What is the IC-DISC Federal Export Tax Incentive?

The Interest Charge Domestic International Sales Corporation (IC-DISC) offers significant Federal income tax savings for making or distributing US products for export. The IC-DISC was originally created by Congress to promote export sales by allowing companies to defer income, with interest charged on the deferred tax. Now, the IC-DISC provides significant and permanent tax savings for producers and distributors of U.S. made products used abroad.

Estimate Benefits with the IC-DISC Calculator

Who Can Benefit?

IC-DISC benefits are available to qualified producers or distributors that are either directly involved in exporting, or selling products to distributors or wholesalers who resell for use outside of the U.S. This includes traditional manufacturers as well as those who grow agriculture products, extract minerals, distribute U.S. made goods, and develop software. Engineering and architectural services related to foreign construction projects are also included.

How does it work?

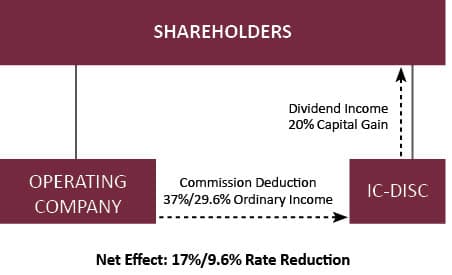

The owner of the operating company forms a tax-exempt IC-DISC. The IC-DISC must maintain its own bank account, accounting records, and file U.S. tax returns, but otherwise, there are no changes to business operations.

- The operating company pays a tax-deductible commission to the IC-DISC equal to the greater of 4% of operating company’s gross receipts from qualified exports or 50% of the operating company’s net income from qualified exports.

- The operating company expenses the commission and reduces ordinary income taxed at a maximum 37%, (or 29.6% with full QBI deduction) rate.

- The IC-DISC is tax exempt and is not taxed on the commission income it receives from the operating company.

- The IC-DISC pays dividends to its shareholders, which are taxed at a 20% rate.

- The result yields a 17/9.6% permanent tax rate arbitrage (3.8% net investment income tax may yield different results).

KBKG Advantage

Discover why so many companies and accounting firms rely on KBKG for their tax incentive, credit and deduction planning needs.

As one of the premier service providers in the industry, we are passionate about helping business owners and accounting professionals across the country identify, claim and—when needed—defend their tax savings strategies. Our KBKG Advantage is the reason why clients turn to us time and time again for assistance. For superior teamwork, tailored service, and assurance backed by our KBKG Audit Guarantee, you can rely on KBKG. Learn more...