The IRS and Treasury released Rev. Proc. 2022-14 earlier this year, updating and superseding the current list of automatic method changes.

Background

Taxpayers generally cannot change from an established accounting method to a different method unless they first obtain IRS consent to change from the established accounting method. Taxpayers must obtain IRS consent to change from a permissible accounting method to another permissible accounting method or from an impermissible accounting method to a permissible accounting method. The IRS grants automatic consent for certain accounting method changes to expedite the IRS approval process outlined in IRC Section 446(e).

On January 31, 2022, the IRS released guidance listing the specific changes in accounting method to which the automatic change procedures set forth in Rev. Proc. 2015-13 apply. Rev. Proc. 2022-14 updates and supersedes the current list of automatic changes. The new guidance stems from the significant modifications outlined in TCJA provisions, CARES Act, final bonus depreciation regulations, as well as removing outdated terms, conditions, and procedures provided in Rev. Proc. 2019-43.

Rev. Proc. 2022-14 provides 22 modifications which include, but are not limited to income recognition, UNICAP, §174 expenditures and depreciation. The focus of this insight will be the specific changes to the list of automatic changes since the issuance of Rev. Proc. 2019-43, specifically related to depreciation or amortization-related method changes outline in §168.

KBKG Insight:

Taxpayers who never took advantage of a cost segregation analysis can utilize the automatic change in accounting method to retroactively incorporate the results and catch up on all the benefits of the accelerated depreciation in the current year filing.

Specific changes to automatic accounting method procedures from Rev. Proc 2019-43

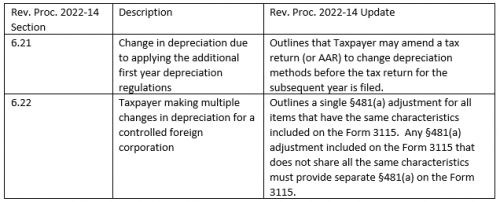

Rev. Proc. 2022-14 updates the list of automatic change procedures stemming from new guidance. Please see the chart below for specific updates related to Section 6 Depreciation or Amortization changes in the accounting method.

Removal /clarification of outdated terms & conditions

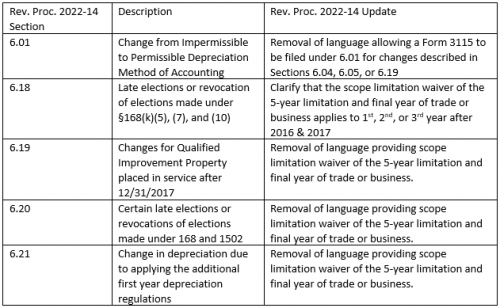

Rev. Proc. 2022-14 clarifies or removes language on certain rules as the timeframe for these rules have passed and the language is outdated. Please see chart below for specific updates related to Section 6 Depreciation or Amortization changes in accounting method.

Effective Date /Transition Guidance

Rev. Proc. 2022-14 is generally effective for Forms 3115 filed on or after January 31, 2022, for a year of change ending on or after May 31, 2021, that is filed under the automatic change procedures of Rev. Proc. 2015-13.

To learn more about Cost Segregation, contact our experts.

About the Author

Amar Patel – Director

Southeast

Amar spent 15 years at a Big Four accounting firm and one year at Centiv, LLC, focusing on various specialty tax products including Cost Recovery Solutions and Research & Development Tax Credits. In the past 16 years of practice, Amar has become an expert in cost segregation and large fixed asset depreciation reviews for purposes of identifying federal, state, and property tax benefits. » Full Bio