SEE IF YOU QUALIFY

SEE IF YOU QUALIFY

Who Can Benefit From The Research & Development Credit?

The research credit provides dollar-for-dollar cash savings each year for companies performing activities related to the development of new or improved products and processes. These benefits could provide much needed cash to hire additional employees, increase R&D, expand production facilities, etc.

Case Studies by Industry

Case Study

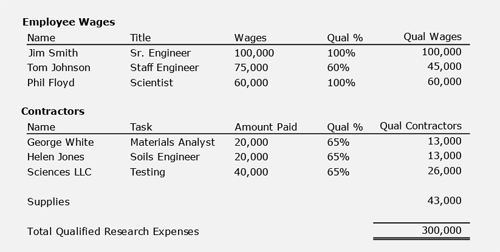

The following is a case study that presents a fictitious company, some of whose activities qualify for the credit.

Qualifying Activities

- Activities must involve the development of new or improved products, processes, or software

- There must be uncertainty as to the design of the new product, process, or software

- Testing alternative methods in an attempt to achieve the desired result

- The activities must be technological in nature, making use of the principles of the physical sciences

Qualifying Costs Associated With The Above Activities Include:

- Wages subject to income tax withholding paid to employees to perform qualified activities

- 65% of amounts paid to non-employees to perform qualified activities (contract research)

- Supplies (non-depreciable property) used to build prototypes and other tangible items used in the development process

KBKG Results

The calculation of the Credit requires several other attributes not included in this case study. However, in this case study, the current year federal credit could be up to $30,000.