for cost segregation

below and one of our Cost Segregation experts will contact you.

Qualify for

cost segregation

Cold Storage Cost Segregation Case Study

Cost Segregation is a commonly used strategic tax planning tool that allows companies and individuals who have constructed, purchased, expanded or remodeled any kind of real estate to immediately reduce tax by accelerating depreciation deductions and deferring federal and state income taxes. The following is a case study for a cold storage to demonstrate the benefits of accelerated depreciation on this property type.

Building Type: Cold Storage

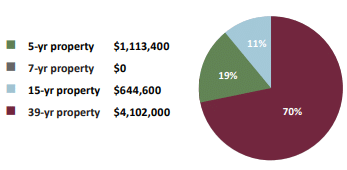

| Summary of Benefits | Results |

|---|---|

| Additional Tax Deductions in First Year | $1,737,308 |

| Net Present Value (NPV) Over 10 Years | $503,682 |

| NPV Over Remaining Life of Property | $416,205 |

| *Benefits typical for tax returns filed 2018-2022 |

Building Allocation After Study

Building Information

| Purchase Price of Property (less land) | $5,860,000 |

| Property Type | Cold Storage |

| Building Sq Ft | 105,100 |

| Entire Site Sq Ft | 306,400 |

| Date Acquired | July - Current Tax Year |

| Federal Tax Rate | 29.6% |

| State Tax Rate | 5% |

| Combined Tax Rate | 34.6% |

| ROI Factor | 8% |

| Bonus Depreciation | 100% |

Calculate Your Tax Savings

Use our Cost Segregation Savings Calculator to estimate tax savings for your type of building. Enter building details for instant results at kbkg.com/costsegregation/calculator.

Get a Free Download of this Cost Segregation Case Study

Cost Segregation Insights

How Manufacturers Can Now Fully Expense Their Facilities and Real Property

07/23/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Lester Cook | Principal, Cost Segregation The 2025 One Big Beautiful Bill Act (OBBBA) introduced a significant opportunity for domestic manufacturers with the creation of Qualified Production Property (QPP) under new IRC §168(n). This new category allows eligible taxpayers to fully expense certain real estate … Read More

Real Estate Incentives Revitalized: What the OBBBA Means for Developers, Investors, and Owners

07/17/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Lester Cook | Principal, Cost Segregation The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, permanently restores and enhances key provisions of the Tax Cuts and Jobs Act of 2017. From 100% bonus depreciation and qualified production property expensing to Opportunity … Read More

OBBB Tax Bill Makes 100% Bonus Depreciation Permanent – What You Need to Know

07/09/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Amar Patel | Principal, Cost Segregation Real estate investors know that tax strategies can make all the difference in maximizing profits. One of the most powerful, yet underutilized, tools available is the short-term rental (STR) loophole. This allows real estate investors to utilize property-related rental losses … Read More

Why You Should Only Use a Certified Cost Segregation Professional

06/09/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube When Cost Segregation studies are conducted, professional standards and technical accuracy are critically important, especially as studies are subject to IRS scrutiny. The best way to assess a provider’s qualifications is to confirm whether the person conducting your study is a Certified Cost Segregation Professional (CCSP) … Read More

Form 3115 for CPA’s: Unlocking Missed Tax Deductions Without Amending Returns

06/04/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube Many CPAs likely come across clients who have historically mis- or over-capitalized expenditures, particularly in real estate, retail or manufacturing. Fortunately, tax preparers don’t need to amend years of returns to correct these issues. The IRS offers a fix for this with Form 3115 (Application for … Read More

Navigating the Updated IRS Cost Segregation Audit Techniques Guide: What’s New?

05/30/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Amar Patel | Principal, Cost Segregation Cost Segregation remains one of the most powerful tax strategies for real estate investors, allowing them to accelerate depreciation and maximize deductions. On February 6, 2025, the IRS published the latest edition of the Cost Segregation Audit Techniques Guide (ATG), … Read More

How The Short-Term Rental Loophole & Cost Segregation Can Benefit Passive Investors

05/21/2025Follow KBKG on Social Media Linkedin Facebook X-twitter Youtube By Amar Patel | Principal, Cost Segregation Real estate investors know that tax strategies can make all the difference in maximizing profits. One of the most powerful, yet underutilized, tools available is the short-term rental (STR) loophole. This allows real estate investors to utilize property-related rental losses … Read More

The Interplay Between Cost Segregation and a 1031 Exchange

04/22/2025When a property is acquired in a Section 1031 like-kind exchange, tax preparers should consider several facts before deciding how to best depreciate the carryover basis from a relinquished property. When a cost segregation study is also considered on the newly acquired property, additional analysis is recommended before finalizing the 1031 tax basis calculations. To … Read More

100% Bonus Depreciation Making a Comeback?

03/17/2025By Amar Patel | Principal, Cost Segregation In a speech to a joint session of Congress, President Trump outlined priority tax legislation expected later this year to restore provisions of the Tax Cuts and Jobs Act (“TCJA”), which includes “providing 100% expensing, retroactive to January 20, 2025”. This leads many to believe that 100% Bonus Depreciation … Read More

Six Ways Cost Segregation Remains Valuable as Bonus Depreciation Declines

11/12/2024Thought leadership provided by Eddie Price | Principal – Cost Segregation For a long time, the concept of cost segregation has been a powerful tax-saving strategy for real estate investors, enabling property owners to significantly increase their cash flow by accelerating depreciation on certain assets. With the phasing down of bonus depreciation — from 100% … Read More