As featured in Accounting Today

Intercompany pricing corrections now can help generate cash by utilizing tax net operating losses.

In a pandemic environment, longstanding transfer pricing policies can lead to suboptimal tax results. Multinationals that incur losses in some locations while earning generous profits in others could be overpaying taxes. For many companies, modifications to intercompany pricing that reduce taxes payable and utilize losses are overlooked tax savings opportunities.

KBKG Insight:

A multinational company’s transfer prices of goods, royalties, services and loans affect where profits are generated, or the losses incurred in each country. For companies impacted by COVID-19, an assessment of estimated taxes payable and losses by country can highlight tax savings opportunities.

For many cross-border businesses, well-established policies have facilitated the pricing of intercompany goods, royalties, and services transactions over many years. However, even the most robust transfer pricing policies were not designed for pandemic-driven closures. As a result, multinational companies have a high global effective tax rate even when incurring company-wide losses. Paying unnecessary income tax bills is particularly painful for those companies already short on cash.

Tangible Tax Savings

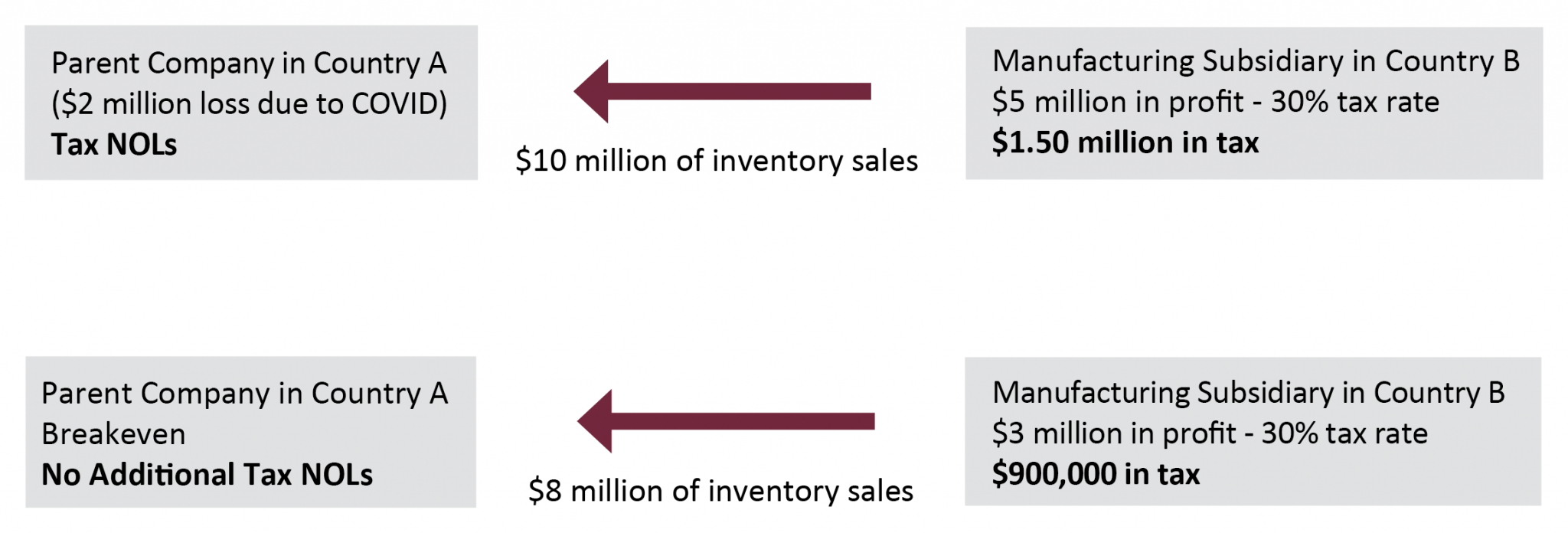

An example may best illustrate the potential for savings from revisiting transfer pricing policies in the wake of the pandemic. In this situation, a wholly-owned manufacturer relies on a sizeable cost-plus margin policy when selling inventory to the parent company.

For a subsidiary in a 30 percent tax rate jurisdiction, a $2 million reduction in transfer prices leads to $600,000 in tax savings by utilizing tax-inefficient parent company losses. Corrections to royalty rates and service fees have similar impacts. The result is the same: utilizing tax net operating losses in Country A while reducing Country B’s taxes. That being said, there does need to be economic substance to justify these changes.

Implementing Tax Savings

Utilizing tax NOLs in Country A while paying fewer income taxes in Country B is, at first glance, a straightforward concept. However, implementing corrections to transfer pricing often requires some planning. In my experience, senior management on both sides of the border needs to be involved in the decision-making process. Other issues, such as adjustments to Customs entries, are additional complications. Transfer pricing documentation is often well-advised support for changes to transfer prices.

KBKG Insight:

Tax auditors may have questions about why transfer prices have changed. COVID-19 has transformed the global business environment, but preparing support to quantify the pandemic’s impact on a company is advisable. Furthermore, making modifications before year-end is less complicated than afterward.

Bottom Line

Now more than ever, multinational companies should consider modifications to transfer prices when assessing their global effective tax rate; however, changes to cross-border taxes need to be explained. While there are some complications, cash and tax savings can be well worth the effort.Transfer pricing changes drive tax savings for coronavirus-impacted companies

If companies or CPAs have questions about Transfer Pricing, KBKG’s Principal and Practice leader, Alex Martin, is here to assist. » Schedule a call now

KBKG also has many resources on our website to help you answer any other questions not listed here. » Learn about Transfer Pricing

Register for our Transfer Pricing after Tax Reform and COVID Webinar

For additional information, join us for a free webinar on transfer pricing presented by Alex Martin.

Author: Alex Martin

About the Author

Alex Martin – Principal

Alex Martin – Principal

Midwest

Alex Martin is Principal and Transfer Pricing Practice leader at KBKG, operating from Michigan. He has 22 years of full-time transfer pricing experience working in Washington, D.C.; Melbourne, Australia; and Detroit, Michigan over the course of his career. Alex has assisted companies in many industries addressing transfer pricing issues on a US and global basis. » Full Bio