for cost segregation

below and one of our Cost Segregation experts will contact you.

Qualify for

cost segregation

Cannabis Grow Facility Cost Segregation Case Study

Cost Segregation is a commonly used strategic tax planning tool that allows companies and individuals who have constructed, purchased, expanded or remodeled any kind of real estate to immediately reduce tax by accelerating depreciation deductions and deferring federal and state income taxes. The following is a case study for a cannabis grow facility to demonstrate the benefits of accelerated depreciation on this property type.

What is Cost Segregation?

Cost Segregation is a commonly used strategic tax planning tool that allows companies and individuals who have constructed, purchased, expanded or remodeled any kind of real estate to increase cash flow by accelerating depreciation deductions and deferring federal and state income taxes.

Building Type: Cannabis Grow Facility

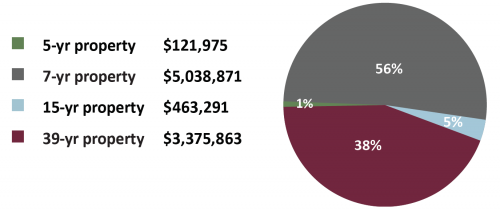

| Summary of Benefits | Results |

|---|---|

| Additional Tax Deductions in First Year | $5,629,032 |

| Net Present Value (NPV) Over 10 Years | $1,970,692 |

| NPV Over Remaining Life of Property | $1,991,385 |

| *Benefits typical for tax returns filed 2018-2022 |

Building Allocation After Study

Building Information

| Purchase Price of Property (less land) | $9,000,000 |

| Property Type | Cannabis Grow Facility |

| Building Sq Ft | 95,500 |

| Entire Site Sq Ft | 180,000 |

| Date Acquired | July - Current Tax Year |

| Federal Tax Rate | 29.6% |

| State Tax Rate | 5% |

| Combined Tax Rate | 34.6% |

| ROI Factor | 8% |

Calculate Your Tax Savings

Use our Cost Segregation Savings Calculator to estimate tax savings for your type of building. Enter building details for instant results at kbkg.com/costsegregation/calculator.

Get a Free Download of this Cannabis Grow Facility Cost Segregation Case Study

Cost Segregation Insights

KBKG Tax Insight: Overcoming Passive Losses from Self-Rental Property Using the Grouping Election

02/27/2024KBKG Tax Insight: Overcoming Passive Losses from Self-Rental Property Using the Grouping Election By Eddie Price & Amar Patel | Principals – Cost Segregation When business owners acquire a building that they intend to use primarily to operate their business, they often set up a separate LLC to hold the building and land asset that … Read More

KBKG Tax Alert: Proposed Bill Fixes 174 Capitalization and Cuts Off New ERC Claims

01/16/2024KBKG Tax Alert: House passes proposed bill to Fix 174 Capitalization, Extend 100% bonus depreciation, and Cut Off New ERC Claims, now in Senate consideration. Proposal Aims to Boost Businesses with Immediate Deductions for Domestic Research and Experimental (R&E) Expenditures and Capital Investments on qualified property while reining in the Employee Retention Credit (ERC). The … Read More

Cost Segregation for Airbnb, Vrbo, HomeAway

11/18/2023Cost Segregation for Airbnb, Vrbo, HomeAway If you’re an Airbnb, Vrbo, or HomeAway host, you’re likely familiar with the complexities of managing and optimizing rental properties. What you may not be aware of, however, is a powerful financial tool that can help you maximize your property’s financial benefits while minimizing your tax liability – Residential … Read More

Unlocking Hidden Value: The Power of Cost Segregation Studies

10/17/2023Unlocking Hidden Value: The Power of Cost Segregation Studies Optimizing tax benefits and enhancing cash flow are pivotal to achieving financial success in finance and real estate. One strategy with significant potential is cost segregation. Dive into cost segregation basics, explore what a cost segregation study entails, understand its timing and relevance, and discover KBKG’s … Read More

KBKG’s Residential Cost Segregator

10/10/2023KBKG’s Residential Cost Segregator Cost segregation is a powerful tool for maximizing tax benefits on real estate investments. This IRS-approved strategy can speed up depreciation, but harnessing the solution’s full potential requires professional expertise. That’s where KBKG’s Residential Cost Segregator® comes in. Our revolutionary program spotlights tax advantages typical owners miss. Explore residential cost segregation, … Read More

Accelerate Deductions for Better Cash Flow With KBKG

10/09/2023Accelerate Deductions for Better Cash Flow With KBKG Tax professionals often face residential cost segregation challenges when dividing expenses for multi-unit properties. If this struggle sounds familiar, you might be missing the necessary tools and resources for a successful real estate cost segregation allocation. KBKG streamlines and simplifies the process with our Residential Cost Segregator® … Read More

KBKG’s Approach to Residential Cost Segregation

10/08/2023KBKG’s Approach to Residential Cost Segregation Here at KBKG, we conduct in-depth cost segregation studies for a number of clients. Our studies can help you reduce your tax burden and save money. We realize that performing a residential cost segregation study can be intimidating, so we work closely with you every step of the way. … Read More

Residential Cost Segregation – The Basics

10/07/2023Residential Cost Segregation – The Basics A real estate cost segregation study is a tax planning process used by property owners who have constructed, purchased, or remodeled any type of income-generating property. The study allows them to accelerate depreciation deductions, which can defer state and federal income taxes and increase cash flow. If you are … Read More

Can You Do Cost Segregation on Residential Rental Property

10/06/2023Can You Do Cost Segregation on Residential Rental Property? If you’re a real estate investor or property owner, you’ve probably heard about cost segregation and how it can help you maximize tax benefits. But can you do cost segregation on residential rental property? The answer is “yes.” Below, we explore how cost segregation works for … Read More

KBKG Tax Insight: Qualified Improvements, Bonus Depreciation, and 179

09/20/2023KBKG Tax Insight: Qualified Improvements, Bonus Depreciation, and 179 By John Manolos | Senior Manager – Cost Segregation With the passage of the CARES Act on March 27, 2020, Congress addressed the much anticipated “Retail Glitch” associated with the 2017 Tax Cuts and Jobs Act (TCJA). This rule previously prevented investments in qualified improvement property … Read More