What is the Research and Development (R&D) Tax Credit?

The R&D Tax Credit (26 U.S. Code §41) is a federal benefit that provides companies dollar-for-dollar cash savings for performing activities related to the development, design, or improvement of products, processes, formulas, or software. This credit provides much needed cash to hire additional employees, increase R&D, expand facilities, and more. The credit was enacted in 1981 to stimulate innovation and encourage investment in development in the US. Since then, many states have also passed the R&D Tax Credit. As such, this benefit is available across a wide variety of industries. Some of the common industries that qualify include, but are not limited to:

Estimate Your Benefits Instantly

Use our calculators for an estimate of state and federal benefits or to determine if you can offset payroll tax using the R&D tax credit. It's easy to use and free. If at any time you have questions, contact us. We are here to help you realize your maximum tax benefit.

What are the Potential Benefits of the R&D Tax Credit?

There are several benefits to realizing the R&D tax credit. These benefits can include the following:

- Receive up to 12-16 cents of federal and state R&D tax credits for every qualified dollar

- Create a dollar-for-dollar reduction in your federal and state income tax liability

- Increase earnings-per-share

- Reduce your effective tax rate

- Improve cash flow

- Carry forward the credit up to 20 years

- Perform look back studies to recognize unclaimed credits for open tax years (generally 3 or 4 years)

- Utilize the federal R&D tax credit against payroll tax (applicable to certain startup companies)

Four-Part Test

Qualified research activities are defined by the four-part test outlined below

Technological in Nature

Activities must fundamentally rely on the principles of physical or biological science, engineering, or computer science.

Permitted Purpose

Activities must be performed in an attempt to improve the functionality, performance, reliability, or quality of a new or existing business component.

Eliminate Uncertainty

Activities intended to discover information that could eliminate technical uncertainty concerning the development or improvement of a product.

Experimentation

All of the activities must include a process of experimentation including testing, modeling, simulating, systematic trial and error.

Research and Development Tax Insights

How to Claim R&D Credits After an Acquisition

07/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Acquiring another company isn’t just a strategic move that grows market share or expands a portfolio of products. Acquisitions can also unlock significant tax advantages. One area that companies often overlook is the Research and Development (R&D) Tax Credit, which can help them gain significant value … Read More

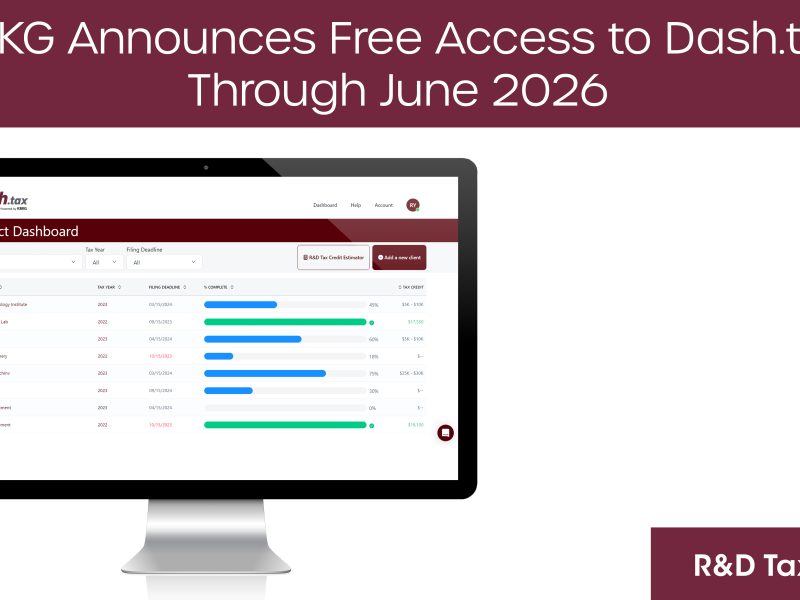

KBKG Announces Free Access to Dash.tax Through June 2026, Empowering Tax Advisors to Claim R&D Tax Credits for Clients

07/14/2025PASADENA, Calif. – July 14, 2025– KBKG, a recognized leader in specialty tax solutions, announced its flagship Research & Development (R&D) tax credit software, Dash.tax, is now available at no cost to approved tax preparers through June 30, 2026. The limited-time initiative enables Certified Public Accountants (CPAs) and other tax professionals to access the full power of Dash.tax-an … Read More

Claiming the R&D Tax Credit for Failed Projects

07/14/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Most businesses associate the Research and Development (R&D) Tax Credit with breakthrough innovations and completed projects. If a product launches successfully or a process gets optimized, it seems obvious to include those efforts in an R&D claim, but what happens when your project fails? Surprisingly, failure … Read More

R&D Expensing is Back: What the Section 174 Fix Means for Your 2024 Tax Strategy

07/08/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Kevin Zolriasatain and Paul McVoy | Principals, Research & Development Tax Credits For the last two years, companies conducting qualified research have been burdened with an unfavorable tax provision that has made Research and Development (R&D) investments more expensive, at precisely the wrong time. That’s … Read More

KBKG Tax Insight: One Big Beautiful Bill – 2025 Tax Changes and Summary Chart

07/03/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Gian Pazzia and Paul McVoy | Research & Development Tax Credits Breaking News – July 4, 2025 On July 4th, President Trump signed the “One Big Beautiful Bill Act” (OBBBA), marking a significant overhaul to federal tax policy. The signing reflects a major pivot in legislative … Read More

SALT Workaround Preserved, Real Estate & R&D Expensing Win Big. What Businesses Need to Know

06/30/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Paul McVoy | Principal, Research & Development Tax Credits The reconciliation process for the “One Big Beautiful Bill” (OBBB) has entered its final phase, and in the past three days, Senate Republicans cleared a key procedural hurdle and released updated text that could reach the Senate … Read More

Texas Enhances R&D Credit, Allowing Companies to Claim More

06/27/2025By Bill Taylor and Giovanni Ortiz | Research & Development Tax Credits On June 1, 2025, Texas lawmakers passed Senate Bill 2206 legislation that significantly enhances the state’s R&D Tax Credit structure. The Governor signed this bill into law on June 17, 2025. Effective for franchise tax reports due on or after January 1, 2026, … Read More

Retroactive and Permanent R&D Expensing Restored Under Proposed Senate Legislation

06/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits The Senate Finance Committee has proposed a significant change to the way U.S. businesses deduct their research and development (R&D) expenses. If passed, the bill would reverse a major change that took effect in 2022 based on … Read More

California Senate Bill 711 Proposes Simplified R&D Credit Method

06/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Tetyana Guguchkina, Elise Rhee, & Michael Maroney | Research & Development Tax Credits California is poised to overhaul its R&D Tax Credit with Senate Bill 711 (SB 711), which proposes replacing the state’s Alternative Incremental Research Credit (AIRC) with a new Alternative Simplified Credit (ASC) … Read More

House Narrowly Passes Major GOP Tax Bill 215–214, Senate Signals Revisions Ahead

05/22/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits Just after midnight on Thursday, May 22, 2025, a full House debate on the multi-trillion-dollar tax bill began, and the House narrowly passed this sweeping tax and spending package dubbed the “One Big Beautiful Bill Act” with … Read More