Are R&D Tax Credits Available in Connecticut?

The state of Connecticut provides the Research and Development (R&D) Tax Credit which allows C corporations to claim both incremental AND non-incremental Research and Development Tax Credit for R&D expenses paid or incurred by the corporation within the state. The definition of qualified research expenses for both credits is expenses that may be deducted under IRC § 174 and basic research payments defined under IRC § 41.

Here is a summary of the two credits:

Incremental R&D Credit

- The tax credit is equal to 20% of the incremental increase in R&D expenses that are conducted in Connecticut.

- Depending on the tax year, the credit can reduce up to 70% of the corporate business tax liability.

- This tax credit may be carried forward for up to 15 years.

- Partially refundable for taxpayers whose gross income does not exceed $70 million AND have no tax liability.

Non-incremental R&D Credit

- A qualified small business can claim a tax credit equal to up to 6% of the current year's R&D expenses, dependent on gross receipts.

- For tax years beginning on or after January 1, 2021, any unused credits can be carried forward up to 15 years. Prior years can carry forward for an unlimited period of time.

- Depending on the tax year, the credit can reduce up to 70% of the corporate business tax liability.

- Partially refundable for taxpayers whose gross income does not exceed $70 million AND have no tax liability.

Connecticut R&D Tax Credit Case Study

A Stanford company designs and manufactures components for the aerospace industry. The company claims R&D credits each year for the development activities of its engineers. This project involved a multi-year study.

The Company qualified for the federal R&D Tax Credit of $327,833 and an additional $184,000 for the state R&D Tax Credit in Connecticut.

|

FEDERAL

|

CONNECTICUT

|

|||||

|

Year

|

Total QREs

|

Credit

|

Total QREs

|

Credit

|

||

|

2021

|

$1,300,000

|

$135,333

|

$1,300,000

|

$72,000

|

||

|

2020

|

$900,000

|

$91,000

|

$900,000

|

$52,000

|

||

|

2019

|

$650,000

|

$63,000

|

$650,000

|

$36,000

|

||

|

2018

|

$450,000

|

$38,500

|

$450,000

|

$24,000

|

||

| Total | $3,300,000 | $327,833 | $3,300,000 | $184,000 | ||

You can read more about this Connecticut case study here.

Four-Part Test

Qualified research activities are defined by the four-part test outlined below

Technological in Nature

Activities must fundamentally rely on the principles of physical or biological science, engineering, or computer science.Permitted Purpose

Activities must be performed in an attempt to improve the functionality, performance, reliability, or quality of a new or existing business component.Eliminate Uncertainty

Activities intended to discover information that could eliminate technical uncertainty concerning the development or improvement of a product.Experimentation

All activities must include a process of experimentation including testing, modeling, simulating, and systematic trial and error.Research and Development Tax Insights

Lawmakers Introduce Bill to Retroactively Fix R&D 174 Expensing

03/14/2025By Kevin Zolriasatain and Paul McVoy | Principals, Research & Development Tax Credits On March 10, 2025, a bipartisan group of lawmakers introduced the American Innovation and R&D Competitiveness Act of 2025 in the U.S. House of Representatives. The legislation aims to restore the immediate deductibility of research and experimental (R&E) expenditures and reverse the amortization requirement imposed … Read More

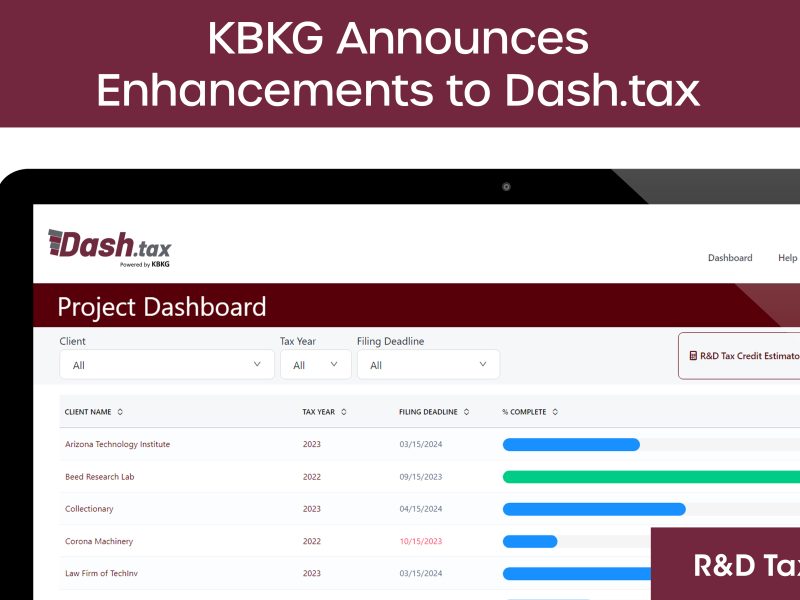

KBKG Announces Enhancements to Dash.tax, Streamlining R&D Tax Credit Claims for CPAs, Startups, and Small Businesses

03/04/2025PASADENA, Calif. – March 4, 2025– KBKG, a leader in tax credits and incentives solutions, has introduced significant enhancements to Dash.tax, its innovative tax automation platform designed for CPAs, startups, and small businesses. The latest updates further streamline the process of claiming R&D tax credits, ensuring businesses can efficiently apply credits to payroll taxes, maximize … Read More

Engineering Firms Loses R&D Credits in Court Ruling

02/12/2025By Michael Maroney | Director, Research & Development Tax Credits The Phoenix Design Group, Inc. v. Commissioner decision issued on December 23, 2024, is an important reminder of the hurdles faced when substantiating research activities for the R&D tax credit. The court denied all research credits claimed by Phoenix Design Group (PDG), a multidisciplinary engineering … Read More

KBKG Tax Insight: Michigan R&D Tax Credit Now Available

02/07/2025By Michael Maroney | Director, Research & Development Tax Credits On January 13, 2025, Michigan Governor Gretchen Whitmer signed HBs 5099-5102 and 4368 to establish the Innovation Fund and the R&D tax credit. With the passage of HBs 5100 and 5101, Michigan will again offer a state-level R&D tax credit. The Michigan research credit offers … Read More

Texas Issues Guidance on Franchise Tax Credits and Carryforward

01/23/2025By Bill Taylor | Principal, Research & Development Tax Credits Recently, the Texas Comptroller’s Tax Policy Division issued guidance on how to apply multiple franchise tax credits and credit carryforwards when more than one is available. The updated guidance clarifies the order in which credits should be applied to maximize tax benefits for taxable entities. … Read More

45X Advanced Manufacturing Production Credit Regulations Update

12/19/2024By Jonathan Tucker | Principal – R&D Tax Credits Republican Senators Tom Cotton (R-AR) and Rick Scott (R-FL) have introduced a resolution (S.J.Res. 119) to overturn final regulations (TD 10010) implementing the Section 45X Advanced Manufacturing Production Credit, a green energy tax incentive created by the Inflation Reduction Act. This mirrors a bipartisan House resolution … Read More

KBKG Tax Insight: Potential Tax Changes Under a Republican Trifecta – Key Issues to Watch

12/03/2024By Jonathan Tucker | Principal, Research & Development Tax Credits Republicans are slated to take control of the legislative and executive branches this coming year, and shifts in fiscal policy will affect taxes, tariffs, and broader economic strategies. KBKG Insight: While there is excitement and talk around “tax cuts,” taxpayers should monitor this changing landscape, … Read More

Key Changes in Accounting Method Procedures for Section 174 Research Expenditures

10/02/2024The IRS has recently issued Rev. Proc. 2024-34, which modifies the method change procedures for specified research or experimental (SRE) expenditures under Section 174. This updated guidance provides important changes for taxpayers seeking to comply with the amended rules following the 2017 Tax Cuts and Jobs Act (TCJA). Here’s a breakdown of the key provisions … Read More

Senate Votes on Tax Relief Bill for IRC 174 R&E Expenditures, Bonus Depreciation and Section 163(j)

08/01/2024By Jonathan Tucker | Principal, Research & Development Tax Credits In a significant move after months of waiting, the Senate voted on the highly anticipated tax relief for American Families and Workers Act, aimed at easing the financial burden on millions of Americans. Championed by Senate Majority Leader Chuck Schumer to bring a vote in … Read More

KBKG Tax Insight: Identifying Expenditures for the New IRC 174 Capitalization Requirements

07/24/2024By Jonathan Tucker | Principal, Research & Development Tax Credits With the enactment of the Tax Cuts and Jobs Act (TCJA) of 2017, significant changes were made to the Internal Revenue Code (IRC), notably to IRC 174. Starting in the tax year 2022, businesses can no longer fully expense their research and experimental (R&E) costs … Read More