ERC Tax Season Reminders and Updates Thought Leadership by Ian Williams, Principal | KBKG As we near tax filing deadlines we are also approaching the first Employee Retention Tax Credit (ERC or ERTC) filing deadline (4/15/2024 for any 2020 ERC claims, 4/15/2025 for any 2021 ERC claims). Many taxpayers are still awaiting the processing of … Read More

News

KBKG Tax Insight – Does Coke Owe the IRS $10+ Billion for Transfer Pricing?

What Happens if Coke Continues to Lose in Tax Court? Coca-cola recently lost an appeal of a transfer pricing court case, which concluded that Coke owes an additional $3.1 billion in tax for 2007 through 2009.¹ In addition to denying the Motion for Reconsideration on procedural grounds, Tax Court Judge Albert Lauber decided to elaborate … Read More

Reviving Michigan’s R&D Tax Credit

Reviving Michigan’s R&D Tax Credit Michigan businesses are one step closer to large tax benefit. On February 7, Michigan’s governor, Gretchen Whitmer, presented her FY2025 Executive Budget Recommendation. Included in the budget is a proposal for a $100 million research and development (R&D) credit, the state’s first R&D credit since the corporate income tax (CIT) … Read More

Withdrawal of ERC Claims: A Comprehensive Guide for CPAs

Withdrawal of ERC Claims: A Comprehensive Guide for CPAs Thought Leadership by Ian Williams, Director | KBKG In IRS notice, IR-2023-193, released this week, the IRS has taken a significant step to protect small businesses and organizations from potential scams related to the Employee Retention Tax Credit (ERC) by introducing a novel withdrawal process. This process is designed … Read More

A Guide to Claiming the 179D Deduction

Using the 179D Deduction Successfully running and managing a business requires paying attention to a lot of things, including tax planning. Taxes get complicated, and it can be tough for the average business owner to know which deductions and credits could benefit their company. Take the 179D deduction. This provision allows eligible taxpayers to get … Read More

Take Advantage of the 45L Tax Credit for Residential Development

Take Advantage of the 45L Tax Credit for Residential Development Residential builders, investors, and developers can now qualify for up to $5,000 in tax credits for every energy-efficient dwelling unit. The IRS updated its 45L tax credit program in 2023 to align with Department of Energy programs for Energy Star and Zero Energy Ready Homes. … Read More

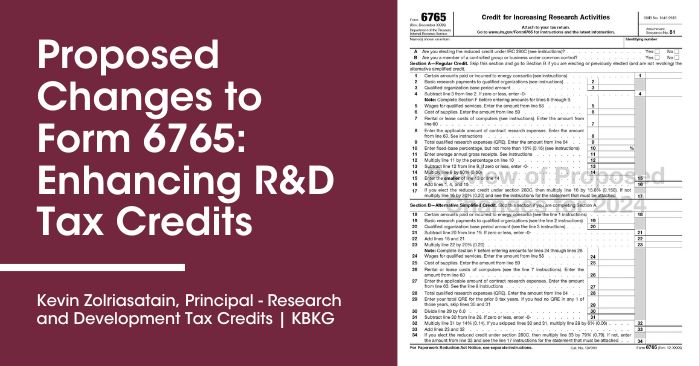

Proposed Changes to Form 6765: Enhancing R&D Tax Credits

Proposed Changes to Form 6765: Enhancing R&D Tax Credits Thought Leadership by Kevin Zolriasatain | Principal, Research & Development Tax Credits Staying informed about regulatory updates is vital for tax professionals, especially when it comes to Research and Development (R&D) tax credits. The Internal Revenue Service (IRS) made a significant announcement on Friday, September 15th, unveiling … Read More

Unlocking Hidden Value: The Power of Cost Segregation Studies

Unlocking Hidden Value: The Power of Cost Segregation Studies Optimizing tax benefits and enhancing cash flow are pivotal to achieving financial success in finance and real estate. One strategy with significant potential is cost segregation. Dive into cost segregation basics, explore what a cost segregation study entails, understand its timing and relevance, and discover KBKG’s … Read More

KBKG’s ERC Guidance for CPAs and Tax Professionals

KBKG’s ERC Guidance for CPAs and Tax Professionals Thought Leadership by KBKG Regarding the latest IRS rules and regulations on the Employee Retention Tax Credit program, it’s paramount for Certified Public Accountants (CPAs) and Tax Professionals to stay ahead of the curve. The Internal Revenue Service (IRS) recently introduced a moratorium on processing Employee Retention … Read More

Accelerate Deductions for Better Cash Flow With KBKG

Accelerate Deductions for Better Cash Flow With KBKG Tax professionals often face residential cost segregation challenges when dividing expenses for multi-unit properties. If this struggle sounds familiar, you might be missing the necessary tools and resources for a successful real estate cost segregation allocation. KBKG streamlines and simplifies the process with our Residential Cost Segregator® … Read More