for cost segregation

below and one of our Cost Segregation experts will contact you.

Qualify for

cost segregation

Warehouse / Industrial Property Cost Segregation Case Study

Cost Segregation is a commonly used strategic tax planning tool that allows companies and individuals who have constructed, purchased, expanded or remodeled any kind of real estate to immediately reduce tax by accelerating depreciation deductions and deferring federal and state income taxes. The following is a case study for a warehouse or industrial property to demonstrate the benefits of accelerated depreciation on this property type.

What is Cost Segregation?

Cost Segregation is a commonly used strategic tax planning tool that allows companies and individuals who have constructed, purchased, expanded or remodeled any kind of real estate to increase cash flow by accelerating depreciation deductions and deferring federal and state income taxes.

Building Type: Warehouse/Industrial Property

| Summary of Benefits | Results |

|---|---|

| Additional Tax Deductions in First Year | $643,437 |

| Net Present Value (NPV) Over 10 Years | $186,546 |

| NPV Over Remaining Life of Property | $154,147 |

| *Benefits typical for tax returns filed 2018-2022 |

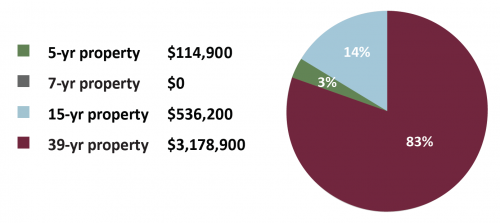

Building Allocation After Study

Building Information

| Purchase Price of Property (less land) | $3,830,000 |

| Property Type | Warehouse/Industrial |

| Building Sq Ft | 72,700 |

| Entire Site Sq Ft | 238,800 |

| Date Acquired | July - Current Tax Year |

| Federal Tax Rate | 29.6% |

| State Tax Rate | 5% |

| Combined Tax Rate | 34.6% |

| ROI Factor | 8% |

| Bonus Depreciation | 100% |

Calculate Your Tax Savings

Use our Cost Segregation Savings Calculator to estimate tax savings for your type of building. Enter building details for instant results at kbkg.com/costsegregation/calculator.

Get a Free Download of this Warehouse / Industrial Property Cost Segregation Case Study

Cost Segregation Insights

Six Ways Cost Segregation Remains Valuable as Bonus Depreciation Declines

11/12/2024Thought leadership provided by Eddie Price | Principal – Cost Segregation For a long time, the concept of cost segregation has been a powerful tax-saving strategy for real estate investors, enabling property owners to significantly increase their cash flow by accelerating depreciation on certain assets. With the phasing down of bonus depreciation — from 100% … Read More

Senate Votes on Tax Relief Bill for IRC 174 R&E Expenditures, Bonus Depreciation and Section 163(j)

08/01/2024By Jonathan Tucker | Principal, Research & Development Tax Credits In a significant move after months of waiting, the Senate voted on the highly anticipated tax relief for American Families and Workers Act, aimed at easing the financial burden on millions of Americans. Championed by Senate Majority Leader Chuck Schumer to bring a vote in … Read More

KBKG Tax Insight: Leverage Section 179 to Offset Declining Bonus Rates

07/30/2024By Eddie Price & Amar Patel | Principals – Cost Segregation After years of 100% bonus depreciation, rates have recently fallen to 80% for 2023 and 60% for 2024, which has motivated some real estate investors to look for additional strategies to offset taxable income. Section 179 of the tax code offers taxpayers the opportunity … Read More

Addressing Misconceptions Surrounding Transferable Tax Credits

07/29/2024With the renewable energy market continuing to expand, the popularity of transferable tax credits for funding projects and reducing corporate tax liabilities is becoming increasingly common. The signing of the Inflation Reduction Act in 2022 has further fueled interest among both developers and investors in this space, which has resulted in increased fraud that the … Read More

KBKG Tax Insight: IRS Issues Warning on Scams Involving Energy Tax Credit Transfers

07/19/2024By Amar Patel, CPA, CSSP | Principal – Cost Segregation The Internal Revenue Service (IRS) recently published an article issuing a warning about a new scam involving the misrepresentation of rules surrounding the transferability of clean energy tax credits under the Inflation Reduction Act (IRA). KBKG Insight: The market for transferable clean energy credits, notably … Read More

How the Inflation Reduction Act Expanded Transferable Tax Credits Eligibility

07/15/2024The Inflation Reduction Act (IRA) significantly altered the landscape of federal clean energy tax credits, offering new opportunities for monetization and strategic financial planning. For solar developers, these changes present a unique chance to optimize tax benefits through expanded options for investment and production tax credits in renewable energy projects. A New Paradigm for Tax … Read More

Final Regulations Released on Transferability of Clean Energy Tax Credits

05/08/2024By Mike Cornell | Senior Manager, Cost Segregation On Thursday, April 25, the Department of Treasury and Internal Revenue Service issued final regulations regarding the transferability of certain clean energy tax credits in a taxable year, including specific rules for partnerships and S corporations. The Inflation Reduction Act added Section 6418 to the tax code, … Read More

KBKG Tax Insight: Overcoming Passive Losses from Self-Rental Property Using the Grouping Election

02/27/2024KBKG Tax Insight: Overcoming Passive Losses from Self-Rental Property Using the Grouping Election By Eddie Price & Amar Patel | Principals – Cost Segregation When business owners acquire a building that they intend to use primarily to operate their business, they often set up a separate LLC to hold the building and land asset that … Read More

KBKG Tax Alert: Proposed Bill Fixes 174 Capitalization and Cuts Off New ERC Claims

01/16/2024KBKG Tax Alert: House passes proposed bill to Fix 174 Capitalization, Extend 100% bonus depreciation, and Cut Off New ERC Claims, now in Senate consideration. Proposal Aims to Boost Businesses with Immediate Deductions for Domestic Research and Experimental (R&E) Expenditures and Capital Investments on qualified property while reining in the Employee Retention Credit (ERC). The … Read More

Cost Segregation for Airbnb, Vrbo, HomeAway

11/18/2023Cost Segregation for Airbnb, Vrbo, HomeAway If you’re an Airbnb, Vrbo, or HomeAway host, you’re likely familiar with the complexities of managing and optimizing rental properties. What you may not be aware of, however, is a powerful financial tool that can help you maximize your property’s financial benefits while minimizing your tax liability – Residential … Read More