For the most up-to-date information on Qualified Improvement Property, see our latest post. In response to our previous release last week, Qualified Improvement Property (QIP) Technical Correction in CARES Act, KBKG has received several inquiries related to the changes in QIP law. Since that post, we have also learned more through discussions with high ranking … Read More

Cost Segregation

KBKG Tax Insight: Qualified Improvement Property (QIP) Technical Correction in CARES Act

For the most up-to-date information on Qualified Improvement Property, see our latest post. With the passage of the CARES Act on Friday, March 27, 2020, Congress addressed the much anticipated “Retail Glitch” associated with the 2017 Tax Cuts and Jobs Act (TCJA). This rule previously prevented investments in qualified improvement property (QIP) from qualifying for … Read More

KBKG Tax Insight: Maximizing Deductions on Like-Kind Exchanges Using Cost Segregation

As featured in AICPA The Tax Advisor When a property is acquired in a Sec. 1031 like-kind exchange, tax preparers should consider several facts before deciding how to best depreciate the carryover basis from a relinquished property. When a cost segregation study is also considered on the newly acquired property, additional analysis is recommended before … Read More

KBKG Tax Insight: IRS to Increase Scrutiny of Building Partial Dispositions, Provides Guidance to Field Agents

As featured in Accounting Today As a result of the disposition regulations that were finalized in 2014, taxpayers are able to claim a partial disposition of a building component and recognize a loss on their tax return in the year of disposition. The partial disposition election is one of five issues targeted by the IRS … Read More

Tax Deadline is Approaching – Now’s the Time to Request Your Cost Segregation Studies

Are you or your clients interested in performing a cost segregation study before the upcoming March 15 tax deadline? KBKG is committed to timely work. Since the months leading up to a tax deadline is our busiest time of year, we encourage you to start the process now to avoid any delays in filing your … Read More

KBKG Tax Insight: Impact of Bonus Depreciation for Companies with Floor Plan Financing

As a follow up to the KBKG Tax Insight article, Impact of Final Regulations and New Proposed Regulations for Additional First Year Depreciation Deduction, released last week providing a summary of the new final proposed regulations for additional first year depreciation deduction, we now dive deeper into the impact of floor plan financing indebtedness upon … Read More

KBKG Tax Insight: Impact of Final Regulations and New Proposed Regulations for Additional First Year Depreciation Deduction

For the most up-to-date information on Qualified Improvement Property, see our latest post. On September 13, 2019, the IRS and Treasury Department released the much-anticipated final regulations that provide guidance regarding additional first year bonus depreciation deductions under section 168(k) of the Internal Revenue Code (REG-104397-18). While the final regulations clarified some questions, there are … Read More

KBKG Tax Insight: Final Regulations and New Proposed Regulations for Additional First-Year Depreciation Deduction

For the most up-to-date information on Qualified Improvement Property, see our latest post. On September 13, 2019, the IRS and Treasury finalized first-year bonus regulations (REG-104397-18). In tandem, they issued additional proposed regs (REG-106808-19) for bonus nuances. Here are a few highlights: Final Regulations: Qualified Improvement Property (QIP) – 2018 and beyond: The IRS and … Read More

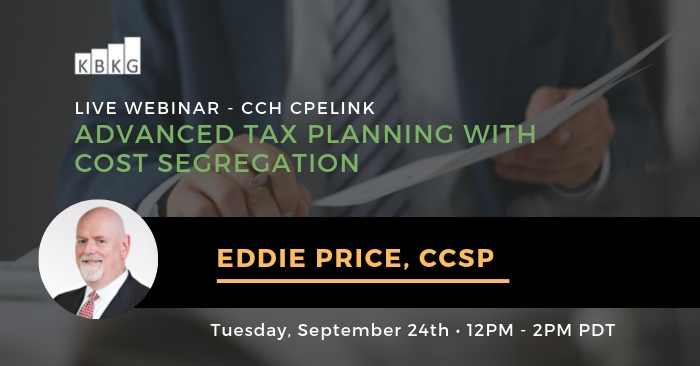

Featured Speaker – Eddie Price

Our Director, Eddie Price, has been featured as a speaker for Wolters Kluwer | CCH CPELink. He’ll be discussing Advanced Tax Planning with Cost Segregation on September 17th at 12 PM Pacific on their platform. With over 35 years of experience, Eddie has been a featured speaker and author for agencies such as The Tax … Read More

Evaluating a Cost Segregation Provider? Consider Someone with the ASCSP Certification

Are you considering a cost segregation study? As you begin to evaluate potential service providers, it’s important to remember that there are significant differences among cost segregation advisors in the marketplace. Sometimes taxpayers are not immediately aware of how those differences may impact their experience from start to finish. The American Society of Cost Segregation … Read More