For the most up-to-date information on Qualified Improvement Property, see our latest post.

Rev. Proc. 2020-25 was issued on April 17, 2020, providing guidance on how to implement Qualified Improvement Property (QIP) corrections made within the CARES Act. With this guidance, the IRS provides several options for taxpayers who have placed QIP into service during the 2018, 2019, or 2020 tax year. Additionally, this guidance provides reduced filing requirements for correcting this issue using a Form 3115, Change of Accounting Method.

Prior to the CARES Act, previous law required qualified improvement property (QIP) placed in service after December 31, 2017 to use a 39-year tax life and was not eligible for bonus depreciation. The CARES Act retroactively changed the recovery period for QIP to 15 years thus making it eligible for bonus depreciation through 2026 (100% through 2022). KBKG’s Qualified Improvement Reference Chart has been updated accordingly.

Notable items from Rev. Proc. 2020-25 permit taxpayers to file an amended return, administrative adjustment request under section 6227 (AAR), or a Form 3115, Application for Change in Accounting Method, to change their depreciation of QIP placed in service after December 31, 2017, in the taxpayer’s 2018, 2019, or 2020 taxable year.

KBKG Insight: Many tax preparers do not realize you can amend a tax return and include a Form 3115 for an automatic change in accounting method as long as it is filed before the extended due date of the return. This automatic extension is addressed in Rev. Proc. 2015-13 section 6.03(4)(a). Flow through entities who already filed on or before March 16, 2020 without extending their returns still have time to fix the QIP error for the 2019 tax year.

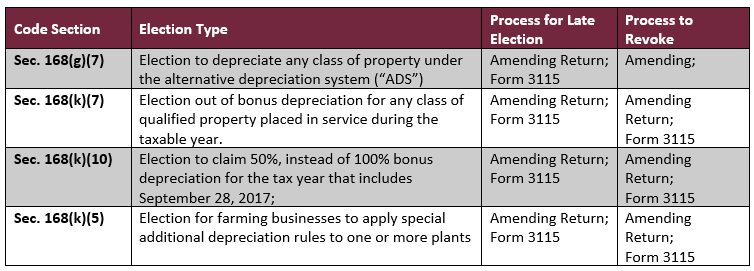

Options to change certain elections under IRC §168

A number of depreciation elections are also addressed. This is because the new 15-year recovery period for QIP can cause a number of unexpected issues depending on a taxpayer’s circumstances. As such, Rev. Proc. 2020-25 allows for the following late elections as well as the ability to revoke previously made elections. The automatic accounting method change number to be used on Form 3115 for election changes is DCN 245.

KBKG Insight: The IRS provides significant relief by allowing taxpayers to use a Form 3115 to change the elections above for a limited period of time. The one exception from above is that the IRC §168(g)(7) election may only be revoked with an amended return or AAR, not by filing a Form 3115.

KBKG Insight: Making a late election or revoking an election under § 163(j) (i.e. electing real property trade or business) are not included here. Any changes to depreciation for QIP affected by §163(j) election changes must follow Rev. Proc. 2020-22.

Options for Correcting Depreciation

Form 3115 – Change of Accounting Method

QIP corrections are allowed using Form 3115 with a new method change number (DCN 244). Rev. Proc 2020-25 allows taxpayers to use Form 3115 even if the impermissible QIP life was reported only once on a previous tax return. Normally, two consecutive returns must be filed to establish an accounting method.

KBKG Insight: A new DCN for QIP provides flexibility to certain taxpayers who would not have been allowed to use DCN #7 for depreciation changes. For example, DCN #7 cannot be used if a historic credit was claimed on QIP. A new DCN also allows taxpayers who already filed a 3115 using DCN #7 in 2019 (maybe for a cost segregation study) to avoid the scope limitation prohibiting a second method change for the same item within a 5-year period.

Reduced filing requirements: Taxpayers only need to fill out the following sections of Form 3115:

1. Page 1, Identification section (above Part I) and signature section;

2. Part I;

3. Part II, all lines except lines 11, 12, 13, 15, 16, 17, and 19;

4. Part IV, all lines; and

5. Schedule E, all lines except lines 1, 4b, 5, and 6.

Late elections or revoking the elections discussed above can be completed by filing an IRS Form 3115 on a timely filed return for the first or second tax year after the property was placed in service or with any return filed after April 16, 2020 and before October 16, 2021. For multiple changes made under Rev. Proc. 2020-25 such as QIP adjustments and late or revoked elections, only one Form 3115 is needed showing the net taxable income adjustment.

KBKG Insight: New changes waive the eligibility rules in Rev. Proc. 2015-13 that normally do not allow an automatic method change for final year returns and also prevent filing a second accounting method change for the same item in a five year period.

Amend Tax Returns or Administrative Adjustment Requests

Rev. Proc. 2020-23 allows BBA partnerships (i.e. subject to the centralized audit regime) to amend 2018 and 2019 returns as long as amended returns and K-1’s are filed before September 30, 2020. BBA partnerships can also file an administrative adjustment request (“AAR”) on or before October 15, 2021, for the tax year in which property was placed in service, but not later than the expiration of the statute of limitations. All other taxpayers may amend returns no later than the expiration of the statute of limitations for the tax year or, if earlier, October 16, 2021.

Qualified Improvement Property is defined as any improvement made by the taxpayer to an interior portion of a building that is nonresidential real property as long as that improvement is placed in service after the building was first placed in service by any taxpayer (Section 168(k)(3)). QIP specifically excludes expenditures for (1) the enlargement of a building; (2) elevators or escalators; (3) the internal structural framework of a building.

KBKG Insight: Taxpayers that want to maximize depreciation must segregate QIP from non-QIP. Building improvements often include items that are not eligible. Examples include but are not limited to HVAC, storefronts, seismic retrofits, roofing, and structural steel. Since budgets and design plans should be reviewed to identify QIP, cost segregation engineers can be engaged to assist.

State Tax Conformity

Although QIP is now eligible for 100% bonus depreciation for Federal income taxes, many states do not conform to bonus deprecation and require a 39-year tax life. For higher taxed states, cost segregation can still make sense when interior improvements are significant.

Interest Limitations under IRC §163(j)

Taxpayers who elect out of the interest limitations under IRC §163(j) are required to use a 20-year ADS life for QIP and therefore are not eligible for bonus depreciation. In these cases, a cost segregation study is greatly beneficial because the items segregated into personal property categories do not get ADS treatment and are therefore eligible for bonus depreciation.

Contact a KBKG specialist to discuss options on how to maximize depreciation deductions on your capital improvements. Our team is available to answer any questions you may have.

You can download our Qualified Improvements Quick Reference Chart for an easy-to-use resource reflecting these new changes for free, by joining our mailing list. Download will be available immediately following submission:

Access the Qualified Improvements Quick Reference Chart

Authors: Gian Pazzia, CCSP; Malik Javed, CCSP; Lester Cook, CCSP

Contributors: Sumit Sharma, CCSP and Eddie Price, CCSP