for the R&D Tax Credit

below and one of our R&D Tax Credit experts will contact you.

Qualify for the

R&D Tax Credit

PRODUCTS AND PROCESSES

R&D Tax Credits for the Brewery Industry

Refunds are available for companies performing research within the Brewery Industry. The research credit provides dollar-for-dollar cash savings each year for companies performing activities related to the development of new or improved products and processes. These benefits could provide much needed cash to hire additional employees, increase R&D, expand production facilities, etc.

Many companies involved with brewing are unaware that their efforts within designing and developing their products can yield a large amount of research credits. Examples of R&D activities related to the industry as well as potentially qualifying job titles are listed below.

Examples of Qualifying R&D Activities

Related to the development of new or improved:

- Bottle conditioning

- Filtration methodologies or wastewater methods

- Hopping techniques and styles

- Manufacturing technology in efforts to improve manufacturing flexibility and agility due to increased product volume and diversity

- Packaging designs to ensure shelf life longevity

- Product formulations or recipes (e.g. dry hopping, fermentation methods)

- Product formulations or improved ingredient mixing methods or testing of product ingredient combinations relative to new flavors or enhancements

- Prototype product samples for testing and validation of new recipe formulations

- Quality assurance testing processes

- Testing of prototype samples for analytical and microbiological qualities

Potentially Qualifying R&D Job Titles

- Assistant Brewer

- Head Brewer

- Lab Assistant

- Lab Manager

- Production Operations Manager

- Regional Brewer

AMT Offset

For tax years beginning after December 31, 2015, eligible small businesses (those with $50 million or less of gross receipts) may claim the research credit against AMT liability.

Up to $250,000 in Payroll Tax

Qualified start-up companies may elect to use up to $250,000 of the research credit against payroll taxes. Treasury Regulations have substantially broadened the range of taxpayers who are eligible for the credit. Start-ups to publicly traded businesses who were previously unable to realize a benefit from this lucrative tax credit should reassess their eligibility.

Estimate Your Benefits with our FREE Calculators

Use our calculators for an estimate of state and federal R&D tax credit benefits or to determine if you can offset payroll tax using the R&D tax credit. It's easy to use and free. If at any time you have questions, contact us. We are here to help you realize your maximum tax benefit.

Get a Free Download of this Research & Development One Pager

Research and Development Tax Credit Insights

Why R&D Credit Claims Fail Without Documentation

08/08/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Many businesses invest heavily in innovation, developing new technologies, improving systems, and solving technical problems. However, when it comes time to claim the Research and Development (R&D) Tax Credit, they often come up short because they fail to demonstrate a proper process of experimentation, which is … Read More

R&D Deductions for 2024? AICPA Pushes IRS for Urgent Guidance with Recommendations

08/07/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker and Paul McVoy | Principals – Research & Development Tax Credits The One Big Beautiful Bill Act (OBBBA) established that eligible small businesses may fully deduct domestic research costs capitalized in 2022-2024 via amended return. The problem is there’s currently no clear guidance … Read More

Choosing Between ASC and Regular R&D Credit Methods

08/01/2025This update was originally published on June 2, 2014. Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Kevin Zolriasatain | Principal, Research & Development Tax Credits In a surprising, and long overdue modification to the Section 41 Research & Development tax credit, Treasury announced TD 9666 allowing taxpayer’s the opportunity to use the Alternative … Read More

Mastering the Business Component Test for R&D Tax Credit Success

07/28/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube When it comes to claiming the Research and Development (R&D) Tax Credit, understanding the Business Component Test is essential. This test serves as a cornerstone of eligibility, requiring that all qualified research activities be directly tied to a specific business component. Without this alignment, your R&D … Read More

New Refund Option for Minnesota R&D Credit Could Boost Cash Flow

07/25/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Paul McVoy and Michael Maroney | Research & Development Tax Credits On June 14, 2025, Minnesota Governor Tim Walz signed H.F. 9 into law, enacting a major update to the state’s R&D tax credit. Beginning in tax year 2025, businesses may elect to receive a … Read More

Manufacturing: Claiming R&D Credits for Improving Processes

07/24/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube When most people hear “Research and Development,” they imagine high-tech labs, futuristic prototypes, or scientists in white coats. In reality though, Research & Development (R&D) Tax Credits are just as available to the manufacturing floor as they are to the science lab. Many companies in manufacturing, … Read More

Section 174A and the 2024 Filing Dilemma for Eligible Small Businesses: Do You File or Amend?

07/21/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits As the dust settles following the passage of the One Big Beautiful Bill Act (OBBBA), many small businesses and their CPAs are navigating the mechanics of Section 174A, the newly enacted provision that restores the ability to … Read More

How to Claim R&D Credits After an Acquisition

07/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Acquiring another company isn’t just a strategic move that grows market share or expands a portfolio of products. Acquisitions can also unlock significant tax advantages. One area that companies often overlook is the Research and Development (R&D) Tax Credit, which can help them gain significant value … Read More

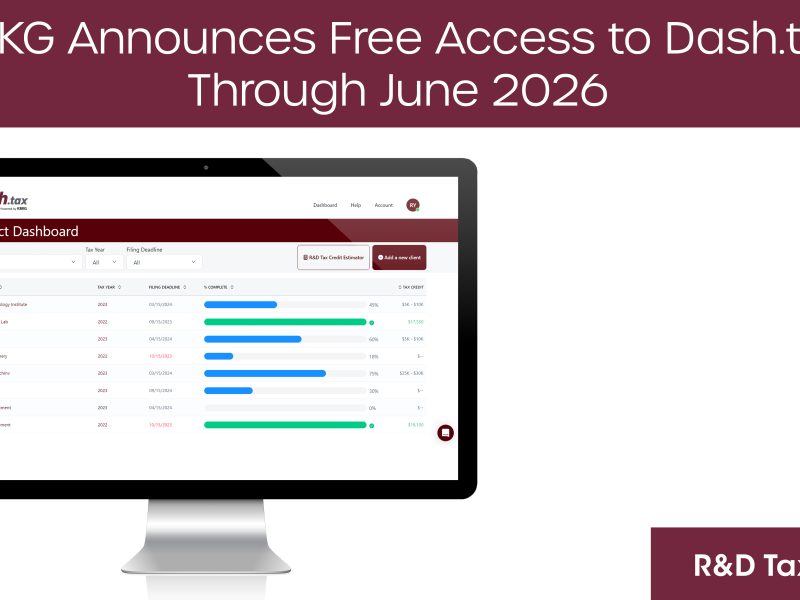

KBKG Announces Free Access to Dash.tax Through June 2026, Empowering Tax Advisors to Claim R&D Tax Credits for Clients

07/14/2025PASADENA, Calif. – July 14, 2025– KBKG, a recognized leader in specialty tax solutions, announced its flagship Research & Development (R&D) tax credit software, Dash.tax, is now available at no cost to approved tax preparers through June 30, 2026. The limited-time initiative enables Certified Public Accountants (CPAs) and other tax professionals to access the full power of Dash.tax-an … Read More

Claiming the R&D Tax Credit for Failed Projects

07/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Most businesses associate the Research and Development (R&D) Tax Credit with breakthrough innovations and completed projects. If a product launches successfully or a process gets optimized, it seems obvious to include those efforts in an R&D claim, but what happens when your project fails? Surprisingly, failure … Read More