The 179D energy efficiency tax deduction has been extended retroactively for improvements completed by the end of 2017. This financial incentive is geared towards:

1) building owners (commercial or multifamily),

2) tenants making improvements, and

3) architects, engineers, and other designers of government buildings.

The tax deduction is worth up to $5.00 / square foot and is available to those investing in energy efficient improvements. Eligible improvements can be from any of the following categories: the building envelope, HVAC & hot water systems, and/or interior lighting systems.

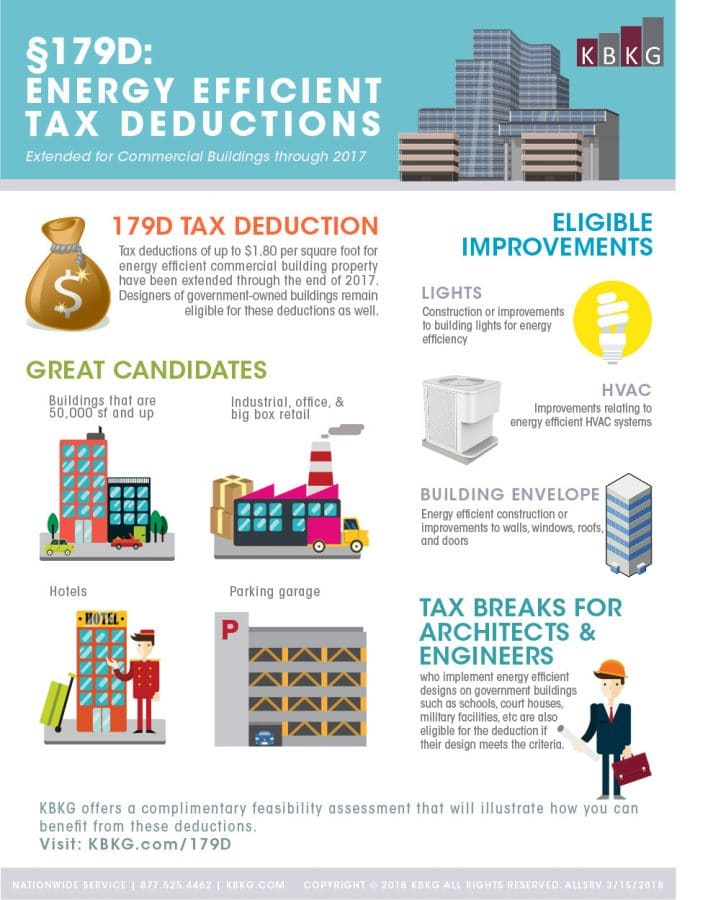

For a concise description of the 179D tax deduction, we’ve created this infographic. Have questions about 179D? We have answers. Contact our 179D experts today to see if you or your client qualifies for the deduction.