through:

Paying Less Tax

As outlined in Example 1b, if the component manufacturer can reduce inventory transfer prices to five million dollars at a 30% tax rate, the company pays $600,000 less in taxes in total.

Reducing Investment Costs

If the subsidiary in Country A incurs losses, the company may be forced to invest additional capital to fund operations. In this example, Country A only needs to finance five million in inventory purchases rather than eight million dollars. The company does not need to tap into credit lines or request additional capital.

Limiting Tax Audit Risks

The product assembly subsidiary faces higher tax audit risks for not paying “their fair share” when incurring losses. Practically speaking, auditors in Country A would likely expect some taxes would be payable, especially after a supply chain restructuring.

Multinational companies paying significant taxes in some jurisdictions and incurring losses elsewhere could be missing out on significant cash savings opportunities. A supply chain optimized for transfer pricing can substantially improve the return on investment.

Why KBKG is the Trusted Partner for You

Transfer pricing is a highly contentious issue for multinational corporations. KBKG is exceptionally well-equipped to provide transfer pricing advice with tailored customer service.

We have a history of strong relationships with multinationals, CPAs, and other professional service providers. We focus on helping our clients optimize cash flow, reduce global effective tax rates, and manage audit risks. Our time-tested strategies assist companies in managing TP consistently with their global operations.

KBKG’s TP practice leader has over 25 years of experience and the International Tax Review has named KBKG one of the world’s leading transfer pricing practices.

About the Author

Alex Martin – Principal, Transfer Pricing

Alex Martin – Principal, Transfer Pricing

Alex Martin is the Principal and Transfer Pricing Practice leader at KBKG, operating from Michigan. He has over 25 years of full-time transfer pricing experience working in Washington, D.C.; Melbourne, Australia; and Detroit, Michigan over the course of his career. KBKG has been named one of the world’s leading transfer pricing consultancies by International Tax Review for three years running. » Full Bio