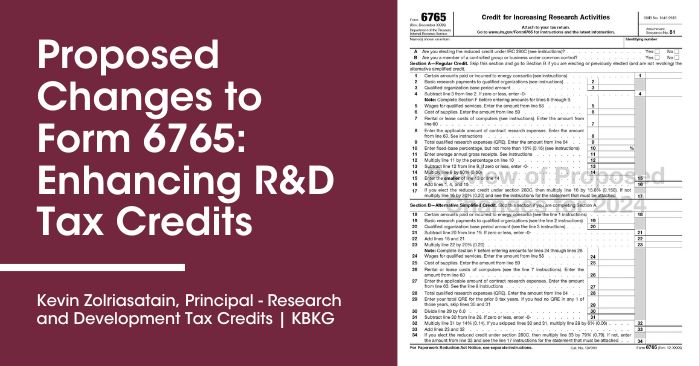

Proposed Changes to Form 6765: Enhancing R&D Tax Credits

Thought Leadership by Kevin Zolriasatain | Principal, Research & Development Tax Credits

Staying informed about regulatory updates is vital for tax professionals, especially when it comes to Research and Development (R&D) tax credits. The Internal Revenue Service (IRS) made a significant announcement on Friday, September 15th, unveiling proposed changes to Form 6765, the “Credit for Increasing Research Activities.” This form, also known as the Research Credit or R&D Tax Credit form, plays a pivotal role in incentivizing and rewarding businesses for their investments in research and development activities.

What Are the Key Proposed Changes to Form 6765?

The proposed changes to Form 6765 include the introduction of a new Section E, featuring five miscellaneous questions, and a new Section F, for reporting both quantitative and qualitative information for each business component.

Additionally, the IRS plans to relocate the “reduced credit” election question and the question related to “controlled groups or businesses under common control” from their previous positions on lines 17 and 34 to the top of Form 6765.

The IRS is also soliciting feedback on whether Section F should be optional for specific taxpayers meeting certain criteria, such as those with qualified research expenditures below a designated threshold at a controlled group level, those with a Research Credit lower than a specified amount at a controlled group level, or those classified as Qualified Small Businesses eligible for the Payroll Tax Credit.

Section E: Other Information

- Number of Business Components

- Officer’s Compensation

- Acquisitions / Dispositions

- New Categories of QRE Included (“Consistency Requirement”)

- ASC 730 Directive

Section F: Business Component Information (Similar to CCM 20214101F)

- Business Component Descriptive Name

- Information sought to be discovered and alternatives evaluated through a process of experimentation

- Business Component New or Improved?

- Type of Business Component

- Business Component Use

- Software

- QRE by Business Component

The IRS Is Requesting Feedback

The IRS is seeking feedback on the proposed changes to Form 6765, including suggestions regarding optional Section F choices and related questions. Stakeholders are encouraged to submit their feedback to [email protected] with the subject line: “Feedback/Questions F6765” by October 31, 2023.

Taxpayers will face added tasks and need more data for their tax returns starting in tax year 2024.

The Significance of R&D Tax Credits

R&D tax credits are a powerful tool for businesses looking to bolster their financial health while fostering innovation. They incentivize research and development activities by offering substantial tax reductions. Understanding the intricacies of these credits is essential for optimizing tax strategies.

Implications for Tax Professionals

As tax professionals specializing in taxation, these proposed changes hold several implications:

- Expertise in Tax Code Evolution

Staying informed about changes in tax forms and regulations is pivotal for tax professionals. These changes offer a firsthand look at how tax regulations evolve. - Compliance Mastery

Tax professionals must excel in compliance requirements, and changes to Form 6765 reflect the IRS’s quest for improved reporting and accuracy, a vital aspect of R&D tax credit claims. - Career Preparedness

Familiarity with tax forms and regulations is a foundational skill for tax professionals. Proficiency in the Research Credit and its related forms is especially valuable, as businesses frequently leverage this incentive. - Potential for Future Advocacy

Tax professionals may find themselves in a position to provide feedback on similar changes in the future, thereby influencing tax regulations.

The Broader Picture

These potential changes align with the IRS’s overarching goals, such as aiding taxpayers in meeting their obligations and employing enhanced data and analytics for more efficient operations. R&D tax credits frequently feature in corporate, business, and individual taxpayer returns, often demanding substantial examination resources. By simplifying reporting and enhancing compliance, the IRS aims to deliver effective tax administration.

Tax professionals specializing in taxation should view these proposed changes to Form 6765 as an opportunity to deepen their understanding of R&D tax credits and compliance. Vigilantly monitoring developments like these ensures that tax professionals are well-prepared to navigate the intricate landscape of taxation, ultimately benefiting their clients. Your expertise and active engagement can contribute to more efficient and effective tax administration, ultimately optimizing R&D tax credit opportunities for businesses.

Read more about the Research and Development Tax credit in these recent blog posts.

- KBKG Tax Insight: IRS Releases Guidance on Section 174 R&E Expenses

- Wisconsin Department Revenue Updates Publication 131 – R&D Tax Credits

- How Form 6765 Can Benefit Your Business

- R&D Tax Credit for Software Development

- Understanding the R&D Tax Credit for Manufacturing

- R&D Tax Credits for Small Businesses

- Section 174 and R&E – Uncertainty and Questions