Follow KBKG on Social Media

By Gian Pazzia and Paul McVoy | Research & Development Tax Credits

Breaking News – July 4, 2025

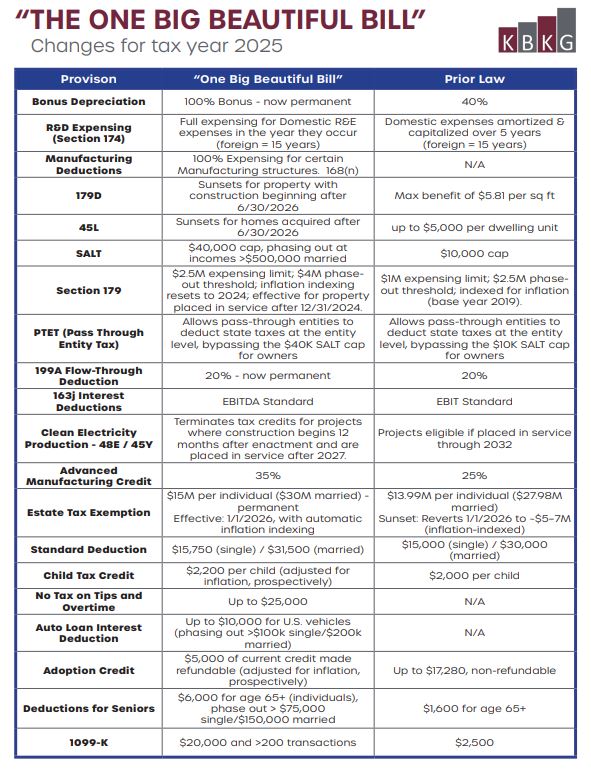

On July 4th, President Trump signed the “One Big Beautiful Bill Act” (OBBBA), marking a significant overhaul to federal tax policy. The signing reflects a major pivot in legislative priorities toward domestic production and pro-business tax policy.

The new law restores 100% bonus depreciation, reinstates immediate expensing for U.S.-based R&D, terminates dozens of Inflation Reduction Act (IRA) clean energy programs, and permanently extends individual tax cuts. It also introduces fresh incentives for middle-class families and manufacturers with details outlined below.

Latest Tax Highlights

1. 100% Bonus Depreciation Restored

Businesses can immediately expense qualifying assets placed in service after January 19, 2025, eliminating the previously scheduled phase-down. This change is expected to drive accelerated capital investment across industries.

2. New Bonus Depreciation for Manufacturing QPP (Section 168(n))

Qualified production property enjoys 100% bonus depreciation through 2032, a significant benefit for domestic manufacturers and supply-chain operators.

3. Immediate Expensing of U.S. R&D (Section 174 Rule Fixed)

Domestic research costs are now fully deductible under new Section 174A. Foreign R&D must still be amortized over 15 years. Companies with capitalized domestic R&D expenses from 2022–2024 can elect a catch-up deduction, which could significantly improve cash flow for firms engaged in innovation. Additionally, eligible small businesses may elect to retroactively apply full expensing to tax years beginning after 2021, allowing them to amend prior returns and recover previously amortized costs.

4. IRA Clean Energy Incentives Terminated

The law eliminates many IRA-era green tax credits, including 179D, 45L, and electric vehicle credits. 179D terminates for properties beginning construction after June 30, 2026. 45L terminates for all dwelling units that are closed or initially leased after June 30, 2026. This reversal requires developers and energy companies to revisit project economics for renewable energy initiatives.

5. Curtailment of Clean Energy ITC and PTC (48/45)

Projects relying on the Investment Tax Credit (ITC) under Section 48 and the Production Tax Credit (PTC) under Section 45 must begin construction within 12 months of the date of enactment of this Act to qualify. Projects placed in service after December 31, 2027, are no longer eligible for these credits. The Act also terminates the tech-neutral credits under Sections 48E and 45Y for electricity production through wind and solar facilities, effectively shifting incentives away from long-term clean energy projects.

Additional Tax Highlights

- Section 179 Expensing Cap Increased: Small businesses can expense up to $2.5 million in qualifying property, creating an expanded opportunity for equipment-heavy operations to write-off costs. The phase-out threshold also rises to $4 million, enabling more businesses to take full advantage of these deductions

- SALT Work-Arounds Preserved: The final text retains full deductibility of state and local taxes paid through state-enacted pass-through entity taxes in over 30 states, a critical win for real estate partnerships and other pass-through businesses.

- SALT Cap Increased with Phaseout for High Earners: The $10,000 cap on state and local tax deductions has been raised to $40,000 for most taxpayers. However, the benefit phases out for households with adjusted gross income (AGI) exceeding $500,000, tapering to restore the lower cap for high earners.

- Section 899 “Retaliatory Tax” Eliminated: The updated text fully drops the controversial Section 899 retaliation measures that would have chilled foreign investment in United States real estate

- Excess Business Losses Softened: The revised text drops plans to permanently silo active pass-through losses from wages and investment income, preserving flexibility for business owners.

- Section 163(j) Business Interest Deduction Changes: Revised EBITDA-based limitation supports capital-intensive businesses and improves access to financing for growth-oriented firms.

- International Tax Reforms: GILTI (renamed Net CFC Tested Income) and FDII (now Foreign-Derived Deduction Eligible Income) rules tighten deductions and credits, requiring multinationals to review their international tax positions.

- Increased LIHTC Ceiling: Encourages more affordable housing development by increasing state credit allocations and lowering financing thresholds.

- Pro-Business Enhancements: Expanded Section 1202 exclusions, Opportunity Zone extensions, and enhanced expensing caps reward domestic investment and provide additional tools for real estate and private equity firms.

- Middle-Class Deductions Introduced: New deductions for overtime pay, car loan interest, and tips aim to ease the tax burden on working families and incentivize participation in key service industries.

Looking Ahead

Tax practitioners and business leaders should begin planning. Many provisions take effect immediately or retroactively to the start of 2025, requiring a fresh look at estimated tax payments and year-end planning. Advisors should model client-specific scenarios for cash flow, effective tax rates, and project timelines.

Next Steps for CPAs and Businesses

- Review Client Portfolios Today: Identify capital investments, R&D activity, and real estate deals impacted by the new rules.

- Model Scenarios: Analyze cash flow effects of immediate expensing, bonus depreciation, and repealed green credits.

- Communicate With Stakeholders: Inform clients and boards of directors about key changes and strategic opportunities to reduce tax burden.

- Plan Accounting Method Changes: Stay ahead of IRS guidance to elect into beneficial provisions like R&D catch-up deductions.

Reference:

Read full text of the One Big Beautiful Bill Act

Related Insight:

KBKG: SALT Workaround Preserved, Real Estate & R&D Expensing Win Big

KBKG: Retroactive and Permanent R&D Expensing Restored

KBKG: What’s Happening with the One Big Beautiful Bill

KBKG: GOP Tax Bill 2025 House Passes Senate Revisions Ahead

How Bonus Depreciation Changes Affect Real Estate Strategy

Schedule your KBKG consultation now

About the Authors

Gian Pazzia | Chairman & Chief Strategy Officer

Gian P. Pazzia is currently the Chairman & Chief Strategy Officer at KBKG and oversees all strategic initiatives for the company. He has over 25 years of experience in the specialty tax industry. He is a recognized leader in the cost segregation field serving as a former President (2013-2015 term) of the American Society of Cost Segregation Professionals… Read More

Paul McVoy | Principal – Research & Development Tax Credits

Paul McVoy is a Principal for KBKG’s Tax Credit Consulting practice. In this role, Paul devotes his time to consulting companies in maximizing their R&D tax credit claims. Prior to joining KBKG, Paul was a manager at a Big Four accounting firm out of the Philadelphia, San Diego, and Los Angeles offices. Paul McVoy has spent nearly 20 years in public accounting, leveraging previous tax compliance… Read More