Are R&D Tax Credits Available in Arkansas?

Yes. The state of Arkansas provides the Research and Development (R&D) Tax Credit for qualified research expenses (QREs) occurring within the state. Taxpayers must invest in a project under one or more of the R&D programs offered by the Arkansas Science and Technology Authority (ASTA) when the projects directly involve an Arkansas business and must be approved by its Board of Directors. The credit may be earned for the first five years following the signing of a financial incentive agreement with the Arkansas Department of Economic Development (ADED).

Some highlights of the Arkansas R&D tax credits include:

- In-House Research and Development: Businesses conducting research qualifying for federal R&D tax credits may claim a credit of 20% of in-house QREs that exceed the base, for a period of five years. For a new in-house research facility, the base year is zero. Therefore, in the first three years following the date of the financial incentive agreement, all eligible expenditures can qualify for the credit. QREs in the 3rd and 4th years are used as the base year to calculate the credits in the 4th and 5th years, respectively. The agreement may be renewed for up to 5 years. May not be used with In-House Research by a Targeted Business Credit.

- Research and Development in Area of Strategic Value: This credit is equal to 33% of in-house QREs in conducting research qualifying for federal R&D credits. The credit for in-house research in an area of strategic value is capped at $50,000 per taxpayer per year. Research must be in an area of strategic value OR for a project offered by the Arkansas Economic Development Commission (AEDC). Research in an area of strategic value means research in fields having long-term economic or commercial value to the state, and that has been identified in an AEDC-approved R&D plan. May not be used with In-House Research by a Targeted Business Credit.

- University-Based Research and Development: An eligible business that contracts with an Arkansas college or university in performing research qualifying for federal R&D credits may qualify for a 33% credit for QREs. May be used with other In-House R&D Credits.

- In-House Research by a Targeted Business: Upon application and approval by the AEDC Executive Director, targeted businesses may claim a credit of 33% of the QREs incurred each year for up to five years. QREs include expenses incurred in the conduct of research qualifying for federal R&D tax credits. This credit may be sold one time upon application and approval by AEDC. A targeted business claiming this credit is prohibited from earning job creation tax credits for the same expenses and may not be used with other In-house R&D credits. Targeted businesses are within the following business sectors: 1) Advanced Materials & Manufacturing Systems, 2) Agricultural, Food and Environmental Sciences, 3) Bio-Based Products, 4) Biotechnology, Bioengineering and Life Sciences, 5) Information Technology, OR 6) Transportation Logistics.

Utilization: The Arkansas R&D tax credit, including any carry forward amount, may be used to offset 100% of Arkansas state tax liabilities. Any amount in excess of the tax liability may be carried forward for a maximum of 9 consecutive tax periods.

Application Required: Taxpayers must apply to the ADED in order to qualify for the Arkansas R&D tax credit for research under programs of the ASTA. Application for this credit must include a project plan that clearly identifies the intent of the project, the expenditures planned, the project start and end dates, and a total project cost estimate. The ASTA specifies the application format for its programs. The ASTA must approve any research for which a taxpayer is seeking credit under this incentive. To claim a credit, a taxpayer must file the Certificate of Tax Credit issued by the ASTA with the tax return on which the credit is first claimed. (Reg. VIIE4b, Consolidated Incentive Act (Act 182 of 2003) Regulations, Research Under ASTA Programs)

Exclusive Provision: Taxpayers claiming the Arkansas R&D credit cannot receive the credit granted by Sec. 26-51-1102(b), A.C.A. for the same expenditures.

Arkansas R&D Tax Credit Case Study

A medical research company in Fort Smith, Arkansas had never claimed the R&D Tax Credits before. This project involved the tax year 2021. The Company qualified for the federal R&D Tax Credit of $75,000 and an additional $99,000 of state R&D Tax Credit in Arkansas.

|

FEDERAL

|

ARKANSAS

|

|||

|

Year

|

Total QREs

|

Credit

|

Total QREs

|

Credit

|

|

2021

|

$750,000

|

$75,000

|

$300,000

|

$99,000

|

You can read more about this Arkansas case study here.

Four-Part Test

Qualified research activities are defined by the four-part test outlined below

Technological in Nature

Activities must fundamentally rely on the principles of physical or biological science, engineering, or computer science.Permitted Purpose

Activities must be performed in an attempt to improve the functionality, performance, reliability, or quality of a new or existing business component.Eliminate Uncertainty

Activities intended to discover information that could eliminate technical uncertainty concerning the development or improvement of a product.Experimentation

All activities must include a process of experimentation including testing, modeling, simulating, and systematic trial and error.Research and Development Tax Insights

How to Claim R&D Credits After an Acquisition

07/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Acquiring another company isn’t just a strategic move that grows market share or expands a portfolio of products. Acquisitions can also unlock significant tax advantages. One area that companies often overlook is the Research and Development (R&D) Tax Credit, which can help them gain significant value … Read More

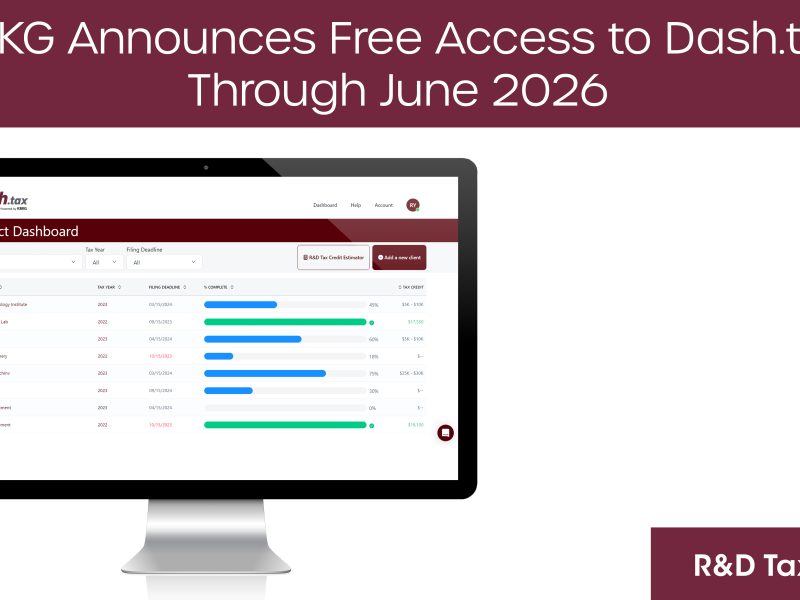

KBKG Announces Free Access to Dash.tax Through June 2026, Empowering Tax Advisors to Claim R&D Tax Credits for Clients

07/14/2025PASADENA, Calif. – July 14, 2025– KBKG, a recognized leader in specialty tax solutions, announced its flagship Research & Development (R&D) tax credit software, Dash.tax, is now available at no cost to approved tax preparers through June 30, 2026. The limited-time initiative enables Certified Public Accountants (CPAs) and other tax professionals to access the full power of Dash.tax-an … Read More

Claiming the R&D Tax Credit for Failed Projects

07/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Most businesses associate the Research and Development (R&D) Tax Credit with breakthrough innovations and completed projects. If a product launches successfully or a process gets optimized, it seems obvious to include those efforts in an R&D claim, but what happens when your project fails? Surprisingly, failure … Read More

R&D Expensing is Back: What the Section 174 Fix Means for Your 2024 Tax Strategy

07/08/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Kevin Zolriasatain and Paul McVoy | Principals, Research & Development Tax Credits For the last two years, companies conducting qualified research have been burdened with an unfavorable tax provision that has made Research and Development (R&D) investments more expensive, at precisely the wrong time. That’s … Read More

KBKG Tax Insight: One Big Beautiful Bill – 2025 Tax Changes and Summary Chart

07/03/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Gian Pazzia and Paul McVoy | Research & Development Tax Credits Breaking News – July 4, 2025 On July 4th, President Trump signed the “One Big Beautiful Bill Act” (OBBBA), marking a significant overhaul to federal tax policy. The signing reflects a major pivot in legislative … Read More

SALT Workaround Preserved, Real Estate & R&D Expensing Win Big. What Businesses Need to Know

06/30/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Paul McVoy | Principal, Research & Development Tax Credits The reconciliation process for the “One Big Beautiful Bill” (OBBB) has entered its final phase, and in the past three days, Senate Republicans cleared a key procedural hurdle and released updated text that could reach the Senate … Read More

Texas Enhances R&D Credit, Allowing Companies to Claim More

06/27/2025By Bill Taylor and Giovanni Ortiz | Research & Development Tax Credits On June 1, 2025, Texas lawmakers passed Senate Bill 2206 legislation that significantly enhances the state’s R&D Tax Credit structure. The Governor signed this bill into law on June 17, 2025. Effective for franchise tax reports due on or after January 1, 2026, … Read More

Retroactive and Permanent R&D Expensing Restored Under Proposed Senate Legislation

06/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits The Senate Finance Committee has proposed a significant change to the way U.S. businesses deduct their research and development (R&D) expenses. If passed, the bill would reverse a major change that took effect in 2022 based on … Read More

California Senate Bill 711 Proposes Simplified R&D Credit Method

06/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Tetyana Guguchkina, Elise Rhee, & Michael Maroney | Research & Development Tax Credits California is poised to overhaul its R&D Tax Credit with Senate Bill 711 (SB 711), which proposes replacing the state’s Alternative Incremental Research Credit (AIRC) with a new Alternative Simplified Credit (ASC) … Read More

House Narrowly Passes Major GOP Tax Bill 215–214, Senate Signals Revisions Ahead

05/22/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits Just after midnight on Thursday, May 22, 2025, a full House debate on the multi-trillion-dollar tax bill began, and the House narrowly passed this sweeping tax and spending package dubbed the “One Big Beautiful Bill Act” with … Read More