Arizona R&D Tax Credit Case Study

The R&D tax credit is one of the most valuable credits leveraged by companies. The R&D credit yields billions of dollars in federal and state benefits to companies engaged in qualifying research. The R&D tax credit can provide a significant reduction to current and future tax liabilities and a source of cash for companies performing R&D in Arizona.

Benefits

- Up to 13.5 cents of R&D tax credit for every qualified dollar

- Dollar-for-dollar reduction in your Arizona income tax liability

- For tax years before 2022, credits can be carried forward for 15 years

- For tax years after 2021, credits can be carried forward for 10 years

Qualifications

More companies in Arizona can now qualify for the R&D tax credit. Companies are able to qualify R&D activities beginning with the development of concepts and extend to the point where a product, process, formula, or other business component is ready to be commercially released. If you are engaged in any research activities in Arizona, looking into the state’s R&D tax credit may be a great benefit. In addition, look back studies can recognize unclaimed credits for the last 3 or 4 open tax years.

Case Study

A chemical manufacturing company in Tucson, Arizona qualified for a substantial credit. The company claims R&D credits each year for the development activities of its engineers. This project involved a multi-year study covering the tax years 2018-2021. The Company qualified for the federal R&D Tax Credits of $255,000 and an additional $306,000 in Arizona state R&D Tax Credits.

|

FEDERAL

|

ARIZONA

|

|||||

|

Year

|

Total QREs

|

Credit

|

Total QREs

|

Credit

|

||

|

2021

|

$750,000

|

$75,000

|

$750,000

|

$90,000

|

||

|

2020

|

$700,000

|

$70,000

|

$700,000

|

$84,000

|

||

|

2019

|

$650,000

|

$65,000

|

$650,000

|

$78,000

|

||

|

2018

|

$450,000

|

$45,000

|

$450,000

|

$54,000

|

||

| Total | $2,550,000 | $255,000 | $2,550,000 | $306,000 | ||

Four-Part Test

Qualified research activities are defined by the four-part test outlined below

Technological in Nature

Activities must fundamentally rely on the principles of physical or biological science, engineering, or computer science.Permitted Purpose

Activities must be performed in an attempt to improve the functionality, performance, reliability, or quality of a new or existing business component.Eliminate Uncertainty

Activities intended to discover information that could eliminate technical uncertainty concerning the development or improvement of a product.Experimentation

All activities must include a process of experimentation including testing, modeling, simulating, and systematic trial and error.Research and Development Tax Insights

Retroactive and Permanent R&D Expensing Restored Under Proposed Senate Legislation

06/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits The Senate Finance Committee has proposed a significant change to the way U.S. businesses deduct their research and development (R&D) expenses. If passed, the bill would reverse a major change that took effect in 2022 based on … Read More

California Senate Bill 711 Proposes Simplified R&D Credit Method

06/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Tetyana Guguchkina, Elise Rhee, & Michael Maroney | Research & Development Tax Credits California is poised to overhaul its R&D Tax Credit with Senate Bill 711 (SB 711), which proposes replacing the state’s Alternative Incremental Research Credit (AIRC) with a new Alternative Simplified Credit (ASC) … Read More

House Narrowly Passes Major GOP Tax Bill 215–214, Senate Signals Revisions Ahead

05/22/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits Just after midnight on Thursday, May 22, 2025, a full House debate on the multi-trillion-dollar tax bill began, and the House narrowly passed this sweeping tax and spending package dubbed the “One Big Beautiful Bill Act” with … Read More

House Committee Advances Major GOP Tax Bill Amid Internal GOP Divisions

05/19/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits On May 18, 2025, the House Budget Committee narrowly approved a major tax and spending package dubbed the “One Big Beautiful Bill Act” with a 17-16 vote. Four Republicans voted “present,” highlighting growing tension within the party … Read More

Senate Reacts to Key Provisions from House Tax Bill, Eyeing Permanent R&D Expensing

05/16/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits Important developments recently came out of Congress related to the House’s ongoing reconciliation efforts, specifically around tax provisions that impact businesses directly, most notably, research and development (R&D) expensing. At a recent Tax Council Policy Institute conference, … Read More

House Tax Bill Prioritizes 174 R&D Amortization Fix, Bonus Depreciation, SALT Cap, and more

05/13/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits On May 12, 2025, the House Ways and Means Committee released a larger text than what Chairman Jason Smith (R-MO) released on May 9 for proposed tax legislation as part of the FY 2025 budget reconciliation process. … Read More

The Case for Human Expertise in your R&D Tax Credits

04/29/2025In a world increasingly driven by automation, it’s tempting to turn to Artificial Intelligence (AI) powered solutions for complex tasks, even something as nuanced as claiming R&D tax credits. While AI can be a powerful tool, when it comes to maximizing your R&D tax credit claim, human expertise of a trusted advisor is not just … Read More

House Passes 2025 Budget Resolution, Paving Way for Tax and Spending Reform

04/10/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Jonathan Tucker | Principal, Research & Development Tax Credits On April 10, 2025, the U.S. House of Representatives approved the final version of the Fiscal Year (FY) 2025 budget resolution (H. Con. Res. 14) by a razor-thin margin of 216 to 214, which will incorporate amendments … Read More

Lawmakers Introduce Bill to Retroactively Fix R&D 174 Expensing

03/14/2025By Kevin Zolriasatain and Paul McVoy | Principals, Research & Development Tax Credits On March 10, 2025, a bipartisan group of lawmakers introduced the American Innovation and R&D Competitiveness Act of 2025 in the U.S. House of Representatives. The legislation aims to restore the immediate deductibility of research and experimental (R&E) expenditures and reverse the amortization requirement imposed … Read More

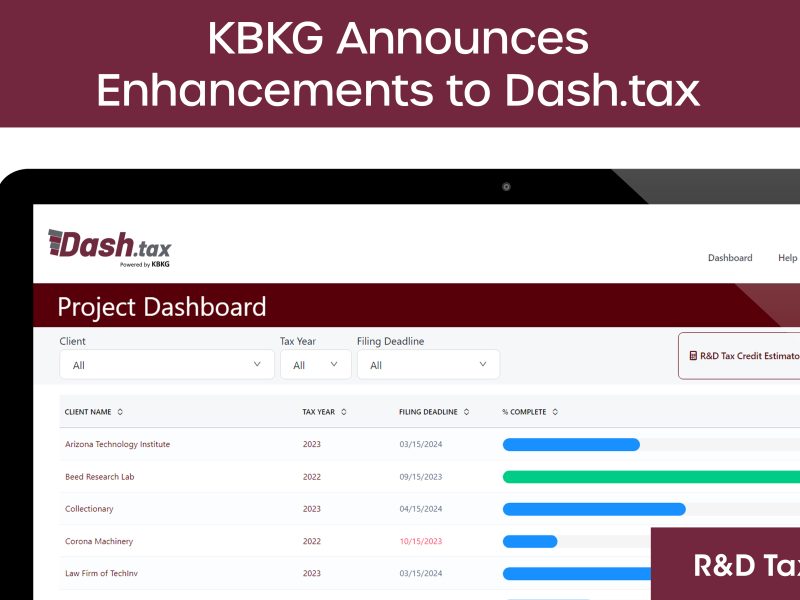

KBKG Announces Enhancements to Dash.tax, Streamlining R&D Tax Credit Claims for CPAs, Startups, and Small Businesses

03/04/2025PASADENA, Calif. – March 4, 2025– KBKG, a leader in tax credits and incentives solutions, has introduced significant enhancements to Dash.tax, its innovative tax automation platform designed for CPAs, startups, and small businesses. The latest updates further streamline the process of claiming R&D tax credits, ensuring businesses can efficiently apply credits to payroll taxes, maximize … Read More