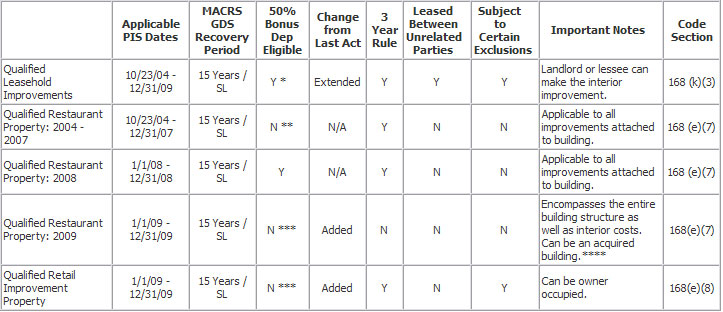

There have been many changes to depreciation laws in the last year that have created some confusion regarding the qualification rules, recovery periods, and the applicability of bonus depreciation. For that reason, KBKG has created a reference table (below) to use as a guide when dealing with real property improvements.

If you would like to more information, register for our FREE 2 hour Cost Segregation Tax Planning Opportunities Webinar (CS301).

* Only eligible for bonus depreciation if placed in service 10/23/2004 - 12/31/2004 OR 1/1/08 - 12/31/09

** QRP is eligible for bonus depreciation if placed in service 10/23/2004 - 12/31/2004.

*** If improvements also meet criteria for Qualified Leasehold Improvements, it is unclear as to whether they would be eligible for bonus depreciation.

**** Although the tax code definition of QRP in 2009 seems to encompass used buildings, it is unclear if this was the intent of Congress since previously these incentive were strictly for new construction.

Definitions:

3 Year Rule: The improvements must have been placed in service by any taxpayer more than three years after the date the building was first placed into service.

Leased Between Unrelated Party Qualification: Improvements must be made subject to a lease between unrelated parties. Can be made by lessees, sub-lessees or lessors to an interior portion of a nonresidential building.

Certain Exclusions: The following items are excluded from the definition (i) the enlargement of the building, (ii) any elevator or escalator, (iii) any structural component benefiting a common area, and (iv) the internal structural framework of the building.

Qualified leasehold improvement property: any improvement to an interior portion of a building which is nonresidential real property if— (i) such improvement is made under or pursuant to a lease (I) by the lessee (or any sublessee) of such portion, or (II) by the lessor of such portion, (ii) such portion is to be occupied exclusively by the lessee (or any sublessee) of such portion, and (iii) such improvement is placed in service more than 3 years after the date the building was first placed in service. (B) Certain improvements not included. Such term shall not include any improvement for which the expenditure is attributable to— (i) the enlargement of the building, (ii) any elevator or escalator, (iii) any structural component benefiting a common area, and (iv) the internal structural framework of the building.

Qualified restaurant property 2004-2007: an improvement to a building if— (A) such improvement is placed in service more than 3 years after the date such building was first placed in service, and (B) more than 50 percent of the building's square footage is devoted to preparation of, and seating for on-premises consumption of, prepared meals.

Qualified restaurant property 2008: an improvement to a building, if more than 50 percent of the building's square footage is devoted to preparation of, and seating for on-premises consumption of, prepared meals.

Qualified restaurant property 2009: any section 1250 property which is—(i) a building, if such building is placed in service after December 31, 2008, and before January 1, 2010.

Qualified retail improvement property: any improvement to an interior portion of a building which is nonresidential real property if— (i) such portion is open to the general public and is used in the retail trade or business of selling tangible personal property to the general public, and (ii) such improvement is placed in service more than 3 years after the date the building was first placed in service. (B) Improvements made by owner. In the case of an improvement made by the owner of such improvement, such improvement shall be qualified retail improvement property (if at all) only so long as such improvement is held by such owner. (C) Certain improvements not included. Such term shall not include any improvement for which the expenditure is attributable to— (i) the enlargement of the building, (ii) any elevator or escalator, (iii) any structural component benefitting a common area, or (iv) the internal structural framework of the building.