by Alex Martin | Principal, KBKG

Transfer pricing (TP) is far more than ‘just another tax compliance issue.’

Multinational companies should understand the implications of cross-border pricing policies. Transfer pricing laws and regulations govern the pricing of goods, services, royalties, loans, and other transactions between related companies. These rules impact the taxes payable and cash flow within global operations.

Many multinational companies can reduce their global effective tax rates, tax risks, and improve their cash flow. This can be done through a strategic approach to transfer pricing. Companies that struggle with TP may be surprised by how this issue affects stakeholders across an organization.

1. Why are Multinational Companies Concerned about Transfer Pricing?

Companies risk substantial additional taxes, interest, penalties, and double taxation if they do not charge arm’s-length prices. Over 100 countries can issue tax adjustments for companies that shift profits offshore through incorrect transfer prices.

Tax authorities are increasingly aggressively questioning whether multinational companies underpay tax through incorrect TP practices. Why? Transfer prices drive how much income tax a multinational corporation pays in each country. A tax auditor may disagree with a taxpayer’s assessment of the value drivers of a global business. The resulting audit leads to unexpected tax bills.

Transfer Pricing audits are widely considered a high return on resource investment for governments needing tax revenue to fund services. The IRS may determine that transfer pricing is incorrect.

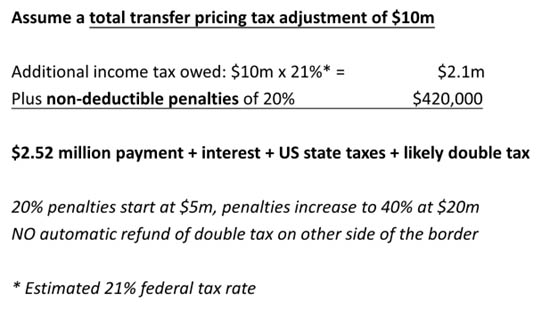

If this is the case, the company would owe substantial federal and state tax, interest, and potential non-deductible penalties. They would not receive an automatic refund for taxes that were overpaid. The following example provides a calculation of a $10 million IRS TP adjustment and resulting costs to the business.

2. Can You Keep Multiple Tax Authorities Happy?

Cross-border transfer prices involve multiple countries. Companies must take this into account when setting intercompany prices. They must consider the transfer pricing (TP) requirements of more than one tax authority.

Management must ensure that their tax position in one country does not contradict their tax position in another jurisdiction. This is essential for proper tax planning.

The “arm’s-length standard” is the core principle for countries enforcing transfer pricing regulations. In other words, companies should charge the same prices to related parties as they would charge to unrelated companies. Fortunately, the arm’s-length principle applies worldwide. Most countries subscribe to the Organization for Economic Co-Operation and Development (OECD) Transfer Pricing Guidelines when enforcing transfer pricing laws.

While governments reference the OECD Transfer Pricing Guidelines when reviewing inter-company pricing arrangements, compliance thresholds vary substantially by country. For example, The U.K. has an exemption from TP audits for small- and medium-sized enterprises. Mexico and India, on the other hand, have very low thresholds for requiring TP compliance documents. [1] A start-up company generating $1 million in revenue in Mexico could be required to prepare the same type of transfer pricing documentation reports as a company 100 times larger.

Given the differences in transfer pricing audit thresholds on a global basis, companies must be pragmatic when addressing TP compliance requirements for each country. Many companies face higher transfer pricing audit risks in developing countries when a transaction is less contentious in a developed country’s jurisdiction.

3. Our Rule of Thumb: Review Profits Earned by Subsidiaries

“Subsidiaries should earn steady levels of profit” is often an auditor’s starting point on both sides of the border. This expectation can challenge companies, especially during economic downturns or difficult market conditions.

For example, during an economic downturn, transfer pricing auditors typically conclude that a parent company should absorb any operational losses. In other words, parent companies should reduce the transfer prices charged to subsidiaries.

This auditor strategy may be particularly surprising for a company with one global TP policy. Tax auditors regularly dismiss a subsidiary company’s attempts to excuse poor profit results. In other words, the parent company should adjust TP.

Conversely, tax auditors of parent companies are concerned about subsidiaries earning too much profit and overpaying tax overseas. Usually, auditors argue that subsidiaries should not generate significant profits from the parent company’s R&D, know-how, and other intangible assets.

In response to these auditor strategies, companies should consider adjustable transfer prices of royalties, service charges, inventory, and loans based on market conditions. A ten-year-old successful transfer pricing policy may not be the correct answer after COVID, inflation, and supply chain disruptions.

4. Transfer Pricing Documentation Saves the Day

TP documentation is the first and best opportunity for companies to avoid a transfer pricing adjustment in the first place. Many tax authorities request TP documentation as part of their initial document request under audit. Other countries require transfer pricing documentation as part of filing the tax return.

TP documentation explains how the company operates on a global basis, the impact of industry conditions, financial information, and an explanation of how transfer prices are “arm’s-length.”

In the U.S., Treas. Reg. §1.6662-6(d) established the standards for contemporaneous transfer pricing documentation, and most countries have similar requirements.[2]

The U.S. transfer pricing regulations specify ten items required for TP documentation. However, the essential parts of this documentation report include the following:

- A detailed explanation of each company’s functions, assets, and risks, including a thorough description of the corporate structure (Functional Analysis).

- Analysis of how recent developments within the industry impact the business (Industry Analysis).

- Description of inter-company transactions and in-depth analysis of pertinent financial information and pricing (Financial/Economic Analysis).

- Selection of the “Best Method” for comparing transactions. Show how the profitability or pricing meets the “arm’s-length” principle (Financial/Economic Analysis).

Transfer pricing auditors expect a thorough explanation of the company’s operations in each tax jurisdiction. Comprehensive transfer pricing documentation greatly enhances management’s ability to defend against an audit or avoid an audit in the first place. Certainly, inter-company pricing policies and legal agreements are useful for supporting a company’s transfer pricing approach. However, tax authorities often assess profit margins earned in each country to target companies for further examination.

5. Yes, Transfer Pricing Compliance is an Annual Requirement

Some companies are unaware that TP compliance is best considered an annual tax compliance issue.

Why?

Transfer pricing documentation reports are prepared annually to support the pricing of inter-company transactions disclosed in a tax return. Transfer pricing reports must be updated annually. Failure to do so carries the risk of penalties if a transfer pricing adjustment is made.

Fortunately, one practical approach available to taxpayers is to prepare an update referencing the prior year’s transfer pricing study. Suppose a multinational company’s business has not changed significantly. A company can replicate a transfer pricing analysis, at a lower cost. This analysis should reference work from the transfer pricing study, to remain compliant.

The Takeaway

Transfer pricing is an essential consideration for multinational companies. Governments globally see transfer pricing audits as a critical revenue source, and penalties for non-compliance are significant.

Our experience demonstrates that adopting a proactive approach to transfer pricing can reduce risks of taxable adjustments, penalties, and double taxation. In fact, a transfer pricing documentation report may prevent an audit altogether. Furthermore, companies may miss out on significant tax and cash savings through relatively straightforward adjustments.

Why KBKG is the Trusted Partner for You

Transfer pricing is a highly contentious issue for multinational corporations. KBKG is exceptionally well-equipped to provide transfer pricing advice with tailored customer service.

We have a history of strong relationships with multinationals, CPAs, and other professional service providers. We focus on helping our clients optimize cash flow, reduce global effective tax rates, and manage audit risks. Our time-tested strategies assist companies in managing TP consistent global operations.

KBKG’s TP practice leader has over 25 years of experience. International Tax Review has named KBKG one of the world’s leading transfer pricing practices.

[1] Mexico requires transfer pricing documentation for companies generating MXN 13,000,000 or more ($US720,000) in revenue. The documentation threshold is lower for service companies. Indian transfer pricing documentation requirements apply when a company has INR10,000,000 ($USD 123,000) or more of related party transactions.

[2] The term “contemporaneous” means that the report must be prepared concurrently with the filing of the corporate tax return. Most countries require that a report be available in the event of an audit. However, some countries, including Denmark, require that a company submits a report with the tax return.

About the Author

Alex Martin – Principal, Transfer Pricing

Alex Martin – Principal, Transfer Pricing

Alex Martin is the Principal and Transfer Pricing Practice leader at KBKG, operating from Michigan. He has over 25 years of full-time transfer pricing experience working in Washington, D.C.; Melbourne, Australia; and Detroit, Michigan over the course of his career. KBKG has been named one of the world’s leading transfer pricing consultancies by International Tax Review for three years running.» Full Bio